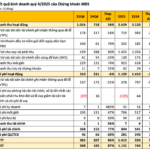

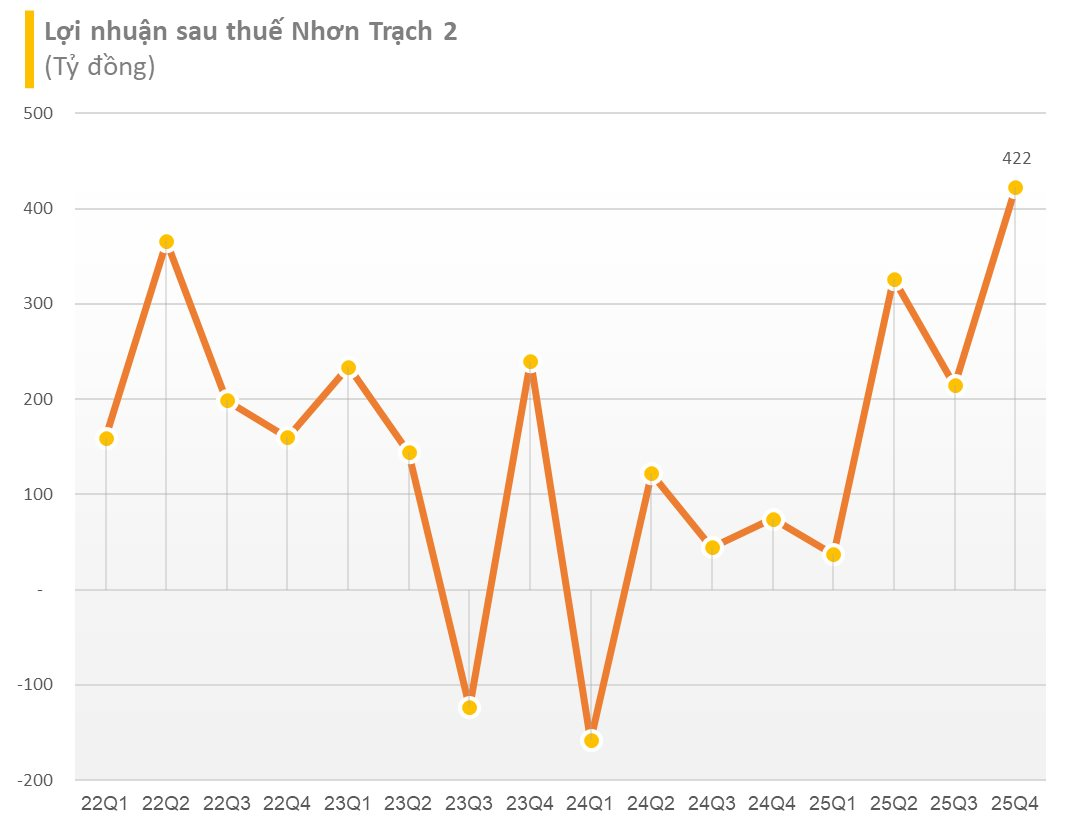

Nhơn Trạch 2 Power JSC (stock code: NT2) has released its Q4/2025 financial report, showcasing remarkable business growth.

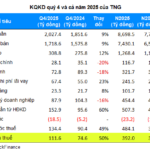

In Q4/2025, NT2 reported net revenue of VND 2,367 billion, a 33% increase from the VND 1,784 billion recorded in the same period of 2024. Notably, the company’s after-tax profit surged by 466% to VND 422 billion, compared to nearly VND 75 billion in Q4/2024.

NT2 attributed this success primarily to its power generation activities. Specifically, revenue from power production in Q4 rose by VND 583.4 billion, while the cost of goods sold increased by only VND 193.6 billion (11.4%). This disparity between revenue and cost growth resulted in a VND 389.8 billion increase in gross profit from power generation, equivalent to a 443.9% rise. Additionally, financial activity profits in Q4/2025 increased by VND 9.6 billion compared to Q4/2024.

For the full year 2025, NT2’s cumulative net revenue reached VND 7,804 billion, a 31% year-on-year increase. Cumulative after-tax profit for 2025 hit nearly VND 1,000 billion, 12 times higher than the VND 82.9 billion recorded in 2024.

As of December 31, 2025, NT2’s total assets stood at VND 9,124 billion, an increase of VND 426 billion from the beginning of the year. The majority of NT2’s assets comprise cash and bank deposits (VND 3,780 billion) and short-term receivables (VND 3,741 billion).

On the liabilities side, total payables decreased from VND 4,509 billion to VND 4,395 billion. Short-term loans and finance leases rose from VND 996 billion at the start of the year to VND 1,762 billion by year-end.

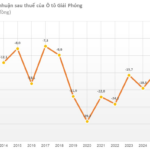

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.

Domestic Car Manufacturer Reports 15 Consecutive Years of Losses, Accumulated Deficit Exceeds $360 Million, Negative Equity

Revised Introduction:

Gia Lai Garment Joint Stock Company (GGG) reported a post-tax loss of nearly VND 4 billion in Q4 and a cumulative post-tax loss of approximately VND 15 billion for 2025. This marks the 15th consecutive year GGG has recorded financial losses.