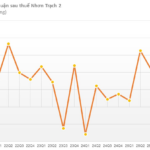

Sonadezi Chau Duc Joint Stock Company (stock code: SZC) has released its Q4/2025 financial report, revealing a 65% year-on-year surge in net revenue to VND 379 billion, with post-tax profit climbing nearly 44% to VND 103 billion.

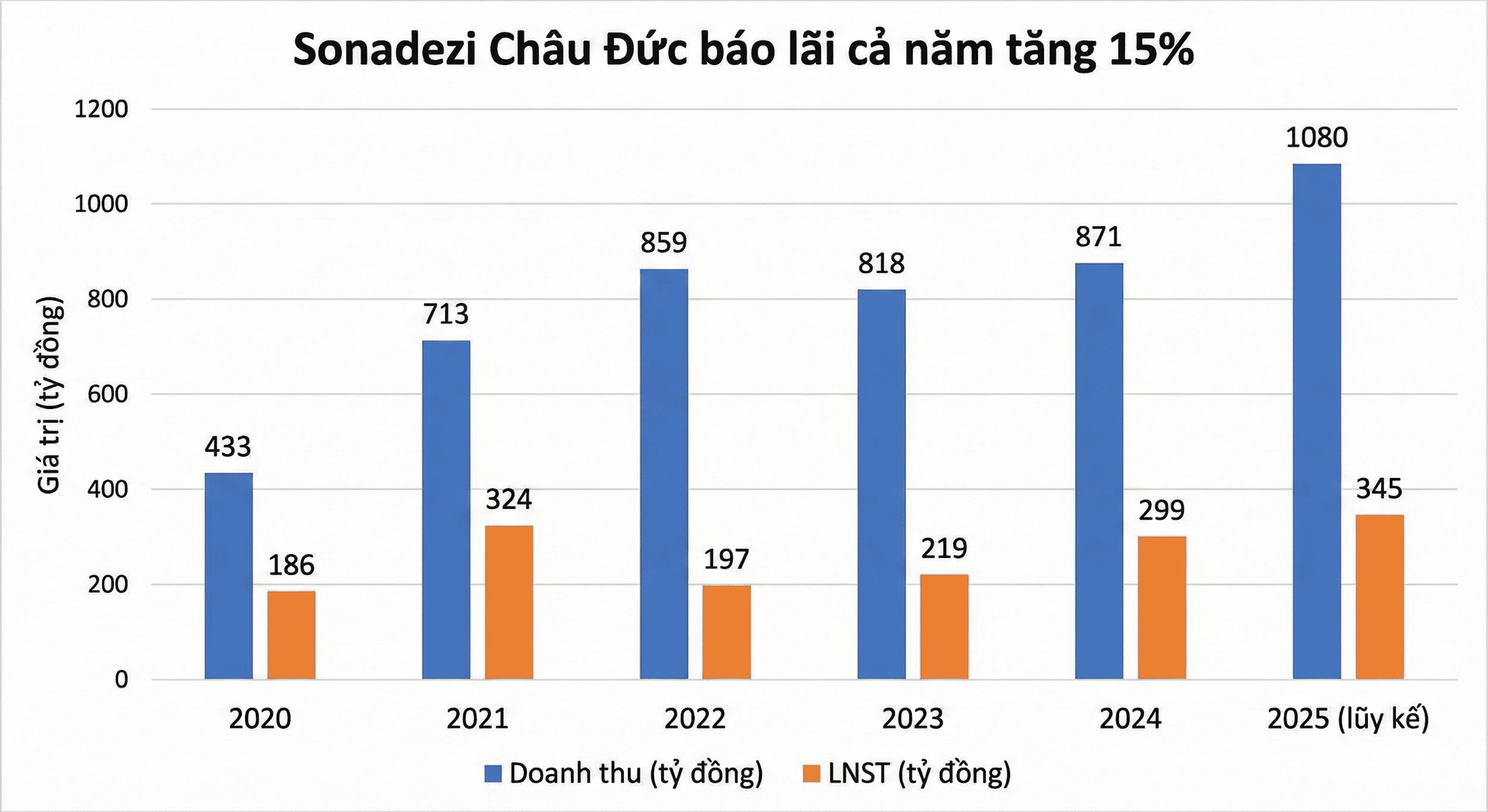

For the full year 2025, the company’s net revenue reached VND 1,080 billion, a 24% increase compared to 2024, while post-tax profit hit VND 345 billion, up 15.6%.

