The Lao Cai Provincial Police, in collaboration with the Ministry of Public Security’s Department of Investigation of Corruption, Economic, and Smuggling Crimes, and the Hanoi City Police, have successfully dismantled a large-scale counterfeit dietary supplement production and distribution ring. The operation was led by Doan Trung Duc, CEO of Medistar Vietnam.

Initial investigations reveal that from 2012 to 2025, the syndicate sold hundreds of tons of fake dietary supplements, generating nearly VND 1.8 trillion in revenue. This operation severely impacted consumer health and rights. The perpetrators concealed substantial profits off the books, causing significant tax losses for the state.

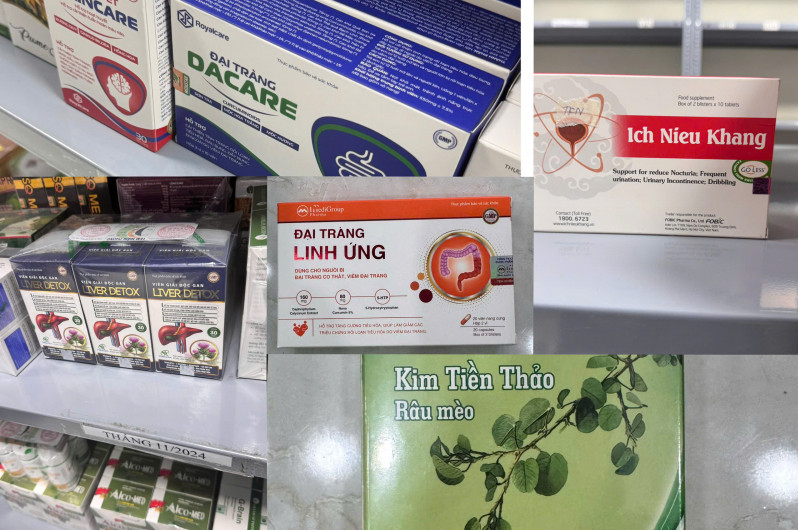

Counterfeit products seized by the police at the scene.

On January 18, 2026, the Lao Cai Provincial Police Investigation Agency issued a decision to prosecute the case and arrest Doan Trung Duc, born in 1980, residing in Trung Yen New Urban Area, Yen Hoa Ward, Hanoi. Duc, the CEO of Medistar Vietnam Co., Ltd., along with five accomplices, faces charges of “Producing and trading counterfeit food, foodstuffs, and food additives” and “Violating accounting regulations with serious consequences.”

Following Duc’s arrest on January 19, the company’s website at https://medistar.com.vn/ became inaccessible, despite functioning normally prior to the incident.

Medistar’s website unexpectedly went offline.

According to the National Business Registration Portal, Medistar Vietnam Co., Ltd. was established in June 2011, headquartered in Phu Dien Ward, Hanoi, specializing in dietary supplement production.

The company is led by Doan Trung Duc (born in 1980) as CEO and legal representative. At its inception, the company’s charter capital was VND 6 billion, with Duc contributing VND 4.2 billion (70%) and Nguyen Thi Hong VND 1.8 billion (30%).

Over time, the company increased its charter capital multiple times: to VND 14.2 billion in November 2014, VND 32 billion, and VND 50 billion in July 2016. By December 2018, the charter capital reached VND 80 billion, with no changes in ownership structure.

The Lao Cai Provincial Police Investigation Agency continues to expand its investigation into Doan Trung Duc’s case, aiming to clarify the roles and actions of all individuals involved, as reported by authorities.

Nutraceutical Firm Accused of Fraud, Pocketing $77 Million in Revenue

The CEO of Medistar Vietnam Co., Ltd. and five accomplices have been indicted for producing and trading counterfeit dietary supplements, as well as violating accounting regulations. The company is accused of distributing hundreds of tons of fake health products, amassing nearly VND 1.8 trillion in profits, despite previously marketing itself as a leading enterprise in the industry.

Exposing the Dark Side: Shark Tank Vietnam’s ‘Sharks’ Accused of Fraud and Tax Evasion

Over the past decade of broadcasting, approximately 20 “sharks” have graced the hot seat on Shark Tank Vietnam. Shockingly, several of these high-profile investors, including Shark Thủy, Shark Tam, and Shark Bình, have faced legal repercussions, including prosecution and imprisonment, for fraud and tax evasion.

Unprecedented Tax Hikes: A New Era of Fiscal Policy

By the end of December 31st, the total revenue managed by the tax authority is estimated to exceed 2.23 quadrillion VND, surpassing the projected target by 30%—the highest increase ever recorded. The Minister of Finance has urged the tax sector to intensify efforts in combating tax evasion, invoice fraud, and improper tax refunds, while also enhancing the quality of services provided to taxpayers.