Rental Apartments Witness Strong Segmentation

According to Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, 2026 will not be a year of uniform growth across all segments but rather a period of distinct segmentation. Market resilience will hinge on real demand, tangible capital flows, and long-term adaptability rather than short-term price appreciation expectations.

From an investment perspective, Tuan emphasizes that residential apartments catering to genuine living needs will be the market’s cornerstone in 2026. Projects with complete legal frameworks, modern amenities, and robust connectivity are poised for stable rental demand, appealing to young professionals, families, and expatriates.

Among these, experts and engineers employed in industrial zones, logistics hubs, and tech centers prioritize high-end projects offering extensive amenities, green spaces, and seamless connectivity to workplaces via major thoroughfares.

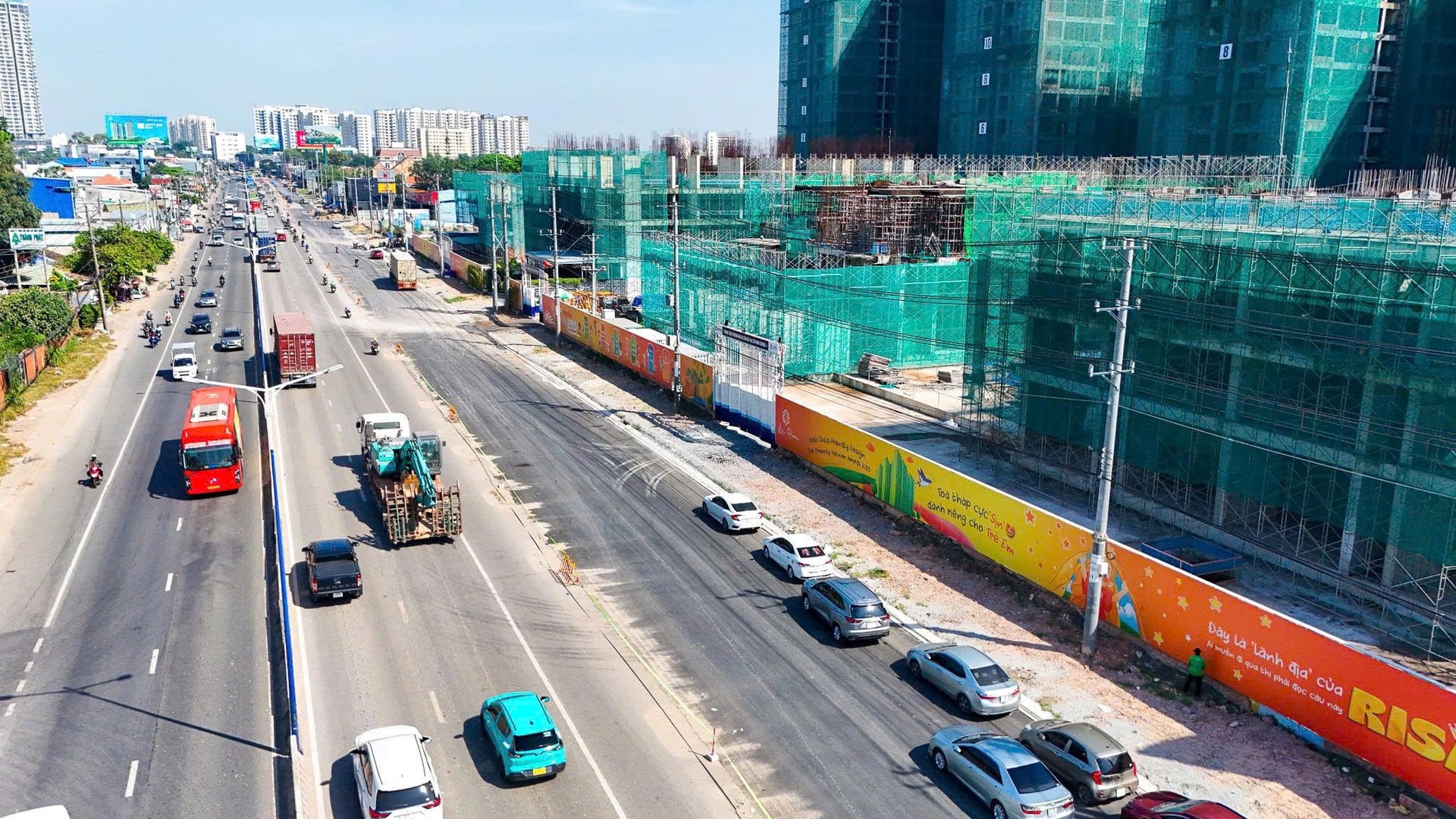

Notably, in Ho Chi Minh City’s Northeast region along National Highway 13, projects such as Landmark Binh Duong by Phu Cuong Group, La Pura by Phat Dat, The Habitat, The Ten by Becamex Tokyu, and Diamond Sky in Van Phuc City are anticipated to attract a significant influx of expatriate tenants and young families, thanks to their high-quality living standards.

Real estate projects along National Highway 13 are expected to attract a large number of expatriate tenants.

Among these, La Pura stands out as the first all-in-one urban development in Ho Chi Minh City’s Northeast, setting a new benchmark for 2026’s supply and catering to the high-quality accommodation needs of expatriates.

Strategically located on the frontage of National Highway 13—which is undergoing expansion to 60 meters—La Pura will offer a 15-minute commute to Hang Xanh intersection and a 30-minute drive to Tan Son Nhat International Airport. The project’s new phase is rumored to launch at approximately VND 75 million per square meter, marking the region’s first “Branded Residences.”

As FDI capital, industrial projects, and businesses continue to shift towards Ho Chi Minh City’s Northeast, the rental market dynamics are evolving. While mid-range apartments cater to middle-income tenants, high-end projects are becoming the preferred choice for expatriate professionals and engineers. This growing demand for quality accommodation translates into consistent cash flows for investors.

Future Value Drivers for Investment

Previously, Ho Chi Minh City’s Northeast lacked high-end residential projects. However, the emergence of developments by major investors along National Highway 13 has transformed the landscape. Many professionals now find apartments near their workplaces, complete with amenities like swimming pools, gyms, playgrounds, green spaces, and robust security.

