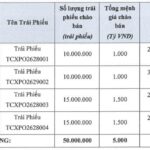

Aqua One Corporation, chaired by Ms. Do Thi Kim Lien (Shark Lien), successfully issued 6,000 private bonds with a face value of VND 100 million each, totaling VND 600 billion. The bonds have a 3-year term, maturing in late 2028, and offer an annual interest rate of 12%, backed by collateral.

This interest rate is double that of the 5.75% bonds previously issued by Aqua One’s subsidiaries, which were guaranteed by a third party. The proceeds from this issuance will not fund new projects but will instead refinance existing loans from individuals and extend debt maturity.

Established in 2015, Aqua One is one of Vietnam’s leading water treatment companies. It operates two major plants: the Song Duong Surface Water Plant in Hanoi and the Phu Yen Water Plant in Dak Lak, with a combined capacity of approximately 350,000 m³/day, ranking among the top 10 largest water treatment facilities nationwide. Additionally, the company manages a retail water distribution network across several areas in Hanoi.

Shark Lien’s Aqua One raises VND 600 billion through private bond issuance – Image: Aqua One

|

According to VIS Rating’s December 2025 credit report, Aqua One’s water sales revenue for 2024-6M2025 ranged between VND 1-1.2 trillion. Profit margins remained healthy due to the Song Duong Plant operating at full capacity and favorable pricing compared to industry averages.

However, future growth requires substantial capital. Aqua One is developing several new projects, including the Xuan Mai Plant, the Xuan Mai – Hanoi distribution network, the Vam Co Dong Plant in Long An, and Phase 2 of the Song Duong Plant. Total investment needs are estimated at VND 3 trillion over the next few years.

The company’s financial leverage has increased significantly to support expansion, with a debt-to-equity ratio of approximately 3.8 times in 2024. The credit rating agency notes that the recent bond issuance, aimed at refinancing lower-interest loans, will substantially raise Aqua One’s interest expenses from 2026 onward.

Repayment of the bonds is expected to rely primarily on subsidiaries’ cash flows rather than the parent company’s. As of late 2024, operating subsidiaries held approximately VND 510 billion in cash and VND 373 billion in bank deposits, while maturing debt obligations totaled only VND 119 billion.

In contrast, the parent company Aqua One has limited business operations, restricted cash flow, and relies heavily on dividends from subsidiaries, particularly Phu Yen Water Supply (UPCoM: PWS). Its debt repayment capacity is closely tied to asset restructuring within its ecosystem.

Bond repayment will be sourced from four main channels: first, the sale of equity in the Phu Yen Plant; second, the recovery of VND 162 billion in receivables as of June 30, 2025; third, dividends from subsidiaries; and fourth, the recovery of VND 346 billion in receivables from Aqua Hau Giang.

In Q3 2025, Aqua One sold a 33.8% stake in the Xuan Mai Plant for VND 258 billion, improving its short-term liquidity. This move demonstrates the company’s willingness to reduce ownership stakes in exchange for immediate cash flow.

Collateral for the VND 600 billion bond includes 51% of the equity in Song Duong Surface Water JSC and 65% of Aqua One’s common shares. However, the credit rating agency cautions that the actual recovery value of these assets will depend on market valuations in the event of collateral liquidation.

– 09:49 22/01/2026

Corporate Bond Issuance Rates Surge to 10.3% Annually in November

Becamex (HoSE: BCM) has successfully completed the issuance of its BCM12503 bond series, raising a total of VND 660 billion. The bonds were issued at an annual interest rate of 10.3%, marking the highest rate recorded in November.

Thai Conglomerate’s Lawsuit Against Shark Lien’s Company Over DA Sông Đuống Surface Water: Court Updates Revealed

WHA Group, Thailand’s leading industrial developer, has invested approximately $360 million in Vietnam, with projects spanning Hanoi, Hung Yen, Nghe An, and Thanh Hoa. The group is poised to further expand its footprint, committing to an additional investment of at least $1 billion over the next five years.