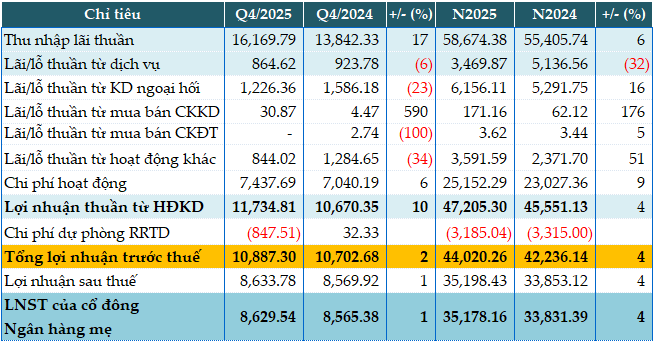

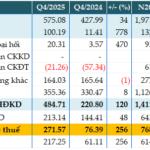

In 2025, VCB’s core operations saw a 6% increase compared to the previous year, with net interest income reaching VND 58,674 billion.

While service income decreased by 32% to VND 3,470 billion, other non-interest income sources experienced robust growth: foreign exchange trading profit (+16%), securities trading profit (+176%), investment securities profit (+5%), and other operating profit (+51%).

Additionally, operating expenses rose by only 9% to VND 25,152 billion, resulting in a 4% increase in net operating profit to VND 47,205 billion.

During the year, the bank slightly reduced credit risk provisions by 4%, setting aside VND 3,185 billion, leading to pre-tax profit exceeding VND 44,020 billion, a 4% increase.

|

Q4 and 2025 Business Results of VCB. Unit: Billion VND

Source: VietstockFinance

|

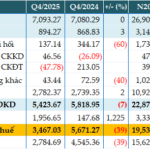

As of the end of 2025, the bank’s total assets reached over VND 2,440 trillion, a 17% increase from the beginning of the year. Customer loans grew by 15%, and customer deposits increased by 10%, both surpassing VND 1,670 trillion.

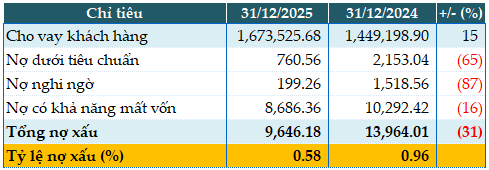

Another notable highlight is the significant improvement in VCB’s loan quality, with total non-performing loans as of December 31, 2025, decreasing by 31% from the beginning of the year to just over VND 9,646 billion. All categories of non-performing loans saw substantial reductions. Consequently, the non-performing loan ratio to outstanding loans decreased from 0.96% at the beginning of the year to 0.58%.

|

VCB’s Loan Quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 10:26 AM, January 31, 2026

VietinBank Projects 37% Pre-Tax Profit Surge by 2025, Credit Growth Nears VND 2 Trillion Milestone

VietinBank (HOSE: CTG) has reported a pre-tax profit of nearly VND 43,446 billion for 2025, marking a 37% increase year-on-year. This impressive growth is primarily attributed to a significant reduction in credit risk provisions. Notably, the bank’s customer loans outstanding at the end of the year surpassed VND 1,990 trillion.

ACB’s Total Assets Surpass 1 Quadrillion VND, FDI Credit Soars 170%

Asia Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 19,539 billion in Q4/2025, reflecting a modest 7% year-on-year decline due to heightened credit risk provisions. Notably, total assets surpassed VND 1,000 trillion by year-end, while non-performing loans significantly decreased compared to the beginning of the year.