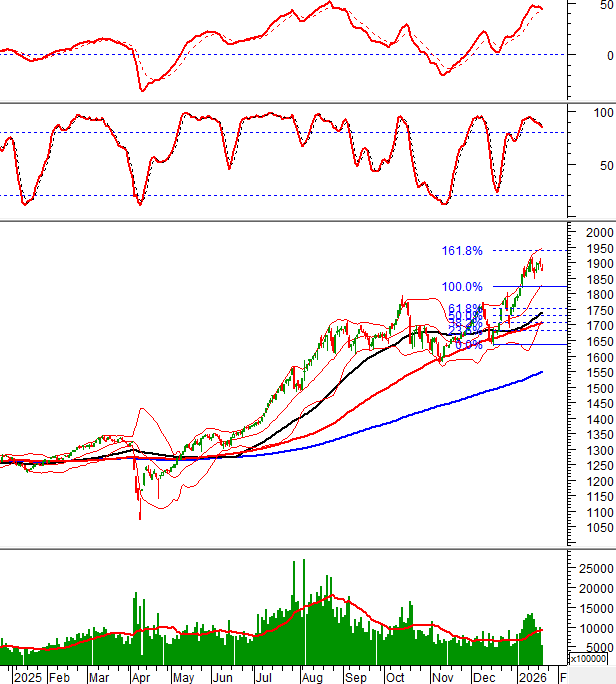

Technical Signals of VN-Index

During the morning trading session on January 21, 2026, the VN-Index experienced volatility, forming a candle with a long upper shadow, indicating strong short-term selling pressure.

The Stochastic Oscillator has issued a sell signal again. If the MACD follows suit in the upcoming sessions, significant volatility may occur.

Technical Signals of HNX-Index

In the morning session on January 21, 2026, the HNX-Index is also undergoing a correction as the Stochastic Oscillator signals a sell.

However, trading volume consistently remains above the 20-day average, suggesting a deep decline is unlikely.

GMD – Gemadept Corporation

The GMD stock price continued to rise during the morning session on January 21, 2026, forming a Big White Candle pattern with trading volume surpassing the 20-session average, indicating active investor participation.

Currently, GMD’s price is trending upward, closely following the Upper Band of the Bollinger Bands after breaking above the 100-day SMA, signaling a positive outlook.

Additionally, the stock price is approaching the September 2025 peak (around 72,500-74,500) while the MACD indicator continues to strengthen after a buy signal. If these technical factors persist, the medium-term uptrend will be further reinforced.

HDC – Ba Ria-Vung Tau Housing Development Corporation

During the morning session on January 21, 2026, HDC’s stock price fluctuated, forming a Gravestone Doji-like pattern with trading volume expected to exceed the average by session’s end, reflecting investor hesitation.

Currently, HDC remains in a medium-term downtrend, staying below the Middle Band of the Bollinger Bands, indicating a lackluster short-term outlook.

Furthermore, while the MACD has issued a buy signal, it remains below zero, making a short-term recovery more challenging.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:04 January 21, 2026