In a bid to compete with Japanese and Chinese rivals, South Korean car brands in Vietnam ramped up aggressive promotional campaigns throughout 2025, particularly during the final months of the year. This strategy proved effective, as December 2025 saw a significant uptick in sales for both Hyundai and Kia.

Hyundai recorded a 22.7% increase, selling 6,704 units, while Kia delivered 4,233 vehicles, a remarkable 48% surge. Hyundai’s top performers—Tucson, Accent, and Creta—all posted strong growth. The Creta led with nearly 1,700 units sold, followed by the Tucson with over 1,400, accounting for nearly half of Hyundai’s total sales.

The Creta was Hyundai’s best-selling model in December 2025.

Kia’s urban SUVs, the Seltos and Sonet, also performed well, with December sales of 1,182 and 1,149 units, respectively, marking growth rates of 46% and 68%.

To sustain this momentum, both brands launched new promotions in early 2026. Hyundai offers discounts of up to VND 50 million on the Creta and VND 58 million on the Tucson. The Accent sedan sees a VND 64 million reduction, while the Stargazer MPV enjoys a VND 96 million discount, up VND 10 million from the previous month. The Santa Fe and Palisade SUVs receive the largest cuts, at VND 220 million and VND 200 million, respectively.

These incentives not only enhance Hyundai’s competitiveness but also put pressure on lower-tier segments. Kia similarly offers discounts across its lineup, including the Morning, Soluto, K3, K5, Carens, Sonet, Seltos, Sportage, Sorento, and Carnival. Reductions range from VND 5 million to VND 210 million for the 2024 Carnival 3.5 Signature. The Sonet and Seltos receive discounts of VND 14-59 million, depending on the variant.

These promotions are expected to boost Hyundai and Kia’s sales in early 2026. For the full year 2025, Hyundai Thanh Cong sold 53,229 vehicles in Vietnam, a 20% decline year-on-year, while Kia’s sales totaled 27,176 units, down 21%.

Combined, Hyundai and Kia sold over 80,000 vehicles in Vietnam in 2025, capturing approximately 21% of the internal combustion engine vehicle market (based on VAMA and TC Motor data). Despite no longer dominating as in 2021-2023, Korean brands maintain a loyal customer base and robust sales, significantly contributing to the overall growth of Vietnam’s automotive market.

Vietnam’s November Auto Sales: Japanese Brand Stumbles, Multiple Segments See Sharp Declines

November 2025 sales figures from VAMA reveal an 11% year-over-year decline compared to the same period in 2024. The passenger car (PC) segment is experiencing significant polarization, notably marked by the downturn of several major brands.

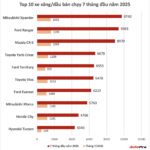

Mitsubishi Xpander: On Track to Become Vietnam’s Best-Selling Gasoline Car of the Year

Although the Mazda CX-5 and Ford Ranger gained traction in July, the Xpander maintained its stronghold as the best-selling gasoline/diesel car of the year. With a significant lead over its competitors, the Xpander continues to dominate the rankings, showcasing its consistent performance and popularity among consumers.