Go Dau Port

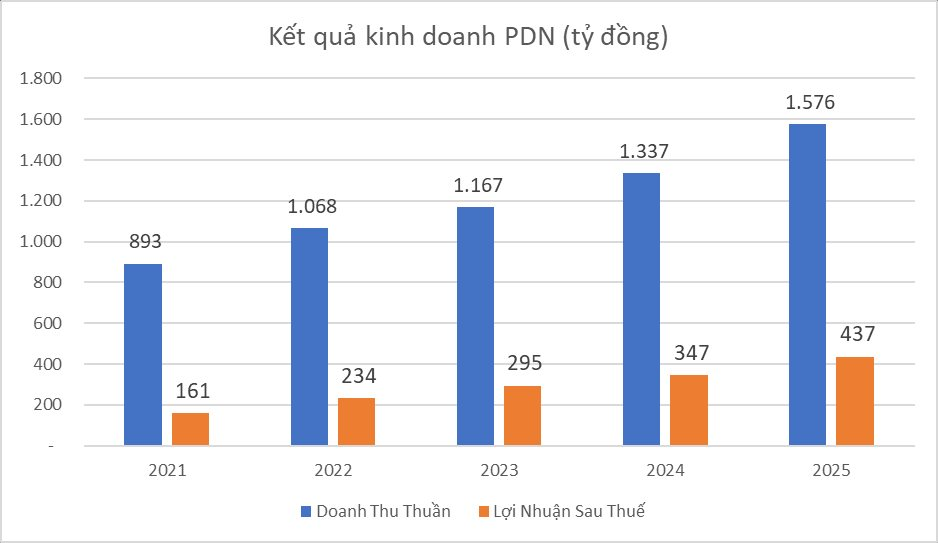

According to the Q4/2025 financial report, Dong Nai Port achieved a net revenue of over 430 billion VND, marking a 16.6% increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached 153.5 billion VND, with a gross profit margin of 35.6%.

The growth momentum in this quarter was driven by favorable seaport infrastructure fees in Ho Chi Minh City, enabling the company to efficiently operate barge routes to Cai Mep and Ho Chi Minh City. The implementation of E-port technology and investment in new equipment supported a 3% rise in container volume and a 14.9% increase in general cargo volume year-over-year.

Financial activities recorded a 65.4% surge in revenue to 16.8 billion VND, primarily from deposit interest. Financial expenses decreased by 22.5% to 1.4 billion VND due to reduced principal debt. Despite a 25% rise in selling expenses, a 29.3% reduction in corporate management costs helped PDN achieve a Q4 net profit of 103.9 billion VND, up 19.7%.

PDN Business Results

For the full year 2025, Dong Nai Port reported a net revenue of 1,575 billion VND, a 17.8% increase. Pre-tax profit reached 545.6 billion VND, and net profit hit 436.5 billion VND, up 25.7% compared to 2024. This is the highest profit since the company’s establishment. Earnings per share (EPS) for 2025 stood at 7,350 VND.

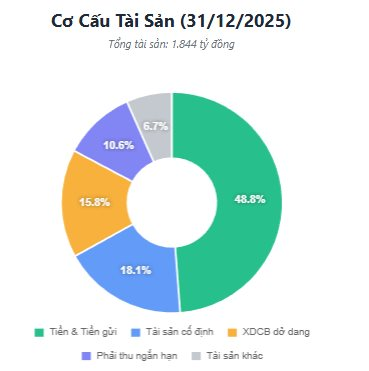

PDN Asset Structure

As of December 31, 2025, total assets reached 1,843 billion VND. The asset structure shows a significant cash position, with cash, cash equivalents, and short-term financial investments (bank deposits) totaling approximately 900 billion VND, accounting for 48.8% of total assets.

Dong Nai Port is a leading seaport operator in the Southeast region, specializing in stevedoring, warehousing, and cargo transportation (containers, general cargo). In terms of ownership, Sonadezi Corporation is the parent company holding 51% of the charter capital. Additionally, Sowatco Corporation is a major shareholder with 20.25% ownership.

Regarding capital, total liabilities stand at 358.8 billion VND. Total short-term and long-term financial debt decreased to 95.2 billion VND from 120.4 billion VND at the beginning of the year. Equity reached 1,485 billion VND, including retained earnings of over 380 billion VND and a development investment fund of 474.5 billion VND.

PDN Stock Price

On the stock market, as of January 19, 2026, PDN shares traded at 112,300 VND/share. At this price, the company’s market capitalization is approximately 6,240 billion VND, with a P/E ratio of around 15.2.

Struggling to Survive: Once-Thriving Textile Giant Earning $65 Million Annually Now Rents Pickleball Courts for $130/Day, Still Operating at a Loss

Garmex Saigon concluded 2025 with losses across all four quarters, extending its streak of consecutive quarterly losses to seven and marking the fourth straight year without profit.

DNSE Sets New Record in Margin Loan and Advance Payment Debt

DNSE has unveiled its Q4 and full-year 2025 financial results, marking a year of unprecedented achievements. In 2025, the company recorded a remarkable revenue of over 1.467 trillion VND, a 77% surge year-on-year. Pre-tax profit soared to more than 340 billion VND, while post-tax profit exceeded 272 billion VND, reflecting a 50% increase compared to 2024. Additionally, outstanding margin loans and advance payments for securities reached a new high of over 5.832 trillion VND.