I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts surged during the January 16, 2026 trading session. Specifically, 41I1G2000 (I1G2000) rose by 1.96%, closing at 2,081.2 points; 41I1G3000 (I1G3000) climbed 2.94%, reaching 2,092.6 points; 41I1G6000 (I1G6000) increased by 2.33%, ending at 2,077 points; and 41I1G9000 (I1G9000) edged up 0.1%, settling at 2,074.7 points. The underlying index, VN30-Index, closed at 2,080.35 points.

Meanwhile, VN100 futures contracts experienced mixed movements on the same day. Notably, 41I2G2000 (I2G2000) gained 1.46%, closing at 1,961.50 points; 41I2G3000 (I2G3000) advanced 1.88%, reaching 1,959.6 points; 41I2G6000 (I2G6000) rose by 1.84%, ending at 1,955 points; and 41I2G9000 (I2G9000) remained unchanged at the reference level of 1,958.6 points. The VN100-Index closed at 1,956.26 points.

During the week of January 12-16, 2026, the 41I1G2000 contract experienced a volatile week, initially rallying in the early sessions as long positions dominated. However, selling pressure intensified mid-week, causing the contract to reverse and decline sharply. By the week’s end, buying interest resurfaced, helping the contract narrow its losses and rebound. Ultimately, 41I1G2000 closed in positive territory at 2,081.2 points, up 20.2 points from the previous week.

Intraday Chart of 41I1G2000 for January 12-16, 2026

Source: https://stockchart.vietstock.vn

At the close, the basis of the I1G2000 contract reversed from the previous session, reaching 0.85 points, indicating renewed investor optimism.

Fluctuations of I1G2000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

Similarly, the basis of the I2G2000 contract reversed, reaching 5.24 points, reflecting improved investor sentiment.

Fluctuations of I2G2000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN100-Index

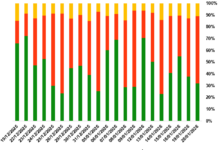

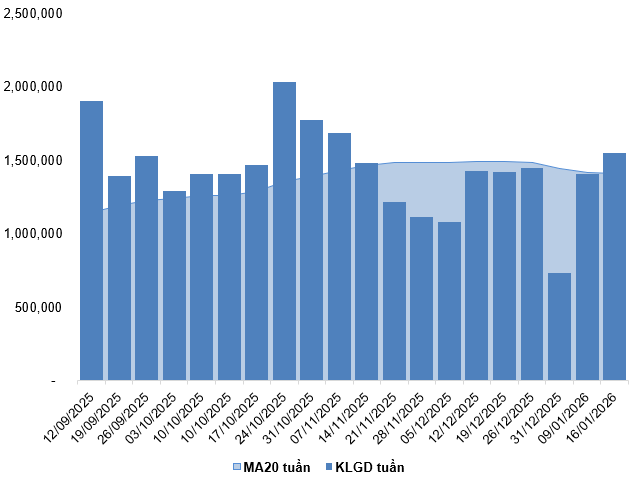

Derivatives market trading volume and value declined by 22.03% and 20.71%, respectively, compared to January 15, 2026. For the week, trading volume and value increased by 10.46% and 10.76%, respectively, from the previous week.

Foreign investors returned to net buying, with a total net purchase of 2,234 contracts on January 16, 2026. For the week, foreign investors net bought 1,440 contracts.

Weekly Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

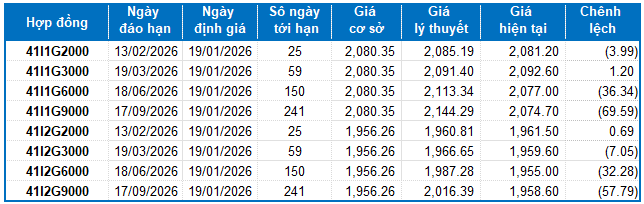

I.2. Futures Contract Valuation

Based on the fair pricing method as of January 19, 2026, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Pricing for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

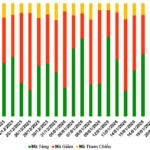

In the January 16, 2026 session, the VN30-Index reversed higher, forming a small-bodied candlestick with reduced trading volume, indicating investor hesitation.

Currently, the MACD indicator is narrowing its gap with the Signal line. If a sell signal reemerges, the outlook may weaken in upcoming sessions.

Additionally, the Stochastic Oscillator is signaling a sell in the overbought zone. If the indicator exits this zone in the coming sessions, short-term correction risks will rise.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

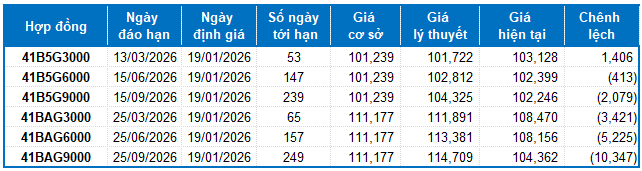

Based on the fair pricing method as of January 19, 2026, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Pricing

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts 41B5G6000, 41B5G9000, 41BAG3000, 41BAG6000, and 41BAG9000 are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near term, as they present favorable market opportunities.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 January 17, 2026

Technical Analysis for the Afternoon Session of January 15th: A Sharp Correction

The VN-Index experienced a sharp correction, accompanied by a sell signal from the Stochastic Oscillator, indicating heightened short-term risk. Similarly, the HNX-Index is in a comparable state, currently finding support at the Middle line of the Bollinger Bands.

Technical Analysis for the Afternoon Session of January 14: Ongoing Tug-of-War in Market Dynamics

The VN-Index is experiencing a tug-of-war after reaching a historic high, with its sights set on the 1,935-1,950 point range. Meanwhile, the HNX-Index continues its upward trajectory, maintaining its position at the upper edge of a Falling Wedge pattern.