I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF JANUARY 19-23, 2026

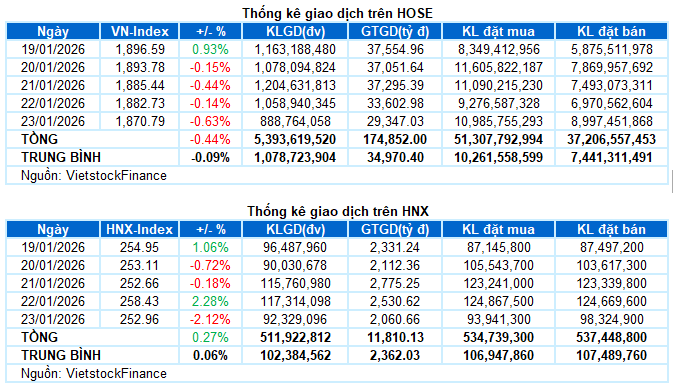

Trading Activity: Major indices closed lower on January 23rd. The VN-Index dropped by 0.63%, settling at 1,870.79 points, while the HNX-Index saw a sharper decline of 2.12%, ending at 252.96 points. For the week, the VN-Index fell by 8.34 points (-0.44%), whereas the HNX-Index edged up by 0.68 points (+0.27%).

Vietnam’s stock market concluded the week in a prolonged state of tug-of-war. Following an initial positive rally, the VN-Index faced profit-taking pressure near the 1,900-point threshold, leading to a reversal and adjustments in subsequent sessions. Repeated failures to breach this psychological barrier highlight the dominance of short-term supply, with bottom-fishing demand only preventing a steeper decline. Investor sentiment remained cautious and fragmented, with capital rotating among sectors rather than consolidating around a clear trend. By week’s end, the VN-Index closed at 1,870.79 points, down 0.44% week-on-week.

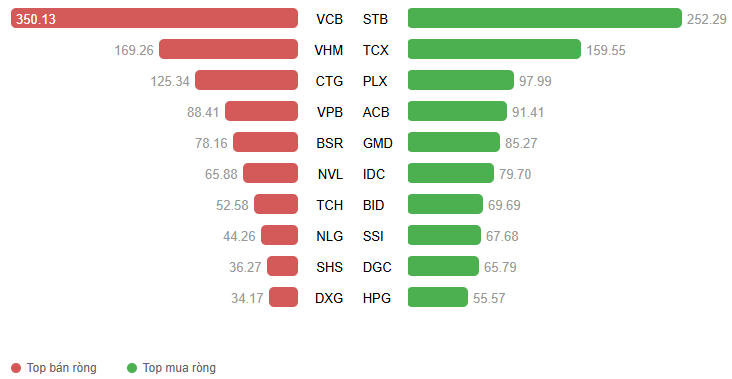

In terms of impact, VCB exerted the most downward pressure, shaving over 4 points off the VN-Index in the final session. GAS, BID, GVR, VNM, and BSR also contributed significantly, each deducting more than 1.5 points from the index. Conversely, VIC, VHM, VJC, and TCX provided crucial support, collectively preserving nearly 12.5 points and mitigating some of the downward momentum.

Most sectors ended the week in negative territory. The communication services sector led the decline with a nearly 10% drop, driven by sharp falls in VGI (-11.59%), FOX (-4.72%), CTR (-3.03%), YEG (-3.47%), FOC (-4.98%), TTN (-3.37%), and VTK (-6.58%).

The energy sector also plummeted by over 5%, with widespread selling pressure. Notable decliners included BSR (limit down), PLX (-3.36%), PVS (-3.73%), PVD (-5.15%), OIL (-8.39%), PVT (-4.8%), PVC (-7.53%), MVB (-3.16%), and PVP (-2.33%).

On the upside, the real estate sector led with a modest 0.87% gain, primarily driven by Vingroup’s trio: VIC (+2.67%), VHM (+1.66%), and VRE (+1.73%). The remainder of the sector faced selling pressure after the previous session’s rally, with KBC (-2.94%), KDH (-1.37%), NVL (-2.34%), DXG (-2.86%), PDR (-2.2%), IDC (-4.01%), KSF (-6.13%), and BCM and SSH hitting their lower limits.

