|

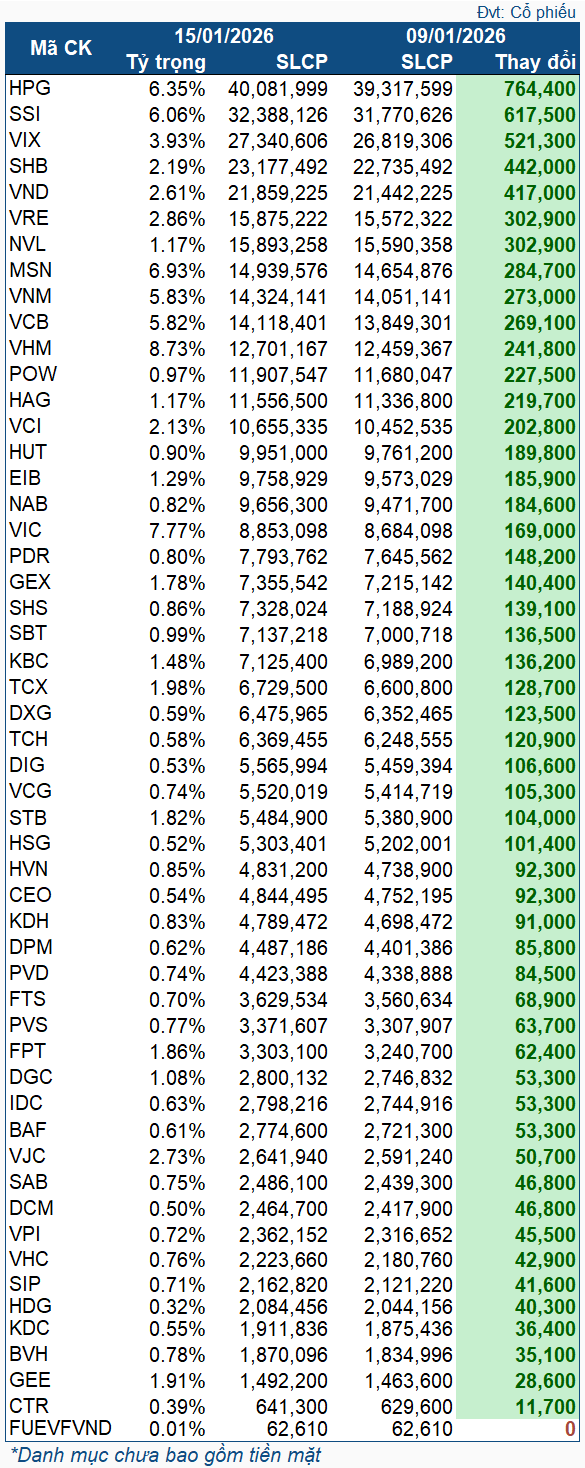

VNM ETF Shareholdings Changes During January 9-15, 2026

|

VNM ETF continued its net buying streak across all portfolio stocks. Leading the charge was HPG, with a significant increase of 764,400 shares. Financial and banking sector stocks followed suit, including SSI (617,500 shares), VIX (521,300 shares), SHB (442,000 shares), and VND (417,000 shares). Conversely, the Fund did not sell any stocks during this period.

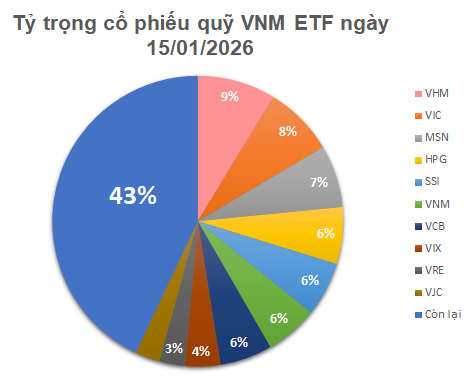

As of January 15, VNM ETF‘s total assets surpassed $664 million, up from $643 million recorded on January 9. The assets are allocated across 52 stocks and 1 fund certificate. The top holdings by weight are Vingroup stocks, with VHM at 8.73% and VIC at 7.77%. They are closely followed by MSN (6.94%), HPG (6.35%), and SSI (6.06%).

– 11:54 AM, January 22, 2026

How Does Ho Chi Minh City’s Largest Employer Reward Its Workers for Tet?

Pouyuen Vietnam Co., Ltd., located in Tan Tao Ward, Ho Chi Minh City, plans to allocate approximately 1,000 billion VND for Lunar New Year bonuses in 2026 for its nearly 41,000 employees. Workers will receive a minimum bonus equivalent to one month’s salary, with the highest bonuses reaching up to 2.2 months’ salary.

VN-Index Projected to Reach 2,040 Points by 2026, According to ACBS

In 2026, ACB Securities’ Market Analysis and Strategy Division (ACBS) forecasts the VN-Index to reach 2,040 points under its base-case scenario. ACBS’s 2026 strategic portfolio emphasizes leading stocks in banking, retail, residential real estate, and public investment sectors.