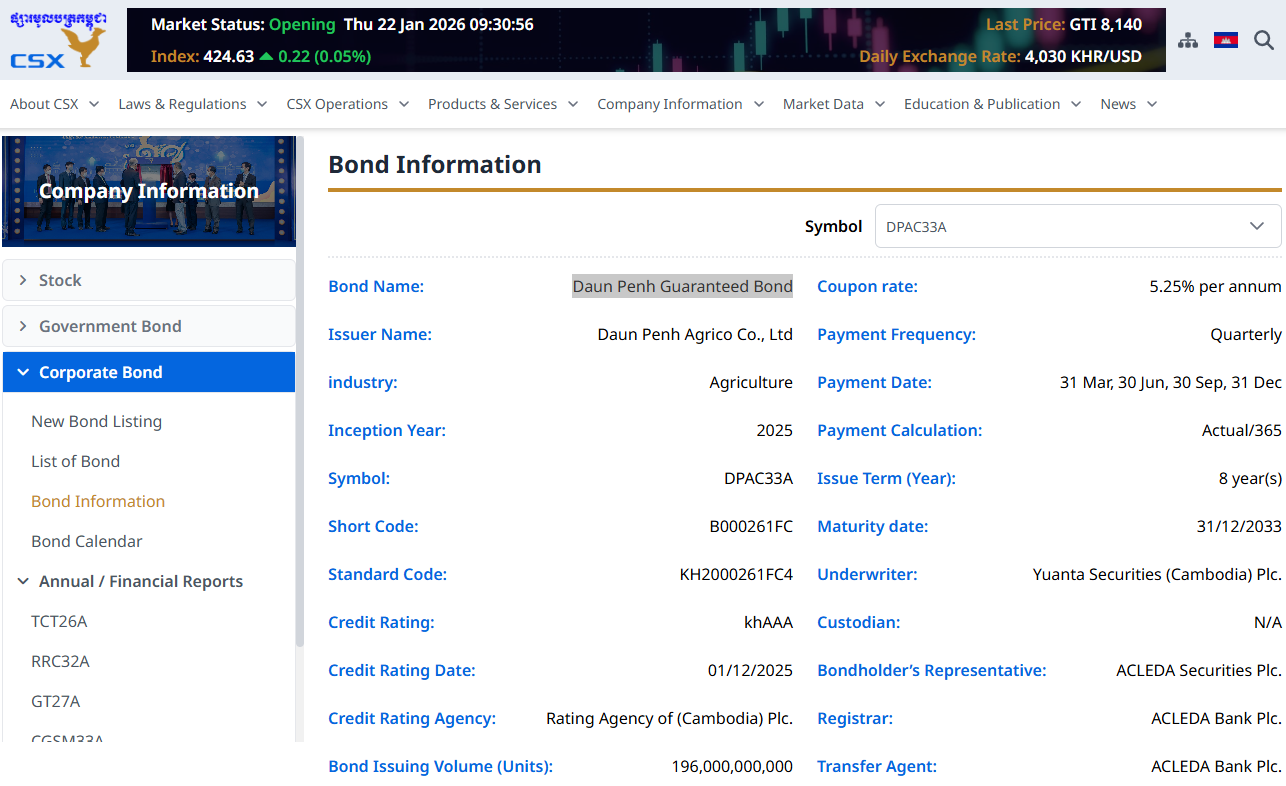

Through its subsidiary Daun Penh Agrico, Truong Hai Agriculture JSC (Thaco Agri) has successfully issued a bond tranche worth 196 billion KHR, equivalent to nearly $50 million, listed on the Cambodia Securities Exchange (CSX). This marks Thaco Agri’s first bond issuance outside Vietnam and represents the first agricultural corporate bond listed in Cambodia.

The bond has an 8-year term (2025–2033), a fixed annual interest rate of 5.25%, and quarterly interest payments, with principal repayment beginning in the third year. GuarantCo, a guarantee institution under the Private Infrastructure Development Group (PIDG), backs the bond’s payment obligations, attracting participation from institutional investors.