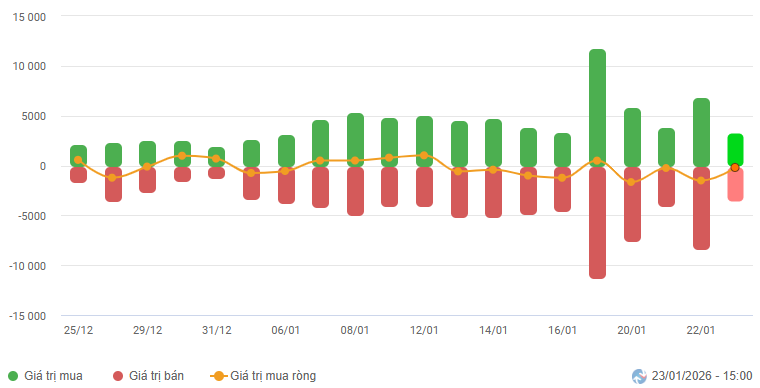

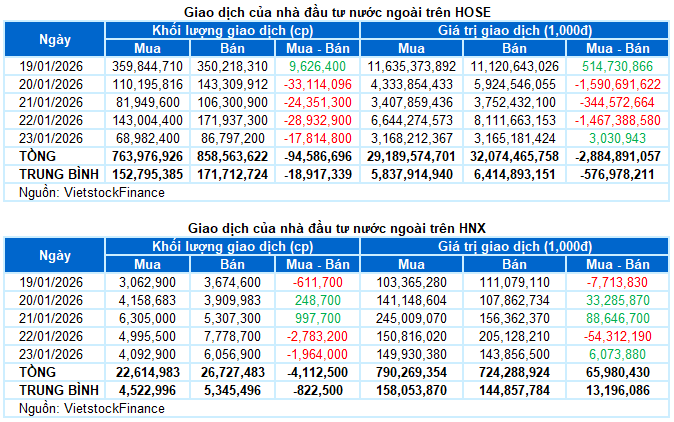

Foreign investors net sold over VND 2.8 trillion across both exchanges during the week. Specifically, they net sold nearly VND 2.9 trillion on the HOSE and net bought approximately VND 66 billion on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

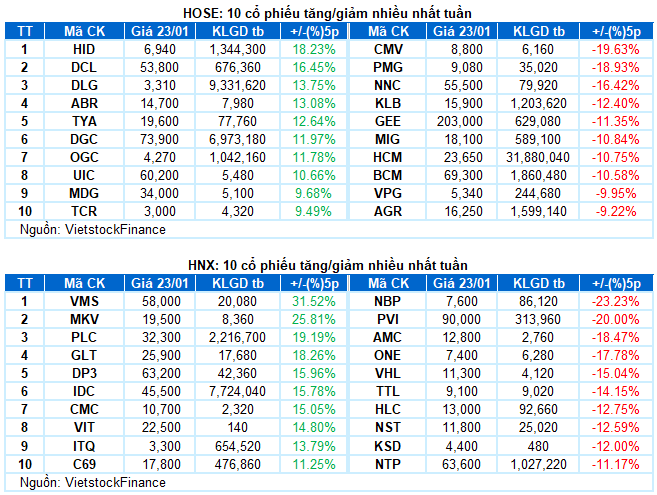

Top Performing Stock of the Week: HID

HID +18.23%: HID continued its positive recovery with four consecutive up sessions. The stock price breached the Middle Bollinger Band and is testing the 50-day SMA.

Short-term optimism is reinforced by the Stochastic Oscillator and MACD, both maintaining strong upward trajectories after generating buy signals.

Worst Performing Stock of the Week: GEE

GEE -11.35%: GEE had a lackluster week, with its price falling below the Middle Bollinger Band and testing the 50-day SMA.

The MACD continues to widen its gap below the Signal line after issuing a sell signal. If conditions do not improve and the indicator falls below zero in upcoming sessions, short-term risks will escalate.

II. WEEKLY MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:06 January 23, 2026