Revenue breakdown highlights that the industrial zone infrastructure segment contributed nearly VND 320 billion in Q4/2025 alone, serving as the primary profit driver and key growth pillar for Sonadezi Chau Duc.

The company attributed the 43.7% rise in post-tax profit for Q4/2025 to a VND 149 billion increase in sales and service revenue, reflecting a 65% growth rate.

Meanwhile, the cost of goods sold rose by only 36.8%, slower than revenue growth, thereby enhancing profit margins. Financial revenue decreased by 55.2%, while financial expenses dipped by 0.7%, resulting in minimal impact on overall performance.

Selling expenses plummeted by 94%, whereas administrative expenses surged 71.8% compared to Q4/2024. Despite higher other expenses in the period, they did not alter the positive profit growth trajectory.

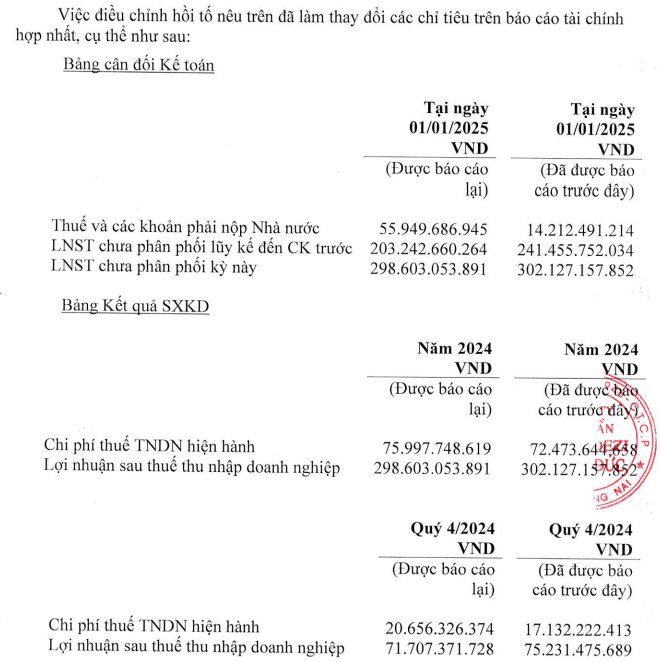

During the period, following a tax audit for 2024 and a review of prior years’ corporate income tax obligations, the company made retrospective adjustments to corporate income tax expenses, leading to retrospective revisions in post-tax profit for previous years, in compliance with current accounting standards.

As of year-end 2025, Sonadezi Chau Duc reported ongoing construction costs for the Chau Duc Industrial Zone project, totaling over VND 3,500 billion in investments.

Additionally, the company’s inventory value reached nearly VND 1,900 billion, primarily concentrated in the Chau Duc Urban Area project at VND 1,579 billion. Remaining inventory includes the Huu Phuoc Residential Area (VND 210 billion) and the Social Housing project (VND 102 billion).

On the stock market, SZC shares rose 5.6% to VND 32,950 per share in the morning session of January 19.

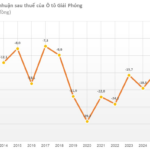

Power Generation Company Reports 2025 Profit of $1 Trillion, a 12-Fold Increase from Previous Year

In 2025, NT2 achieved a remarkable year-end performance with net revenue reaching 7.804 trillion VND, marking a 31% increase compared to the previous year. The company’s after-tax profit for the same period soared to nearly 1.000 trillion VND, a 12-fold surge from the 82.9 billion VND recorded in 2024.

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.

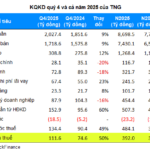

TNG Records 392 Billion VND Profit in 2025, Stock Rebounds Strongly

Despite a slowdown in Q4/2025 profits compared to the previous two quarters, TNG Investment and Trading JSC (HNX: TNG) concluded 2025 with its highest-ever net profit.