During the upcoming written shareholder consultation scheduled from January 17th to 26th, the most anticipated aspect among investors is the list of nominees for the Board of Directors (BOD) supplementary election for the 2023-2028 term. Alongside Mr. Phan Thanh Son from Thaiholdings and Mr. Pham Quang Hung, a financial and insurance expert, the nomination list features Nguyen Xuan Thai.

Mr. Nguyen Xuan Thai – son of Chairman Nguyen Duc Thuy

According to the published profile, Mr. Nguyen Xuan Thai is the son of Chairman Nguyen Duc Thuy, who currently serves as the Acting CEO of Sacombank.

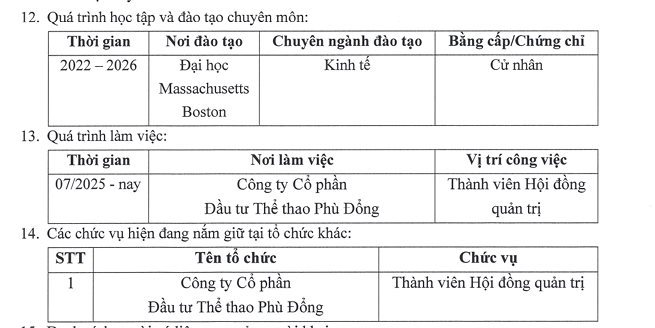

The candidate’s profile indicates that Mr. Nguyen Xuan Thai is pursuing his professional education at the University of Massachusetts Boston (USA), majoring in Economics from 2022 to 2026. This data reveals that Mr. Thai belongs to the Gen Z generation and is being nominated for a senior management position at the securities company at a very young age. Prior to his nomination at LPBS, Mr. Thai had already begun his corporate governance career as a Board Member of Phu Dong Sports Investment JSC since July 2025.

Source: LPBS

In parallel with personnel matters, LPBS is also presenting shareholders with a large-scale capital increase plan through an IPO. Specifically, the company plans to offer up to 126.68 million shares, equivalent to approximately 10% of the total outstanding shares.

If the issuance is successful, LPBS’s charter capital will increase from the current VND 12,668 billion to nearly VND 13,935 billion. The specific offering price will be determined by the BOD but is guaranteed not to be lower than the book value in the most recent quarterly financial report.

Regarding the use of raised capital, LPBS’s management plans to allocate the majority of funds to fixed-income assets and lending activities. Specifically, 50% of the proceeds will be invested in securities, 45% will support margin lending activities, and the remaining 5% will be used for proprietary trading. The disbursement period is expected to span from Q2 to Q4/2026. Immediately after completing the offering, the company will proceed with listing its shares on the Ho Chi Minh City Stock Exchange (HoSE).

Another item up for consultation is the adjustment of the company’s headquarters location. Instead of relocating to Hanoi as approved by the 2025 Annual General Meeting, LPBS’s BOD proposes maintaining the headquarters in Ho Chi Minh City and moving to a new address at 257 Dien Bien Phu, District 3.

This move is justified as being more aligned with the company’s development strategy and personnel scale in the new phase. Currently, LPBS’s major shareholder is Loc Phat Vietnam Commercial Joint Stock Bank (LPBank), holding 5.5% of the charter capital.

Former Eximbank Chairman Takes the Helm at Bao Minh Securities

Ms. Luong Thi Cam Tu joined Bao Minh Securities and was immediately elected as the Chairwoman of the Board of Directors of this securities company.

PYN Elite Fund Anticipates Sacombank’s Imminent “Value Unlock”

The Finnish investment fund PYN Elite has released its December 2025 report, revealing a nearly 3% portfolio growth, primarily driven by the strong performance of two banking stocks: HDBank (HDB) and Sacombank (STB). This achievement comes amidst a highly polarized Vietnamese stock market, despite the VN-Index closing the year at a record high.

GELEX Secures Spot Among Vietnam’s Top 50 Largest Enterprises

GELEX Group Corporation (HOSE: GEX) has been recognized by Vietnam Report as one of the Top 50 Largest Enterprises in Vietnam (VNR500). This prestigious annual ranking, now in its 19th year, evaluates companies based on revenue, profit, growth rate, and asset size.

Xuân Thiện Securities Officially Approved as VNX Trading Member

Amidst significant leadership changes, CTCP Chứng khoán Xuân Thiện (XTSC) has secured substantial backing from prominent investor Nguyễn Văn Thiện. As a result, the Vietnam Stock Exchange (VNX) has officially approved XTSC as a listed securities trading member, granting it registration for trading activities.