As the new trading week of January 19–23 kicks off, Vietnam’s stock market continues to navigate a pivotal phase. The VN-Index is retesting levels below its historic peak of 1,900, following a robust prior rally. With prices at elevated levels, investors are adopting a cautious stance, as broad-based momentum remains uncertain.

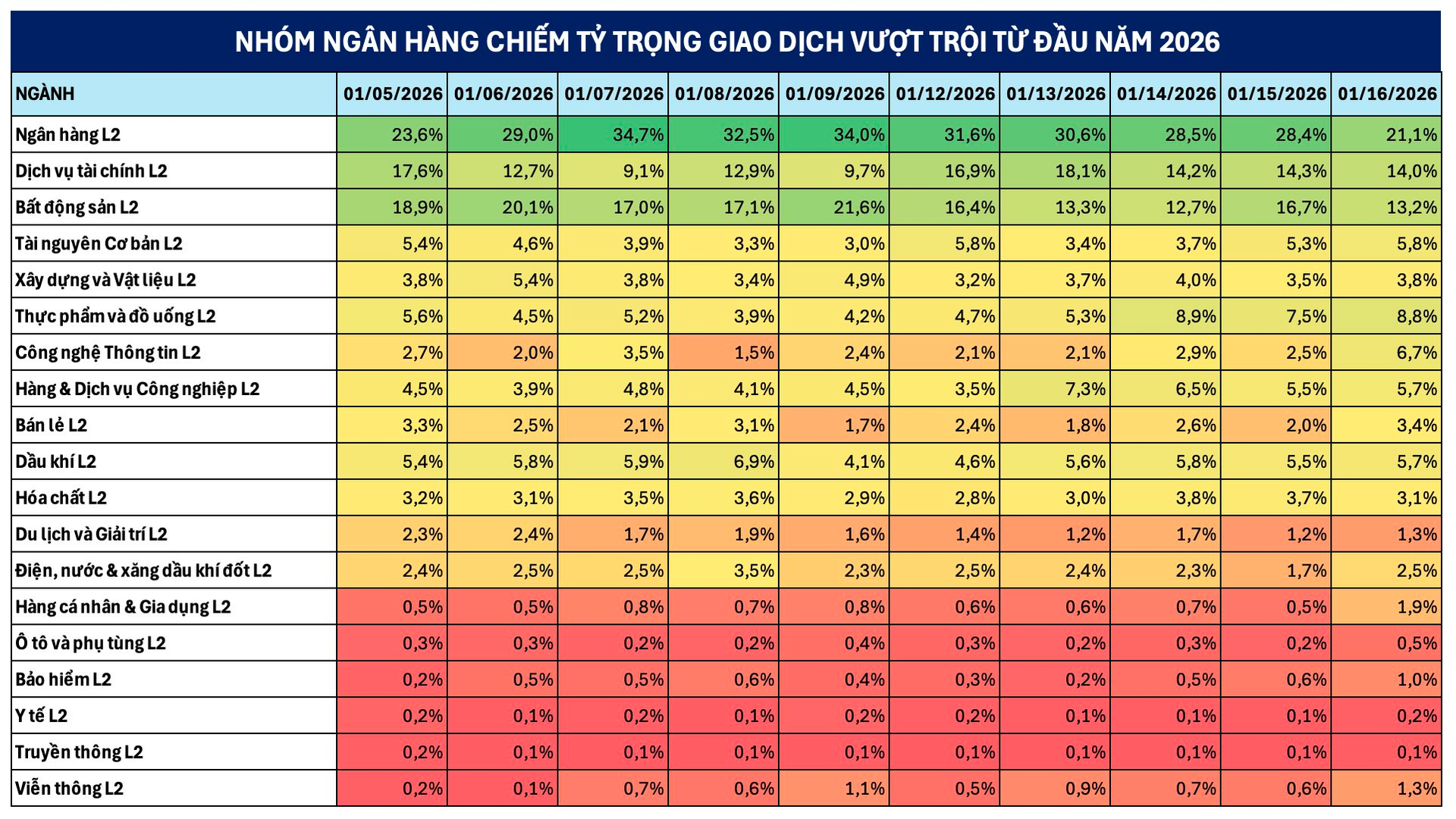

According to Mr. Bùi Văn Huy, Deputy CEO of FIDT, the current environment makes a widespread, short-term market surge unlikely. Instead, the VN-Index will likely see rotational capital flows between sectors. Near record highs, investors are prioritizing selectivity, favoring stocks with clear narratives that can stabilize the market.

Huy highlights state-owned enterprises (SOEs) as a key focus for capital allocation. Beyond their index support role, SOEs benefit from policy expectations—such as Decree 79—aimed at enhancing operational efficiency and restructuring. This mid-term narrative sustains their appeal amid demands for market stability and transparency.

Banking stocks may retain interest but with heightened differentiation. Capital is expected to concentrate on banks with strong asset quality, stable profitability, and robust risk management, rather than the sector as a whole. During accumulation phases, banks often act as market stabilizers.

Sectors tied to long-term value and profit growth—such as consumer goods, retail, and industrial real estate—are also favorably viewed. However, these themes reflect expectations for 2026’s domestic demand recovery rather than near-term catalysts.

Huy advises that predicting short-term sector surges is challenging. Any rallies are likely selective and brief. Investors should monitor capital flows and rally quality, avoiding overextension. Maintaining balanced equity-cash exposure and resisting FOMO during rallies are critical.

The focus should be on risk management and selective opportunities, not quick gains. Partial deployments during pullbacks, targeting fundamentally sound, liquid stocks post-correction, are advisable. High leverage should be avoided in this sensitive market phase. Discipline and patience will be key to portfolio success.

Technical Analysis Afternoon Session 23/01: MACD Signals Sell

The VN-Index remains in a state of flux, with the MACD indicator signaling a potential short-term downturn. Meanwhile, the HNX-Index experienced an unexpected correction but continues to hold above the Middle line of the Bollinger Bands.

VN-Index Slips Below 1,900 Points: What’s Next for the Stock Market Next Week?

The VN-Index concluded the trading week below the 1,900-point mark, following a prolonged rally and heightened profit-taking pressure. Amid rapid capital rotation and foreign investors shifting to net selling, market direction remains uncertain. Investors are advised to avoid FOMO and proceed with caution.

Foreign Investors Net Sell Over VND 1,000 Billion in Session 15/1: Which Stocks Were Hit Hardest?

In a contrasting move, foreign investors actively accumulated large-cap stocks, with VIC leading the charge as they net bought approximately VND 211 billion worth of shares.