A Robust Financial Foundation – A Milestone in Scale and Quality

By the end of 2025, ACB’s total assets surpassed VND 1,000 trillion, doubling over the past five years. This milestone not only reflects the bank’s growth in scale but also underscores its consistent, resilient internal strength, aligned with a prudent development strategy focused on quality over three decades of operation.

Alongside its growth, ACB maintains high asset quality. The non-performing loan (NPL) ratio was controlled at 0.97% by year-end, the lowest since 2023, positioning ACB among the banks with the best asset quality in the system, despite rising industry-wide risks.

Beyond risk management, ACB demonstrates its ability to balance safety with expansion. By year-end 2025, outstanding loans reached VND 689 trillion, up 18.6% year-on-year. Corporate lending remained the primary driver, growing 25.5%, focusing on key economic sectors like trade and manufacturing. ACB also targeted large ecosystem enterprises and capitalized on the FDI wave, a 2025 economic highlight. This strategy yielded impressive results: large corporate lending surged 62%, with FDI loans skyrocketing 170%. Additionally, housing loans showed positive recovery signs, contributing to ACB’s balanced and sustainable growth in this strategic year.

On the funding side, total mobilization (including bond issuance) reached VND 718 trillion, up 12.4%. Notably, corporate CASA improved significantly through tailored financial solutions for sectors like textiles, plastics, FDI, and agriculture. For retail, ACB expanded its ecosystem with innovative products like Lotusmiles Pay and flexible term deposits, reflecting a customer-centric approach and delivering tangible value.

Strengthening Internal Capabilities – Enhancing Growth Quality

Mr. Tu Tien Phat, ACB’s CEO, emphasized, “In a volatile market, banks must focus not only on growth but also on sustaining quality and long-term adaptability. ACB remains committed to strengthening its financial foundation and risk management to prepare for future development cycles.”

In 2025, ACB prioritized asset quality and balance sheet safety. Loan loss provisions increased to over VND 3.3 trillion, double 2024’s figure, alongside strategic cost allocations. Pre-tax profit reached VND 19.5 trillion, reflecting prudent management and proactive provisioning.

Consequently, the NPL coverage ratio (LLR) improved to 114%, up from 78% in 2024, enhancing resilience against macroeconomic fluctuations. Meanwhile, net operating profit before provisions grew to VND 22.9 trillion, showcasing sustained operational efficiency and core profitability.

ACB also maintained strict liquidity and capital management. The short-term funding for medium-long term loans ratio was 24.4%, well below regulatory limits. The loan-to-deposit ratio (LDR) stood at 79%, ensuring sustainable credit growth. Transitioning to Circular 14 in December 2025 elevated the consolidated capital adequacy ratio (CAR) to over 12%, significantly exceeding requirements.

Leveraging Ecosystem Synergy – Towards an Efficient Financial Conglomerate

Long-term, ACB strengthens its subsidiaries to build a comprehensive financial ecosystem. In 2025, subsidiaries contributed 7% to system-wide profits.

ACBS stood out with VND 1.2 trillion in pre-tax profit, up 46% from 2024, driven by growth in investment, brokerage, and margin lending. Other units like ACBL, ACBA, and ACBC also performed well. The upcoming non-life insurance company is expected to further enhance ACB’s financial ecosystem.

Aligning Growth with Sustainability and Social Responsibility

ACB integrates sustainability into its core strategy. From 2025–2030, the bank adopts a Creating Shared Value (CSV) model, focusing on health, education, and the environment.

Initiatives include supporting child cancer patients, providing scholarships, and offering financial solutions for youth and SMEs, aligning with Resolution 68.

In 2025, ACB was honored as a Top 10 Taxpayer in Vietnam and won the Innovative Credit Solution award at Better Choice Awards 2025 for its “First Home” product. Internationally, ACB received “Best Commercial Bank – Vietnam 2025” and “Most Innovative Digital Banking App – Vietnam 2025” from International Finance Magazine. Fitch, Moody’s, and FiinRatings maintained positive ratings, recognizing ACB’s robust financial health and risk management.

Ready for the Next Growth Phase

ACB’s leadership emphasizes that growth is meaningful only when coupled with sustainability and long-term value creation for customers, shareholders, and society. With a strong financial foundation, disciplined governance, and a clear strategy, ACB is poised for its next development phase with resilience and confidence.

For more information, visit acb.com.vn, contact your nearest ACB branch, or call 24/7 Support at 028 38 247 247.

The Future of Bitcoin (Part 1): Has the Year of Defense Arrived?

Over the past decade, Bitcoin has evolved from a rudimentary digital experiment into a sophisticated macro asset class. While many investors still view this market through the lens of chaotic randomness, where luck seems to reign supreme, even the most frenzied price movements leave behind distinct statistical footprints. These patterns empower savvy investors to gain a decisive trading edge.

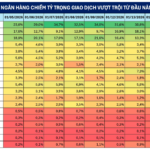

Tracking the Whale Money Flow on January 30: Net Buying Consensus, Focus on HPG

In a bullish market session, both securities firms’ proprietary trading desks and foreign investors maintained their positive momentum, collectively engaging in net buying activities.

An Binh Securities (ABS) Reports Profit Exceeding Targets, Poised for Billion-Dollar Capital Increase

Amidst the positive business growth achieved in 2025, An Binh Securities (ABS) is poised to accelerate its momentum in 2026, targeting a pre-tax profit of 600 billion VND. To fortify its financial capabilities, expand market share, and capitalize on the emerging growth cycle in the securities market, ABS plans to execute a capital increase strategy, elevating its capital to over 3,000 billion VND.

Nuclear Energy: Long-Term Preparation, Serious Investment

At the seminar titled “Nuclear Energy: International Experience and Practical Lessons for Vietnam,” experts emphasized that the success of nuclear power is not solely determined by reactor technology. It also critically depends on institutional frameworks, independent oversight mechanisms, safety culture, and, most importantly, the quality of human resources.

Market Struggles to Generate Widespread Momentum: Experts Highlight Two Stock Groups Poised to Attract Significant Short-Term Capital

From a personal perspective, Mr. Huy believes that at this current stage, accurately predicting which sector will experience a significant surge in the upcoming week is no simple task.