Petrovietnam Drilling & Well Services Corporation (stock code: PVY) has released its Q4 2025 financial report, revealing a net revenue of over VND 269.3 billion, a slight 5.73% decrease compared to the VND 285.6 billion recorded in the same period of 2024.

Despite the decline in core business revenue, PVY demonstrated improved efficiency with a gross profit increase of VND 2.2 billion, reaching VND 16.3 billion.

PVY staged a remarkable turnaround from a VND 7.45 billion loss in Q4 2024 to a VND 1.38 billion after-tax profit this quarter, attributed to effective cost management and increased other income.

In its explanation to the State Securities Commission, PVY’s leadership stated that administrative expenses were significantly reduced by VND 6.44 billion year-over-year, totaling only VND 3.7 billion.

This reduction was primarily due to better control over bad debts, leading to an VND 8.5 billion decrease in provisions. Additionally, a VND 4.45 billion surge in “Other Profits” significantly contributed to the positive net profit.

For the full year 2025, PVY reported a net revenue of approximately VND 1,290 billion and an after-tax profit of nearly VND 470 million, a significant improvement from the modest VND 177 million profit in 2024, marking a nearly threefold increase.

As of December 31, 2025, the company carried a substantial accumulated loss of over VND 1,091 billion, resulting in negative equity of VND 493 billion.

However, PVY’s operating cash flow showed positive signs in 2025, reaching nearly VND 109 billion, a substantial increase from the VND 23.4 billion recorded in the previous year.

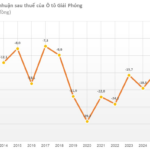

VVS Stock Fluctuates Ahead of Q4 2025 Earnings Report

“Ahead of the Q4/2025 financial report release, VVS stock experienced a sharp short-term decline. This movement starkly contrasts with the company’s highly positive business outlook and growth that surpassed initial projections.”