According to a report submitted to the State Securities Commission and the Ho Chi Minh City Stock Exchange (HoSE), the transaction was executed on January 16, 2026. This acquisition elevated the fund’s ownership stake in Nam Long above the 5% threshold, qualifying it as a major shareholder under regulatory guidelines.

Specifically, prior to the transaction, VinaCapital held 1,855,250 NLG shares, equivalent to 0.3824% of Nam Long’s charter capital (based on 485.1 million outstanding shares). In the latest transaction, the fund purchased an additional 340,670 shares, increasing its total holdings to 2,195,920 shares, or 0.4527% of the charter capital.

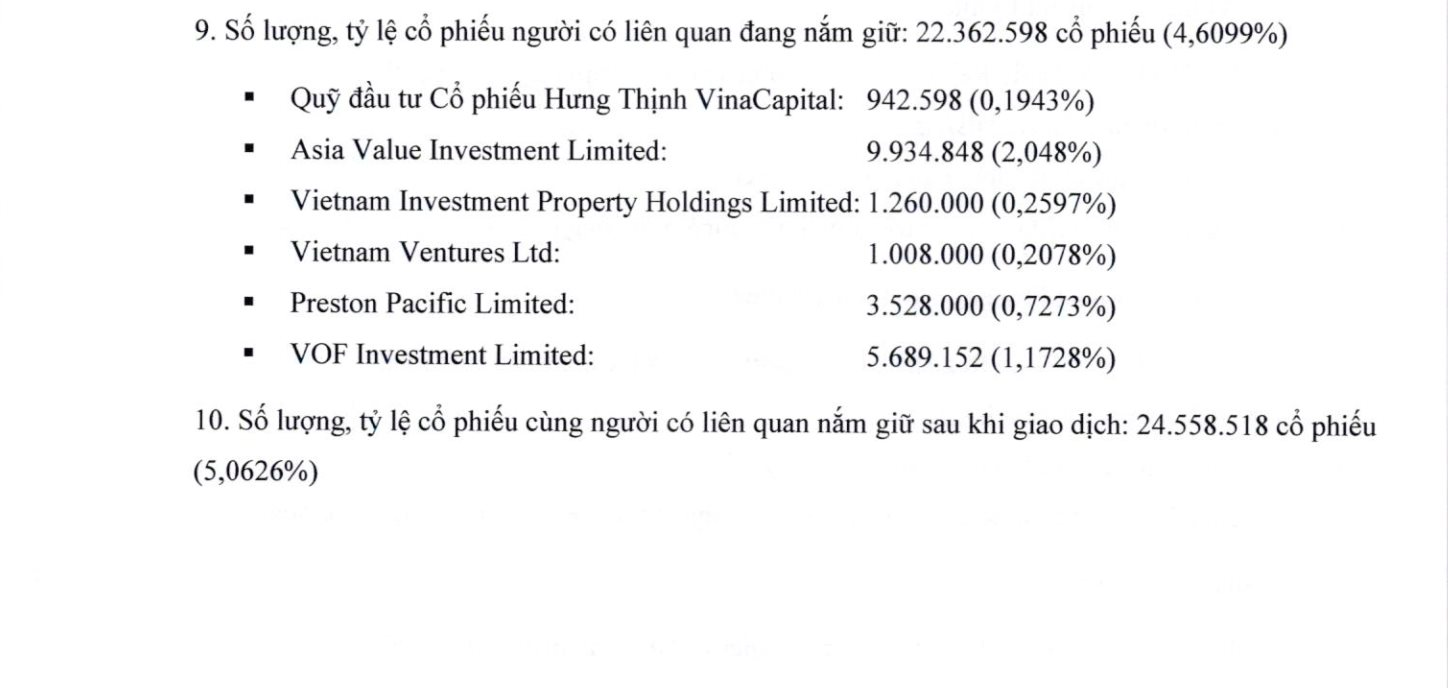

Notably, when including shares held by related parties, the total ownership of the VinaCapital-affiliated investor group in Nam Long rose to 24,558,518 shares, representing 5.0626% of the charter capital. This officially designates the group as a major shareholder of the listed real estate company.

The list of related parties within the VinaCapital group includes several domestic and international entities such as Hung Thinh VinaCapital Equity Fund, Asia Value Investment Limited, Vietnam Investment Property Holdings Limited, Vietnam Ventures Ltd, Preston Pacific Limited, and VOF Investment Limited. Among these, Asia Value Investment Limited holds the largest stake with over 9.93 million shares, equivalent to 2.048% of Nam Long’s charter capital.

VinaCapital officially becomes a major shareholder of Nam Long, holding 5.0626% of the charter capital.

Regarding business performance, in the first nine months of 2025, Nam Long recorded net revenue of VND 3,941 billion and net profit of VND 354 billion, achieving 58% of the annual revenue target and 50% of the profit goal.

The 2025 business plan, approved by the Shareholders’ Meeting, sets a revenue target of VND 6,794 billion and a net profit goal of VND 701 billion.

As of September 30, 2025, Nam Long’s total assets decreased by nearly VND 2,000 billion compared to the beginning of the year, to VND 28,387 billion. Current assets declined by 9%, to VND 24,963 billion, a reduction of VND 2,585 billion, primarily due to a decrease in cash and cash equivalents by over VND 2,000 billion, to VND 3,261 billion.

On the liabilities side, as of the end of Q3 2025, Nam Long’s total debt stood at VND 14,019 billion, an 11% decrease from the beginning of the year, equivalent to a reduction of VND 1,729 billion. Financial debt remained relatively stable at VND 6,992 billion, comprising VND 1,442 billion in short-term debt and VND 5,549 billion in long-term debt.

NLG shares are trading at their lowest level in over six months.

On the stock market, as of the close on January 19, NLG shares were priced at VND 30,100 per share, down 1.79% from the previous session, with a trading volume of over 2.9 million units.

Contrary to the market’s upward momentum, the stock is trading at its lowest level in over six months, reducing Nam Long’s market capitalization to VND 14,601 billion.

VinaCapital: 2026 Economic Acceleration Begins, Caution Advised on Bank NIM Compression Risks

Vietnam’s economy is poised for a robust acceleration, fueled by synchronized policy pillars and easing exchange rate pressures. However, VinaCapital experts caution investors about potential headwinds from rising interest rates and liquidity strains, which could erode bank net interest margins (NIM).