GELEX Infrastructure JSC has recently announced changes to its business registration, including a capital increase of VND 1,000 billion.

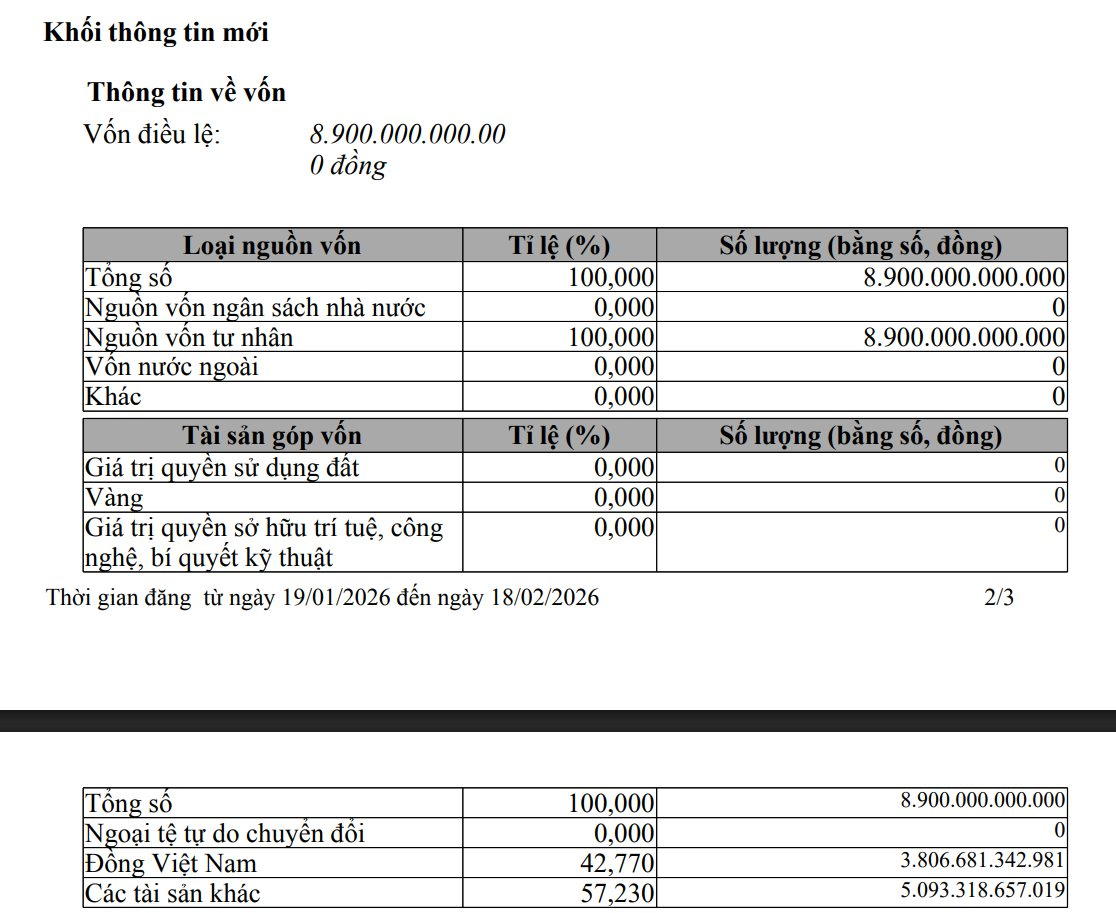

Following this adjustment, the company’s chartered capital has risen from VND 7,900 billion to VND 8,900 billion.

The legal representative is CEO Luong Thanh Tung, who also serves as Vice Chairman of the Board of Directors at GELEX Group JSC.

The capital increase was recorded after GELEX Infrastructure successfully auctioned 100 million shares on the Ho Chi Minh City Stock Exchange (HoSE), with a par value of VND 10,000 per share.

The 100 million shares were sold to 172 investors, including 16.4 million shares purchased by foreign investors. The successful bidding prices ranged from VND 28,000 to VND 35,000 per share, with an average winning price of VND 28,820 per share. GELEX Infrastructure raised a total of VND 2,882 billion from the auction.

GELEX Infrastructure is one of two sub-holdings of GELEX Group, alongside GELEX Electric (stock code: GEE). It plays a key role in managing capital across critical sectors, including real estate, construction materials, and utility infrastructure such as energy and clean water. The company owns and invests in prominent brands like Viglacera, Long Son Petrochemical Industrial Park, Da River Clean Water, and Titan Hai Phong.

As of Q3 2025, GELEX Infrastructure’s total assets reached VND 41,396 billion. Its net revenue for the first nine months of 2025 was VND 9,999 billion, a 13.3% increase year-on-year, with pre-tax profit rising 55.5% to VND 1,356 billion. For 2025, the company aims to achieve net revenue of VND 15,445 billion and pre-tax profit of VND 1,925 billion.

Gen Z Leader Nominated to LPBank Securities Board: Son of Nguyen Duc Thuy, American University Graduate, Heads Sports Company

LPBank Securities JSC (LPBS) has officially released its shareholder consultation materials regarding its planned initial public offering (IPO) for listing on the Ho Chi Minh City Stock Exchange (HoSE). Alongside this strategic move, the company has strengthened its senior leadership team, notably appointing the son of Mr. Nguyễn Đức Thụy to a key position.

Xuân Thiện Securities Officially Approved as VNX Trading Member

Amidst significant leadership changes, CTCP Chứng khoán Xuân Thiện (XTSC) has secured substantial backing from prominent investor Nguyễn Văn Thiện. As a result, the Vietnam Stock Exchange (VNX) has officially approved XTSC as a listed securities trading member, granting it registration for trading activities.