This week, 16 companies announced dividend payout dates. Among them, 13 firms will pay cash dividends, one will issue additional shares, one will distribute stock dividends, and one will grant bonus shares.

Competitive Selling

Vietinbank (stock code: CTG) has registered to sell its entire stake of 19.6 million shares in Saigon Port Corporation (stock code: SGP), equivalent to 9.07% of the charter capital. The transaction is expected to be executed via order matching from January 19 to February 13.

Vietinbank registers to sell its entire 19.6 million SGP shares.

Previously, on December 22, 2025, Vietinbank attempted to sell this stake through an auction on HNX with a starting price of VND 29,208 per share. However, no investors participated by the registration and deposit deadline, leading to the auction’s cancellation. Currently, SGP shares are trading around VND 29,000 per share, potentially yielding Vietinbank approximately VND 570 billion.

Nearly 3.7 million shares of Xuan Mai Corporation (stock code: XMC), representing 5.15% of the charter capital, were transferred with a total value of VND 29.8 billion. All these shares were purchased by Ms. Dinh Thi Thanh Ha, Vice Chairwoman of XMC’s Board of Directors, from Mr. Dinh Van Quan. Following the transaction, Ms. Ha’s ownership increased to 28.24% of the charter capital.

Earlier, on January 8, the market recorded the transfer of over 6.9 million XMC shares, equivalent to 9.68% of the charter capital, with a total value of approximately VND 69 billion. These shares were acquired by Mr. Nguyen Duc Cu, Chairman of the Board of Directors, from Ms. Nguyen Phuong Lan. After the transaction, Mr. Cu’s ownership rose to 29.67% of XMC’s charter capital.

Funds under Dragon Capital sold 1.45 million shares of Dat Xanh Group (stock code: DXG), reducing their ownership to 8.94%. Specifically, Norges Bank sold 450,000 shares, and Vietnam Enterprise Investments Limited sold 1 million shares of DXG. The estimated total transaction value exceeded VND 23 billion.

On December 9, 2025, three Dragon Capital funds—Hanoi Investments Holdings Limited, DC Developing Markets Strategies Public Limited Company, and Vietnam Enterprise Investments Limited—purchased 21 million, 3.07 million, and 4 million DXG shares, respectively.

However, on the same day, two other Dragon Capital funds—Amersham Industries Limited and Saigon Investments Limited—sold 700,000 and 1 million DXG shares, respectively.

Dragon Capital funds sell 1.45 million shares of Dat Xanh Group.

VOF Investment Limited registered to purchase 10 million shares of Khang Dien House Investment and Trading JSC (stock code: KDH) to increase its ownership to 0.89% of the charter capital. The transaction is scheduled from January 20 to February 13. VOF Investment Limited is expected to spend approximately VND 301 billion on this transaction.

Sonadezi Loses Public Company Status

Industrial Zone Development Corporation (Sonadezi – stock code: SNZ) announced that the company no longer meets the criteria for a public company under current regulations.

According to the shareholder list as of October 8, 2025, established by the Ho Chi Minh City branch of the Vietnam Securities Depository and Clearing Corporation (VSDC), Sonadezi has 470 shareholders.

Among them, the People’s Committee of Dong Nai Province is the largest shareholder, holding 99.54% of the total voting shares. The remaining shares are held by 469 shareholders, accounting for only 0.46% of the charter capital, including 8,200 treasury shares held by Sonadezi.

Sonadezi no longer meets the criteria for a public company under current regulations.

With this ownership structure, Sonadezi fails to meet the public company criteria. Specifically, SNZ does not have at least 10% of its voting shares held by a minimum of 100 investors who are not major shareholders.

Golden Lotus Company, an entity related to Mr. Bui Vu Trung, a member of the Board of Directors of Food Union Joint Stock Company (stock code: FCC), registered to sell approximately 2 million FCC shares, equivalent to nearly 35% of the charter capital. The transaction is expected to take place from January 20 to February 13.

This divestment occurs as FCC prepares to lose its public company status, as its equity capital at the end of 2023 fell below VND 30 billion, no longer meeting the requirements of the amended Securities Law.

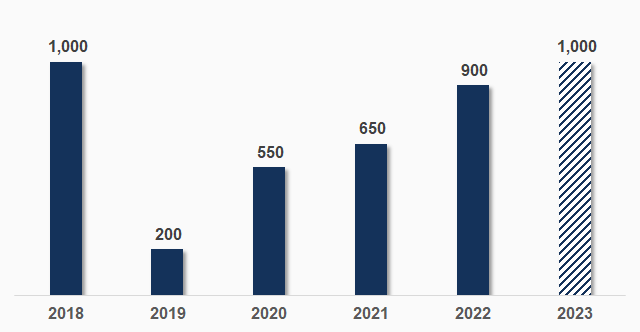

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

Each Employee Generates Nearly $38,000 in Monthly Revenue: What’s Đạm Phú Mỹ (DPM) Strategizing for 2026?

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo – Stock Code: DPM) has unveiled its Board of Directors’ Resolution outlining the 2026 production and business plan. This comprehensive plan includes financial targets, labor productivity goals, and investment strategies funded by shareholders’ equity.