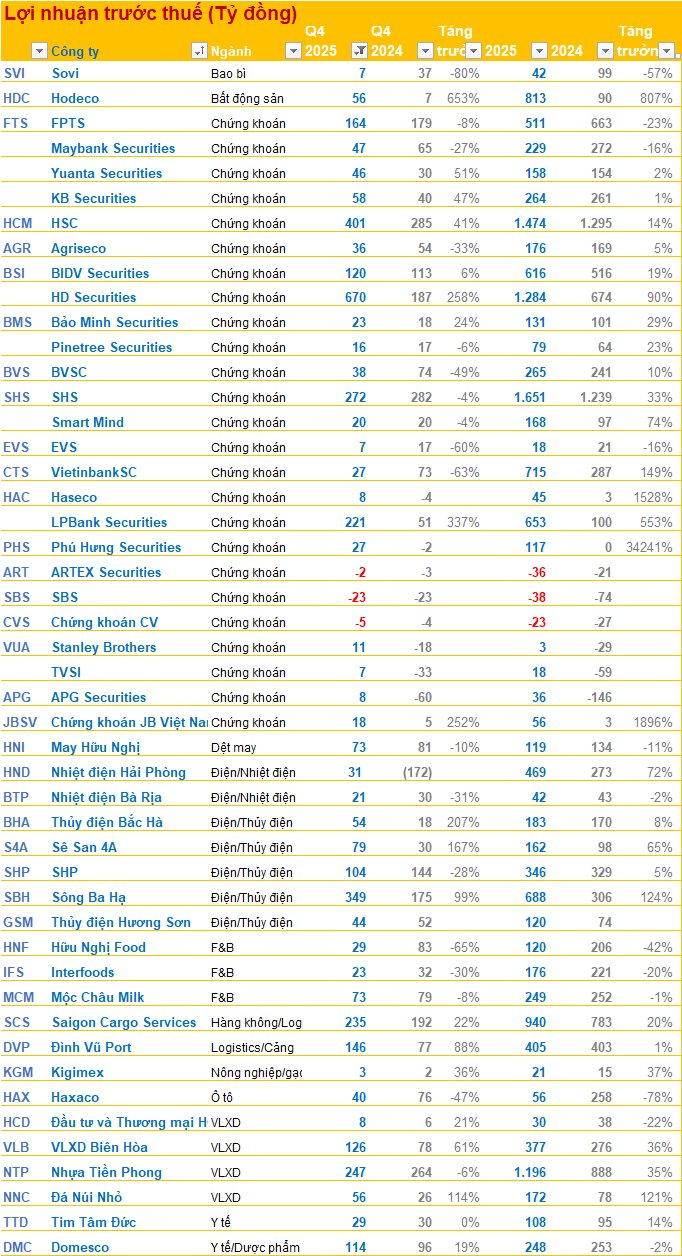

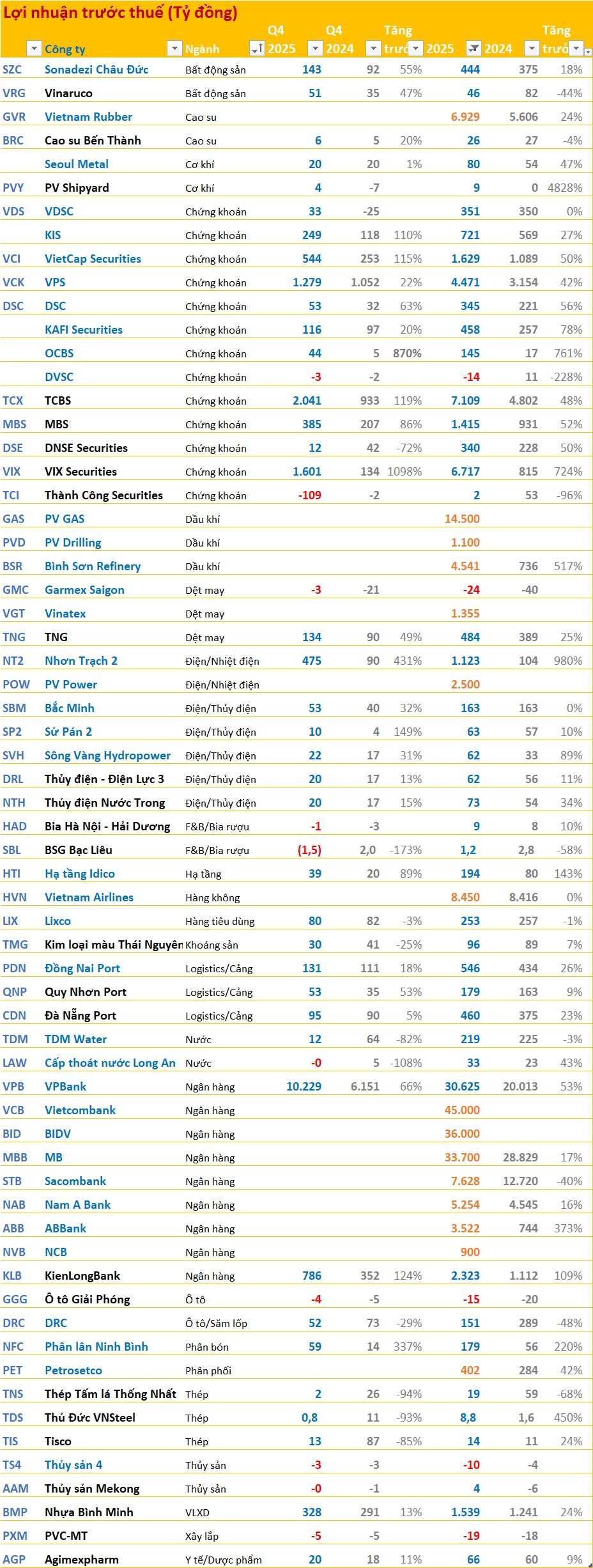

Newly Released Q4/2025 Financial Reports as of January 20, 2025:

VPBank (VPB) reported pre-tax profits of VND 10,229 billion in Q4, a 66% increase year-over-year. For the full year 2025, VPBank recorded profits of VND 30,625 billion, up 53% compared to 2024.

The securities sector saw significant growth, with OCBS reporting a staggering 870% profit increase in Q4, reaching VND 44 billion. For the year, OCBS achieved VND 145 billion in profits, a 761% surge.

VPS maintained its strong performance, with Q4 profits of VND 1,279 billion, bringing its full-year profits to VND 4,471 billion.

VietCap Securities (VCI) and KIS both saw over 100% profit growth in Q4, reaching VND 544 billion and VND 249 billion, respectively.

In the manufacturing and energy sector, Ninh Binh Phosphate (NFC) surprised with a 337% profit increase in Q4, reaching VND 59 billion. For 2025, NFC achieved VND 179 billion in pre-tax profits, a 220% growth.

Contrary to the overall growth trend, some companies faced challenges. DRC saw a 29% profit decline in Q4, with full-year profits at VND 151 billion.

Garmex Saigon (GMC) and TS4 both reported losses of approximately VND 3 billion in Q4.

Lixco (LIX) experienced a slight 3% profit decrease in Q4, reaching VND 80 billion.

Q4/2025 Financial Report Update: Bank Profits Surge 124% in Q4, While Seafood Company Posts Loss

The fourth quarter of 2025 is shaping up to be a promising period for businesses, as early indicators reveal robust growth across various sectors. This quarter’s earnings outlook is painting a picture of profitability, with many companies already reporting impressive gains. The initial results set the stage for what could be a highly successful end to the fiscal year.

Skyrocketing Construction Costs Threaten Transportation Projects, Contractors Face Looming Losses

Soaring construction material costs, coupled with outdated legal frameworks and sluggish price adjustment mechanisms, are pushing contractors in Hanoi and beyond to the brink of significant losses, with some even forced to halt construction altogether.