Asset Scale and Capital Mobilization Maintain Positive Growth Momentum

At the end of the 2025 fiscal year, BAOVIET Bank continued to record significant growth in total asset scale, increasing by 22.22% compared to 2024. This substantial growth reflects the bank’s efforts to expand its operations and strengthen its market presence.

Credit activities maintained stable growth, with total credit issuance rising by 10.19% year-on-year, and customer loan balances increasing by 22.46%. Credit growth was closely tied to risk management, focusing on selective lending to individual and corporate segments, while exercising caution in asset appraisal and collateral acceptance to enhance credit quality and mitigate risks.

In parallel, the bank proactively reduced its financial investment portfolio, notably decreasing bond holdings compared to the previous year. This adjustment aligns with a more cautious asset restructuring policy, reducing indirect investment ratios to concentrate resources on core credit activities. This strategy supports the bank’s risk control and credit quality enhancement objectives, particularly given the complexities in the corporate bond market in recent years.

In terms of capital mobilization, customer deposits increased by 27.83% year-on-year, ensuring ample liquidity to meet business demands and maintain capital safety ratios. This strong growth in deposits underscores customer trust in the BAOVIET Bank brand, particularly as the bank leverages its advantages within the Bao Viet Group ecosystem.

Regarding business results, BAOVIET Bank reported a 3.64% increase in pre-tax profit for 2025 compared to 2024, with credit activities contributing a 4.33% rise in interest income, significantly bolstering the bank’s overall performance.

2026 Outlook: Optimizing the Ecosystem and Accelerating Digital Transformation

As BAOVIET Bank enters 2026, amidst ongoing challenges in the financial and banking sectors, the bank prioritizes enhancing growth quality while managing risks. The year 2025 marked a pivotal phase, with the bank successfully implementing ecosystem linkage activities within the Bao Viet Group, exceeding cooperation targets, and laying a solid foundation for sustainable, high-quality growth.

BAOVIET Bank’s long-term strategy is to become a multi-product retail bank, maintaining a stable position among mid-sized banks, while deeply integrating with the Bao Viet Group’s insurance and financial ecosystem to create sustainable value for customers, shareholders, and the community.

In 2026, the bank plans to focus on improving credit quality and debt resolution efficiency, accelerating digital transformation alongside operational optimization, strengthening connections within the Bao Viet ecosystem, and selectively developing retail and small-to-medium enterprise segments. Additionally, the bank aims to increase low-cost funding, expand service income, and enhance customer experience.

Risk management and capital safety remain top priorities, gradually aligning with the State Bank’s governance standards to ensure stable and sustainable development in the coming years.

– 06:58 21/01/2026

Unlocking Sustainable Growth: Establishing a Green Financial Mechanism for a Circular Economy Value Chain

According to Assoc. Prof. Dr. Bùi Quang Tuấn, Vice Chairman of the Vietnam Economic Science Association, the circular economy is not merely a tool for environmental protection but also a new driving force for economic growth.

Why Credit Streamlining is Essential

This year, the State Bank has set a credit growth target lower than that of 2025, amidst an economic landscape where outstanding debt has reached a significantly high level relative to GDP. The regulatory approach indicates a tighter control over credit flows, prioritizing sectors such as manufacturing, retail, consumer goods, and areas that generate sustainable added value for the economy.

VIB Surges Ahead: 2025 Profit Exceeds 9.1 Trillion VND, Completes 9-Year Foundation Building, Poised for New Growth Phase

VIB Bank (Vietnam International Bank) has unveiled its 2025 business results, showcasing remarkable achievements. By the end of 2025, VIB’s total assets surpassed the half-a-trillion-dong milestone for the first time, while asset quality significantly improved and operational efficiency increased.

Bank Doubles Loan Loss Provisions: Defensive Move or Preparation for Growth?

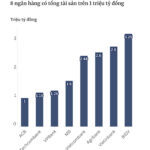

At the close of the 2025 fiscal year, Asia Commercial Bank (ACB) presented a business landscape characterized by both prudence and ambition. While total assets surpassed the 1 quadrillion VND milestone, propelling the bank into the elite group of “quadrillion-asset” institutions, a more than doubling of credit provisioning costs compared to 2024 eroded pre-tax profits, leaving them at approximately 19.5 trillion VND for the year.