Not only has WinCommerce achieved its highest number of new store openings since being acquired by Masan, but it has also demonstrated a fundamental shift: scaling growth alongside efficiency, as the overall new stores have turned profitable.

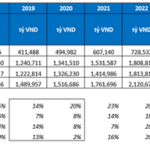

Double-digit revenue growth, surpassing targets

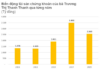

According to the December 2025 business update, WinCommerce opened 764 new outlets in 2025, exceeding the planned range of 400–700 stores. This marks the highest number of new openings in a single year since Masan began operating the WinMart/WinMart+ system in 2019. December 2025 also recorded the highest monthly new store openings since Masan’s acquisition.

Alongside network expansion, WinCommerce’s 2025 net revenue reached VND 39 trillion, a 18.3% increase from 2024, significantly surpassing the initial 8–12% growth target. In December 2025 alone, revenue hit VND 3.557 trillion, up 19.0% year-on-year, reflecting improved consumer demand and the timely expansion strategy.

Notably, growth isn’t solely driven by new stores. Same-store sales for existing outlets grew by approximately 9% in 2025, indicating strengthened operational efficiency rather than reliance on scale expansion alone.

Record new openings since Masan’s acquisition of WinCommerce

Examining the new store composition, 2025 saw a significant acceleration in the WinMart+ Rural model. Of the 764 new stores, 602 were WinMart+ Rural outlets, accounting for nearly 80% of the year’s new openings. This reflects the strategy to expand into non-urban areas, where modern retail potential remains vast.

Regionally, Central Vietnam led with 341 new stores in 2025, contributing 45% of the total. Northern Vietnam remains the largest network with over 2,400 active stores. Together, these regions accounted for 98% of new openings, solidifying WinCommerce’s dominance in these markets through superior scale and coverage.

WinCommerce’s leadership shared that in the initial years post-acquisition, the focus was on stabilizing operations, restructuring product categories, pricing strategies, and financial models, before resuming large-scale expansion.

Sustainable growth: New openings paired with profitability

The current growth phase’s key differentiator lies in the quality of new openings. Reports show that 90.3% of 2025’s new stores surpassed the EBITDA breakeven point at the store level, positively contributing to the system’s overall profitability.

WinCommerce attributes this success to developing diverse store models tailored to consumer needs across regions. From urban to rural areas, each model is designed for accessibility, local pricing, and product assortments aligned with regional shopping habits. This “right product–right region” approach has ensured rapid consumer acceptance and operational efficiency. Simultaneously, optimized financial models—reducing initial investment, operational costs, and enhancing gross margins—have shortened payback periods while elevating customer experience.

Consequently, WinMart+ is now recognized as one of the region’s lowest-breakeven minimart models, enabling rapid expansion with high success rates—critical in the low-margin food retail sector.

Vast growth potential for modern retail

In Vietnam’s retail landscape, WinCommerce’s growth opportunities remain substantial. Modern retail penetration stands at just 13%, significantly lower than regional peers, while urbanization and demand for food safety and quality services are rising.

Long-term consumption prospects are bolstered by positive macroeconomic trends. Nikkei analysis suggests Vietnam’s nominal GDP could reach $500 billion by 2026–2027, surpassing Thailand to become Southeast Asia’s third-largest economy. Projected per capita income exceeding $5,000—approaching Indonesia’s level—will significantly shift consumer behavior.

In this context, WinCommerce’s diverse portfolio—from supermarkets to minimarts—positions it to meet all shopping needs, from convenience to household stocking. With proven low breakeven points, the retailer can expand deeply, modernizing retail infrastructure across Vietnam.

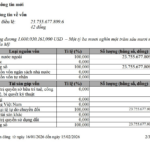

Aeon Mall Vietnam Boosts Capital by VND 2.7 Trillion

Aeon currently operates 7 shopping centers across all three regions of Vietnam, with the first location being Aeon Mall Tan Phu Celadon and the newest addition being Aeon Mall Hue.

Celebrating Techcombank’s 6 Breakthrough Achievements and Ecosystem Innovations at Fchoice 2025

Techcombank and its Ecosystem emerged as the most celebrated entities at the “Business and Entrepreneur Highlights” FChoice 2025, securing the highest number of accolades. Notably, Techcombank was the only bank to sweep both reader-voted categories, claiming the titles of “Bank of the Year” and “Most Favored Bank Stock.”