Vinhomes Successfully Issues VND 4.5 Trillion in Corporate Bonds

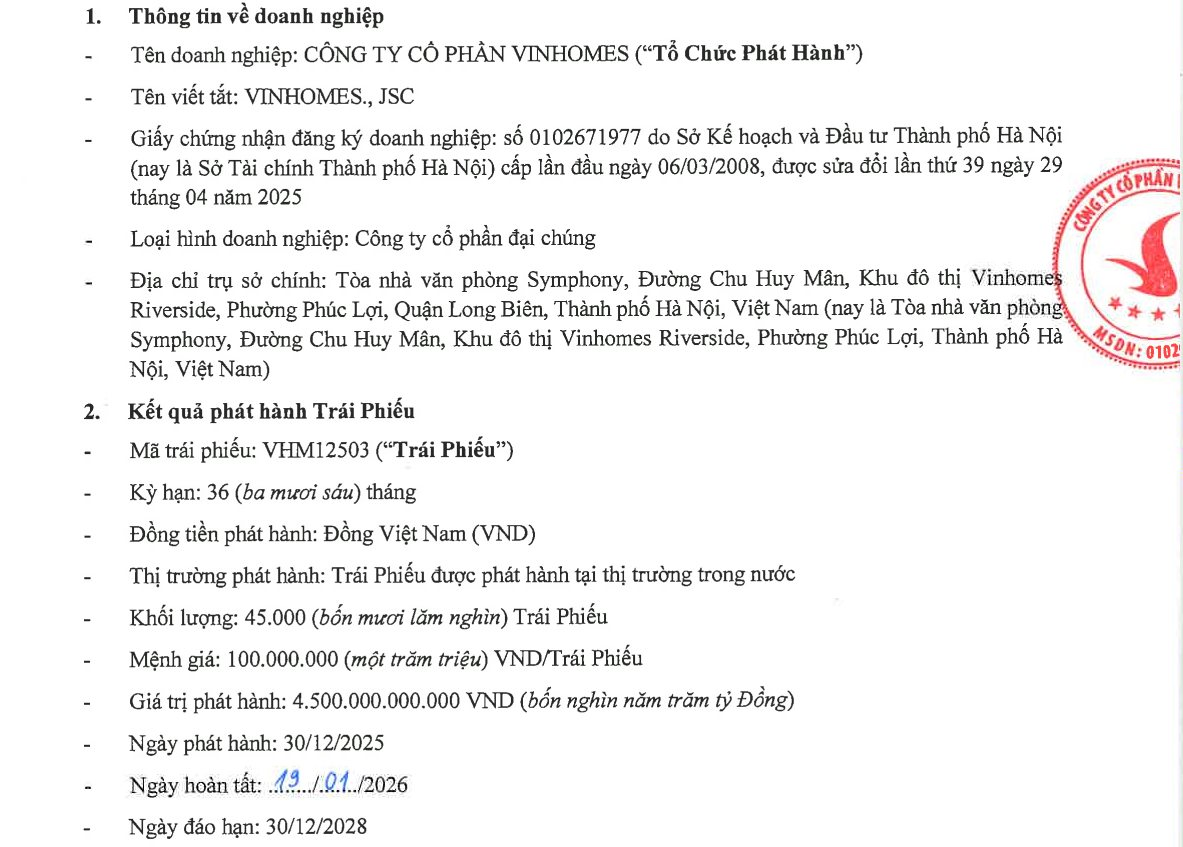

Vinhomes Joint Stock Company (stock code: VHM) has announced to the Hanoi Stock Exchange the successful issuance of its VHM12503 corporate bonds.

The company issued 45,000 bonds with a face value of VND 100 million each, totaling VND 4.5 trillion. The bonds have a maturity period of 36 months.

The interest rate for this bond issuance is set at 12%.

Financial Highlights of Vinhomes

Since late December 2025, Vinhomes has disclosed plans to issue VND 4.5 trillion in bonds. The collateral includes assets legally owned by Vingroup Corporation, Vinhomes, and/or third parties.

In November 2025, Vinhomes completed the repayment of VND 2.000 trillion in principal and VND 61.15 billion in interest for the VHMBS2325004 bond series, as scheduled.

According to the Q3/2025 consolidated financial report, Vinhomes achieved a revenue of VND 162.582 trillion in the first nine months of 2025, a 96% increase year-over-year. The company’s after-tax profit reached VND 15.313 trillion.

As of September 30, 2025, Vinhomes maintained a robust financial position with total assets of VND 768.264 trillion and equity of VND 234.930 trillion, representing a 36% and 6% increase, respectively, compared to the end of 2024.

Vietnamese Billionaires Rush to Raise Nearly $1.5 Billion Through Bonds, Enticed by Up to 12% Interest Rates

The corporate bond market concluded 2025 with a staggering scale of nearly 590 trillion VND. Notably, in just the past month, the market witnessed a remarkable “final sprint” from billionaire ecosystems such as Vingroup, Sovico, Thaco, and Techcombank, collectively raising an estimated total of over 35 trillion VND.

Vinhomes to Develop Vietnam’s Largest International University Urban Area: $2.5 Billion Investment, District-Sized Campus Near Ring Road 3

After nearly 20 years of anticipation, the 880-hectare Berjaya International University Urban Area project is finally gearing up for development, positioning the northwestern gateway of Ho Chi Minh City squarely in the spotlight of the real estate market. With the accelerated progress of Ring Road 3 and early signs of land price movements in the surrounding areas, this project is poised to become a focal point for investors and homebuyers alike.

2026 Spotlight Industries: Is Vingroup Stock Still a Compelling Investment?

The year 2026 is poised to be a pivotal year for the stock market, driven by economic growth, capital upgrades, and a rebound in corporate earnings. Three standout sectors to watch are infrastructure and construction, finance, and consumer goods. Among these, Vingroup shares stand out due to their compelling narrative in infrastructure, real estate, and ecosystem restructuring. However, investors should carefully evaluate pricing dynamics and timing to maximize investment returns.