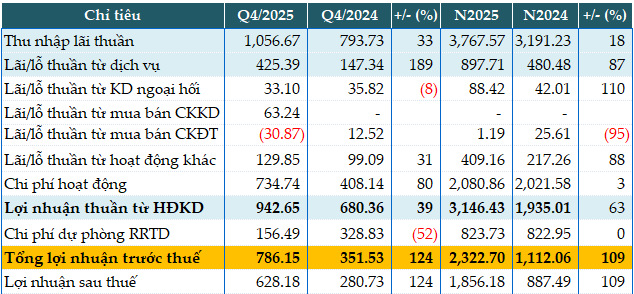

In 2025, KLB’s net interest income reached VND 3.768 trillion, an 18% increase compared to the previous year. Service income surged by 87% to VND 898 billion, primarily driven by an 80% rise in payment service revenue.

Foreign exchange trading profits climbed 110% to VND 88 billion, while investment securities trading yielded only VND 1 billion, a 95% decline.

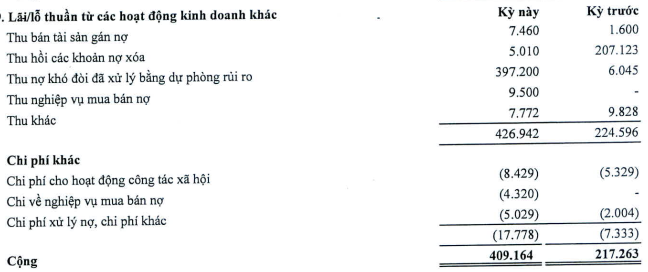

Other operating income also rose by 88% to VND 409 billion, thanks to the recovery of VND 397 billion in non-performing loans previously provisioned for, compared to just VND 6 billion recovered the previous year.

Operating expenses increased slightly by 3% to VND 2.081 trillion. Consequently, net profit from business operations soared by 63% to VND 3.146 trillion. Throughout the year, KLB allocated VND 823 billion for credit risk provisions, equivalent to the previous year, resulting in pre-tax profit doubling to nearly VND 2.323 trillion.

Compared to the annual target of VND 1.379 trillion in pre-tax profit, KLB exceeded this by 68%.

According to KLB’s explanation, these achievements were primarily due to the effective utilization of mobilized capital from the beginning of the year, proactive expansion of non-credit services, and a focus on developing a comprehensive digital ecosystem. This included enhancing electronic transaction channels and modern digital products and services, while also accelerating digital transformation and adopting advanced technologies. Additionally, KLB emphasized cost control, risk management, and productivity improvements.

|

KLB’s Q4 and 2025 business results. Unit: Billion VND

Source: VietstockFinance

|

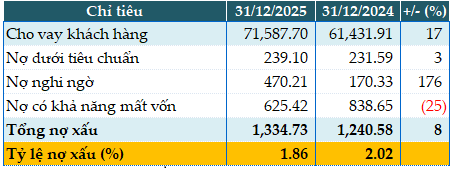

By the end of 2025, the bank’s total assets grew by 12% year-on-year to VND 103.302 trillion. Customer loans increased by 17% to VND 71.587 trillion, while customer deposits rose by 13% to VND 72.010 trillion.

Total non-performing loans as of December 31, 2025, reached nearly VND 1.335 trillion, an 8% increase from the beginning of the year. Doubtful debts surged 2.7 times to VND 470 billion. Although potential loss debts decreased by 25%, they still amounted to over VND 625 billion, accounting for 47% of total non-performing loans. As a result, the non-performing loan ratio to outstanding loans dropped from 2.02% at the beginning of the year to 1.86%.

|

KLB’s loan quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

In other developments, 582 million KLB shares were transferred to the HOSE on January 15th with a reference price of VND 16,200 per share. On the afternoon of January 16th, KLB shares were trading at around VND 18,100 per share, a 12% increase from the first day.

| KLB share price movement after 2 days on HOSE |

– 14:30 16/01/2026

Tech & Telecom Stocks Surge: ELC, CMG Skyrocket, FPT Lags Behind

KBSV forecasts a robust recovery in global IT spending by 2026, with projected growth reaching 9.8% according to Gartner.