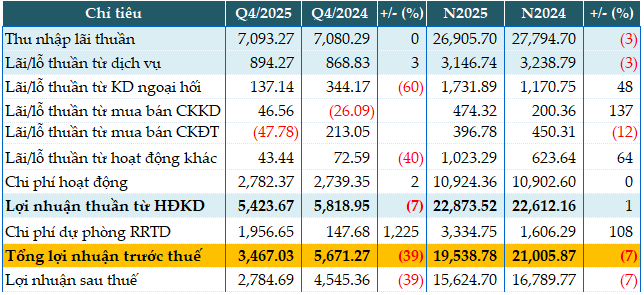

In 2025, ACB’s net interest income saw a slight 3% dip compared to the previous year, reaching VND 26,906 billion. Service-related profits also decreased by 3%, settling at VND 3,147 billion.

Non-interest income streams demonstrated robust growth. Foreign exchange trading profits surged by 48% to VND 1,732 billion, while profits from trading securities doubled 2.3 times to VND 474 billion. However, investment securities trading profits declined by 12% to VND 397 billion. Other operations yielded a profit of over VND 1,023 billion, marking a 64% increase.

ACB maintained its operating expenses at VND 10,924 billion, consistent with the previous year. As a result, net profit from business operations rose by 1% to VND 22,874 billion.

Despite these gains, ACB doubled its credit risk provisions to VND 3,335 billion and allocated additional funds for strategic initiatives. Consequently, pre-tax profit dipped by 7% to VND 19,539 billion, achieving nearly 85% of the VND 23,000 billion target set for the year.

|

Q4 and 2025 Business Results of ACB. Unit: Billion VND

Source: VietstockFinance

|

Commenting on the bank’s direction, Mr. Tu Tien Phat, CEO of ACB, stated: “In a volatile market, it’s crucial for banks to focus not only on growth but also on maintaining growth quality and long-term adaptability. ACB remains committed to strengthening its financial foundation and enhancing risk management capabilities to prepare for future growth cycles.”

By the end of 2025, ACB’s total assets surpassed VND 1,000 trillion, reflecting a 19% increase from the beginning of the year. Customer loans grew by 18% to VND 686,777 billion, with corporate lending as the primary driver, increasing by 26%. This growth was concentrated in key economic sectors such as trade, processing, and manufacturing. ACB expanded its reach into large ecosystem corporations and capitalized on the FDI wave, resulting in a 62% increase in large corporate loans and a remarkable 170% surge in FDI loans. Additionally, the housing loan segment showed positive recovery signs.

On the funding side, total mobilization (including issuance of securities) reached VND 718,000 billion, a 12% increase. Customer deposits rose by 9% to VND 585,180 billion. Notably, corporate CASA improved significantly due to tailored financial solutions for various industries, including textiles, plastics, FDI, agriculture, and aquaculture.

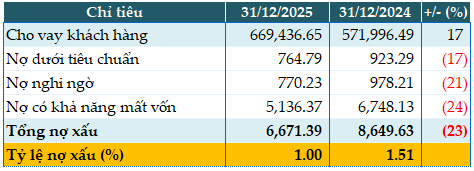

Asset quality was a highlight of ACB’s 2025 performance. Excluding VND 17,340 billion in margin loans from ACBS, ACB’s total non-performing loans (NPLs) decreased by 23% to VND 6,671 billion as of December 31, 2025. The NPL ratio dropped from 1.51% at the beginning of the year to 1%, with the NPL ratio reaching its lowest point since 2023 at 0.97%.

|

ACB’s Asset Quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

The NPL coverage ratio (LLR) reached 114%, up from approximately 78% at the end of 2024. The ratio of short-term funds used for medium- and long-term loans stood at 24.4%. The loan-to-deposit ratio (LDR) remained stable at 79%. The transition to Circular 14 in December 2025 helped maintain a consolidated capital adequacy ratio (CAR) above 12%.

– 09:25 28/01/2026

Bank Doubles Loan Loss Provisions: Defensive Move or Preparation for Growth?

At the close of the 2025 fiscal year, Asia Commercial Bank (ACB) presented a business landscape characterized by both prudence and ambition. While total assets surpassed the 1 quadrillion VND milestone, propelling the bank into the elite group of “quadrillion-asset” institutions, a more than doubling of credit provisioning costs compared to 2024 eroded pre-tax profits, leaving them at approximately 19.5 trillion VND for the year.

ACB Surpasses VND 1 Quadrillion in Total Assets, Maintains Lowest NPL Ratio in the System, and Strengthens Foundation for Sustainable Growth

In 2025, amidst a volatile economic landscape, Asia Commercial Bank (ACB) achieved a milestone with total assets surpassing VND 1 quadrillion. Maintaining the lowest non-performing loan ratio in the industry, ACB solidified its robust financial foundation. This accomplishment sets the stage for ACB’s new growth cycle, aligned with its sustainable development strategy for 2025–2030.

KienlongBank: Projected 2025 Profits Double, Nearly 50% of Loans at Risk of Default

KienlongBank (HOSE: KLB) has reported a remarkable pre-tax profit of nearly VND 2.323 trillion in 2025, doubling its previous year’s performance. This outstanding result surpasses the bank’s annual profit target by 68%. Notably, despite a 25% reduction, non-performing loans still amounted to over VND 625 billion by year-end, accounting for 47% of total bad debt.

ACB Alerts: New Year Scam Scenarios to Watch Out For

In a split second before the transaction was finalized, the banking system detected anomalies linked to two sophisticated high-tech fraud cases. While the victims remained unaware of the trap, bank staff and the monitoring system swiftly intervened, halting the transfer of funds to the fraudsters’ accounts.