The raised capital is part of a targeted $100 million funding package, which Thaco Agri will use to expand fruit cultivation and processing systems for export in Ratanakiri Province, northeastern Cambodia. Key crops include bananas, pineapples, and other fruits, targeting international markets.

Thaco Agri’s first bond issuance outside Vietnam – Image: PIDG

|

Earlier, during a media briefing at the strategic partnership signing ceremony between THACO (Thaco Agri’s parent company) and Fresh Del Monte—a U.S.-based fruit conglomerate with over 135 years of experience—leaders from both companies emphasized Vietnam and Cambodia’s strategic geographic advantages for serving Asian and Middle Eastern markets. These advantages include shorter transportation distances, favorable climates, and the potential for large-scale, concentrated farming zones.

Mohammed Abbas, Executive Vice President of Fresh Del Monte, noted that Vietnam and Cambodia are emerging as new global production hubs for bananas and pineapples, as traditional growing regions lose their competitive edge. Abbas highlighted the potential for these crops to become large-scale industries in both countries through industrialized, rather than small-scale, production models.

Tran Bao Son, CEO of Thaco Agri, stated that the Cambodian bond issuance provides a financial foundation for expanding export-oriented agricultural production and strengthens the company’s integrated, circular farming model in the region.

According to leadership, projects in Cambodia are designed from the outset for export, featuring large-scale operations and high mechanization to meet international partners’ demands for consistent volume and quality.

Partnering with an established player is critical for market access and product standards. Under the agreement, Thaco Agri is expected to supply Fresh Del Monte with a minimum of 71,500 tons of bananas in 2026, scaling up to 240,000 tons annually as production stabilizes. Additionally, both parties will jointly develop 2,000 hectares of pineapple cultivation in Vietnam and Cambodia under Fresh Del Monte’s standards and branding.

Details of Thaco Agri’s Cambodian bond tranche – Screenshot from CSX.

|

Founded in 2019, Thaco Agri is a THACO subsidiary operating in agriculture. The company pursues an integrated, circular production model, combining cultivation, livestock, and processing through industrialization and digitalization. Its total production area spans approximately 85,000 hectares across Vietnam, Laos, and Cambodia.

As of late 2024, Thaco Agri’s equity capital stands at nearly VND 14.2 trillion. Total liabilities exceed VND 53.1 trillion, including bank loans of approximately VND 9.78 trillion.

A credit rating report by VIS Rating highlights capital pressure as the company enters a significant investment phase. By June 2025, Thaco Agri had borrowed roughly VND 43 trillion from its parent company, accounting for nearly 40% of the group’s consolidated debt.

From 2025 to 2027, Thaco Agri plans to invest over VND 20 trillion in developing agricultural farms covering around 40,000 hectares in Vietnam and Cambodia. Credit analysts note that cash flow from core operations is under strain due to rising working capital needs during expansion.

Domestically, Thaco Agri has no outstanding bonds after repurchasing its entire VND 2.4 trillion private bond issuance from 2021 ahead of maturity in August 2025.

Dai Quang Minh Issues First Bond Tranche, Backed by Thaco

Thaco Borrows Additional VND 2 Trillion from Bondholders

THISO, Led by Tran Ba Duong, Raises Trillions in Bonds for Project Acquisition

– 14:34 22/01/2026

Thaco Agri Seeks Special Mechanisms for Agricultural Projects in Gia Lai

At a meeting with the People’s Committee of Gia Lai Province on the morning of November 18, Mr. Trần Bảo Sơn—Deputy General Director of THACO and General Director of Truong Hai Agricultural Joint Stock Company (Thaco Agri)—proposed several special mechanisms for the company’s projects in the region.

HAGL Agrico Reports Hundreds of Billions in Losses Despite Strong Rubber and Fruit Sales

Despite a resurgence in gross profit and a significant increase in revenue from rubber latex and fruit sales, billionaire Trần Bá Dương’s agricultural company has reported its 18th consecutive quarterly net loss. This persistent deficit is primarily attributed to escalating financial expenses, which continue to erode the company’s overall performance.