Experts agree that the demand and potential for rental apartments in this region remain substantial, particularly following recent administrative boundary adjustments.

Dinh Minh Tuan notes that the area is now the Southern region’s industrial and high-tech hub, home to nearly 45,000 expatriate experts and engineers. These tenants demand high living standards, with luxury apartments achieving 80-90% occupancy rates, ideal for senior executives and high-income workers.

Ho Chi Minh City’s Northeast leads in attracting and retaining residents, FDI capital, industrial projects, and high-income labor—key factors sustaining rental demand and property value growth. Notably, the region’s infrastructure is advancing at an unprecedented pace.

Between 2025 and 2030, the Northeast will witness the completion of critical transportation projects: the expansion of National Highway 13 to 8-10 lanes by 2028, the Ring Road 3 this year, the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Expressway by 2027, and the prioritized Metro Line 2 along National Highway 13.

The expansion of National Highway 13 and Metro Line 2 will significantly reduce commute times, positioning the area as an ideal balance of accessibility, affordability, and quality of life for young professionals and expatriates.

Driven by infrastructure improvements, migration to Ho Chi Minh City’s Northeast is expected to surge, bolstering the residential and rental markets. Rental yields in the region have historically reached 7.5% annually, with stable pricing.

Amid rising expatriate demand and limited upcoming high-end supply, the Northeast’s rental market is becoming a magnet for investment. Northern investors are increasingly targeting luxury apartments here to capitalize on stable, high-potential tenant pools.

Experts highlight that infrastructure is no longer a short-term catalyst but a long-term structural growth driver. Concurrent developments in ring roads, expressways, airports, and metro lines will not only reduce travel times but also reshape economic and urban landscapes, influencing population distribution, labor mobility, and investment flows.

From an investment standpoint, targeting properties near major infrastructure projects represents a strategic, long-term approach for investors.

Upcoming Launch of the International Financial Center in Vietnam

Prime Minister emphasizes the need for Ho Chi Minh City and Da Nang to clearly define their roles and complement each other in the operation of the International Financial Center.

Emerging East: The New Destination as Core Central Apartment Prices Skyrocket

The real estate market is witnessing a significant shift as capital flows towards satellite urban areas. With apartment prices in central core regions surpassing 100 million VND per square meter, homeownership is becoming increasingly out of reach for many, while investors face shrinking profit margins.