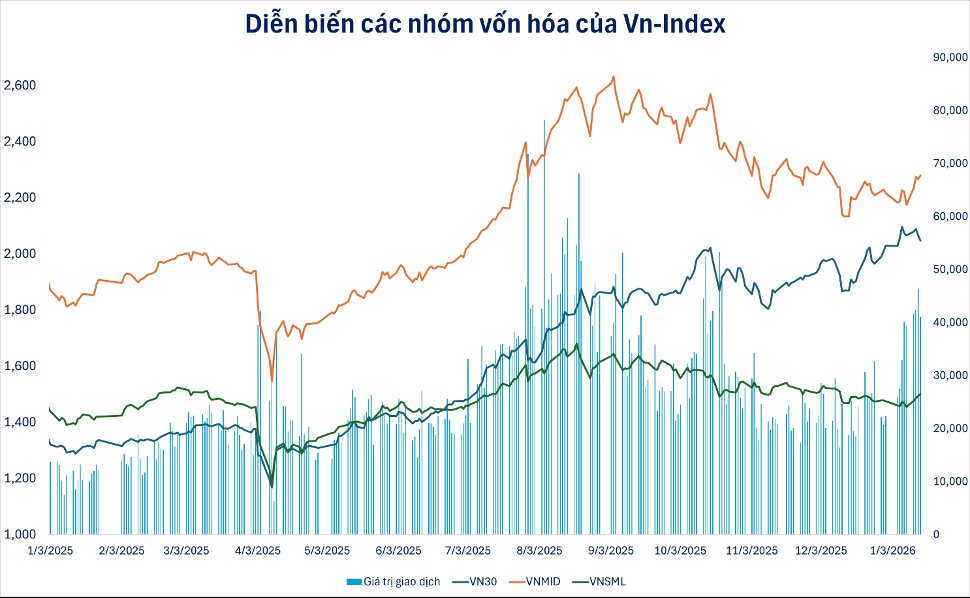

The VN-Index experienced a positive trading week, reaching a new peak above the 1,900-point mark on Tuesday (January 13th). Strong buying pressure came from large-cap stocks. However, in subsequent sessions, the index faced selling pressure as profit-taking increased at higher levels. By the end of the week, the VN-Index closed at 1,879.13 points, up 11.23 points (+0.60%) from the previous week.

Experts suggest that market trends remain uncertain, advising investors to maintain a cautious strategy.

Potential corrections before another attempt at the 1,900-point level

According to Mr. Bùi Văn Huy, Deputy General Director of FIDT, the VN-Index’s performance next week should be viewed in the context of the market entering a historical peak and seeking a new equilibrium. The index surpassing 1,900 points mid-week indicates sustained demand for large-cap stocks, though subsequent profit-taking reflects caution as prices rise.

Experts predict a reasonable short-term scenario where the VN-Index consolidates with possible corrections before sustainably challenging the 1,900-point level again. At current prices, investors tend to slow down and observe, especially since recent gains were driven primarily by blue-chip stocks. A technical correction with reduced liquidity would be more constructive than negative, as it helps absorb selling pressure and establish a new price floor.

Beyond technical factors, during politically significant periods, investors often become more selective and observant rather than aggressively deploying capital, slowing the index’s rise and increasing narrow-range volatility.

The VN-Index’s ability to reclaim the 1,900-point mark will largely depend on the quality of capital flows. If the rally resumes with broader sector participation, especially in sectors with strong fundamentals and reasonable valuations, the chances of breaking the peak improve. Conversely, if the index rises primarily due to blue-chip stocks while most others stagnate or correct, the market may need more time to consolidate and find balance.

Foreign investors’ lack of aggressive net buying last week reflects their caution toward Vietnam’s market at historical highs. With the index near 1,900 points, foreign selling is partly due to profit-taking in stocks that surged recently, along with unclear exchange rate and global interest rate outlooks.

Mr. Huy notes that foreign selling last week should be viewed in the context of medium-term capital flows rather than short-term observations. A key macro factor influencing foreign investors is the exchange rate, as 2025’s strong selling pressure stemmed mainly from the Vietnamese dong’s depreciation against the USD, not negative domestic economic factors.

In 2026, exchange rate pressures are expected to ease significantly, reducing foreign selling intensity. This is supported by rising domestic interest rates and the Federal Reserve’s projected two rate cuts this year. Narrowing the interest rate gap between VND and USD reduces capital outflows from emerging markets like Vietnam. This is crucial to mitigating defensive foreign selling and encouraging selective investment rather than broad withdrawals.

Beyond exchange rates and interest rates, market upgrade expectations are vital for improving foreign investor sentiment. While upgrades may not impact the short term, they strengthen long-term confidence in Vietnam’s stock market and support liquidity as domestic capital remains dominant.

As the VN-Index hovers near historical highs and the market shows clear differentiation, investors should adopt a cautious and flexible short-term strategy. Maintaining a balanced portfolio of stocks and cash is essential, avoiding FOMO during euphoric rallies.

Unclear market trends,

investors should maintain stock and cash ratios

According to Mr. Nguyễn Tấn Phong, Securities Analyst at Pinetree, the stock market began the week enthusiastically, led by State-Owned Enterprise stocks, particularly the trio of state-owned banks. The VN-Index reached a new all-time high of over 1,918 points. However, the sharp decline in Vingroup stocks overshadowed the market’s overall efforts. The market only turned green in the final session as Vingroup and some blue-chip stocks recovered. Notably, foreign investors nearly closed all their strong net buying positions since early 2026.

For the upcoming week, Mr. Phong observes that capital is shifting away from State-Owned Enterprise stocks that surged in the past two weeks, partially returning to beta stocks that declined sharply. The index is likely to remain at high levels in the first half of the week before potentially volatile movements in the second half, depending on new policies and messages.

Historically, the VN-Index has often rallied strongly under similar conditions. Additionally, many companies will announce Q4 2025 earnings next week, influencing overall market trends. With unclear market direction, Pinetree experts advise investors to maintain stock and cash ratios, prioritize portfolio management, and avoid FOMO on stocks that have already surged.

VN-Index Slips Below 1,900 Points: What’s Next for the Stock Market Next Week?

The VN-Index concluded the trading week below the 1,900-point mark, following a prolonged rally and heightened profit-taking pressure. Amid rapid capital rotation and foreign investors shifting to net selling, market direction remains uncertain. Investors are advised to avoid FOMO and proceed with caution.

Doubling Capital Requirements for Football Betting Enterprises

In the latest draft decree replacing Decree 06/2017 on betting business for horse racing, dog racing, and international football, the Ministry of Finance proposes raising the charter capital requirements for pilot enterprises operating in international football betting.