Vietnam concluded 2025 with a notable acceleration in economic activities. The year’s GDP growth reached 8.0%, the second-highest since 2011. This growth momentum was further strengthened in the final quarter, with Q4 GDP rising by 8.5%, the highest in 15 years. The GDP at the time of reporting stood at $514 billion, an increase of $38 billion compared to 2024, pushing the per capita income beyond the $5,000 mark.

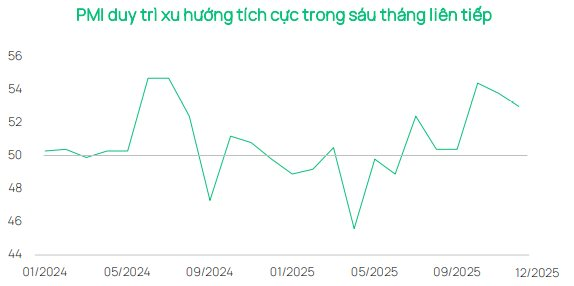

Notably, this growth was widespread and primarily driven by the industrial sector. The manufacturing industry recorded a 10.0% increase, the highest since 2019, while the Industrial Production Index (IIP) rose by 9.2%, also the highest in the same period. The PMI slightly decreased to 53.0 points in December but remained in the expansion zone, marking the sixth consecutive month of growth, with business confidence reaching its highest in 21 months.

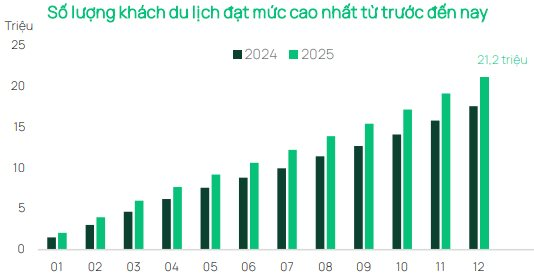

Domestic demand continued to show significant improvement. Total retail sales and consumer service revenue increased by 9.2% year-on-year, with accommodation and food service revenue surging by 14.6%. Simultaneously, international tourism set a new record, with 21.2 million foreign visitors—the highest ever recorded.

According to Dragon Capital, policy flexibility remains intact due to stable inflation and a robust fiscal foundation. Headline and core inflation for 2025 were 3.3% and 3.2%, respectively, below the 4.5% target, while unemployment remained low at 2.2%. State budget revenue reached 134.7% of the estimate, enabling increased public investment disbursement at the year-end, totaling $32.3 billion.

Additionally, foreign investment inflows remained positive. Actual FDI reached $27.6 billion—the highest in five years, up 9.0% year-on-year, while registered FDI stabilized at $38.4 billion. Foreign trade also set a new record, with total import-export turnover reaching $930 billion, up 18.2%. Exports rose by 17.0% to $475.0 billion, supported by a 48.4% increase in electronics and computers; imports increased by 19.4% to $455.0 billion, maintaining a trade surplus of approximately $20 billion.

Dragon Capital believes the stock market positively reflects the improved macroeconomic context. The VN-Index reached a historic high of 1,805 points on December 25 and closed the year at 1,784 points, up 5.9% month-on-month and 38.8% for the year (in USD)—the strongest gain since 2017. Domestic capital flows remained dominant, absorbing significant net selling by foreign investors.

In 2025, foreign investors net sold $5.2 billion—a record high. However, December showed a reversal, with foreign investors net buying in over half the trading sessions, totaling $90.5 million.

“While it’s early to conclude, this aligns with expectations of improving investor sentiment ahead of Vietnam’s potential inclusion in the FTSE Emerging Markets basket in September 2026, alongside continued legal reforms toward MSCI upgrade by 2030,” Dragon Capital emphasized.

Moving into 2026, the key question for investors is whether this growth momentum can be sustained. Dragon Capital suggests that the combination of accelerated production, improved consumption, record tourism, and stable investment flows provides a favorable starting point for profit growth and market confidence. However, the durability of export momentum, reform implementation progress, and exchange rate dynamics will be critical variables to monitor in the next 3-6 months.

Meanwhile, the newly issued Resolution 79 on state-owned enterprise development is expected to enhance the efficiency of public resource allocation through improved accountability and capital allocation, while strengthening the role of state-owned enterprises in strategic investments. These factors collectively reinforce an already solid growth foundation.

VinaCapital’s Head of Research: Stock Market Still Has Room for “Repricing,” Multiple Attractive Sectors with Exceptionally High ROE

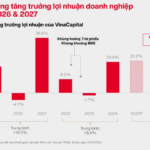

Regarding corporate profit prospects, VinaCapital anticipates a market-wide profit growth of over 18% in 2026, reflecting a significant improvement in domestic demand and profit margins.

“VIP Guests Gather at FChoice 2025 Honors Ceremony, Sharing Insights on Seizing Investment Opportunities in 2026”

With the participation of numerous experts, business leaders, and entrepreneurs, the FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026” Seminar emerged as a pivotal platform. This event seamlessly bridges macroeconomic perspectives with practical investment insights, fostering meaningful connections and strategic discussions.

FChoice 2025 Awards Ceremony and “Double-Digit Economic Growth Momentum & 2026 Investment Opportunities” Seminar Officially Launch Today

FChoice 2025 Awards Gala & Economic Growth Symposium: Unlocking Double-Digit Growth & Investment Opportunities in 2026

Join us on January 13, 2026, at the Sheraton Hotel in Hanoi for the prestigious FChoice 2025 Awards Ceremony and the insightful symposium, “Driving Double-Digit Economic Growth & Investment Opportunities in 2026.” This landmark event will bring together leading economists and top business representatives to explore transformative strategies and emerging opportunities shaping the future of economic growth and investment. Don’t miss this unparalleled platform for knowledge, networking, and inspiration.