The recent surge in gold and silver prices has captured much of the market’s attention. However, behind the luster of precious metals, another notable trend is unfolding: industrial metals like copper, aluminum, and nickel have climbed to multi-year highs, even setting new records, despite fundamental supply-demand dynamics not clearly indicating significant shortages.

Theoretically, there are several rational explanations for the rise in base metals. Most of these factors are directly linked to China—the world’s largest metal consumer—through increased import demand or tightened export policies. Yet, growing evidence suggests industrial metals may be benefiting from speculative forces similar to those driving gold and silver, particularly as global investors seek tangible assets amid uncertainties surrounding U.S. President Donald Trump’s policies.

The weakening U.S. dollar has supported metal prices, but notably, prices in other major currencies are also surging. This indicates the trend is not merely a currency story but reflects broader investor defensiveness.

In the precious metals market, spot gold hit a new all-time high near $5,600 per ounce, up 40% from late October lows. Silver has surged even more dramatically, rising 160% over the same period. Beyond speculation, silver is buoyed by concerns China may restrict exports as the metal gains priority in solar panel and tech manufacturing.

Aluminum prices over the past year.

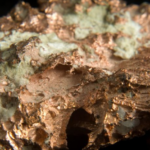

Copper prices over the past decade.

China is also significantly impacting the global aluminum market. Its exports of raw aluminum and aluminum products fell 8% in 2025 to 6.1 million tons. Reduced supply from the world’s largest producer has driven London aluminum prices to their highest since 2022, with continuous gains since April.

Copper has been the most notable performer in the recent rally. Prices on both the Shanghai and London exchanges hit record highs, with double-digit gains year-to-date. While China’s increased imports in late 2025 contributed, analysts attribute much of last year’s surge to metal flows into the U.S. amid tariff concerns—a driver now fading as actual policies proved less severe than anticipated.

Nickel has also seen impressive gains, up nearly 30% from last year’s lows, despite a medium-term supply surplus.

The key question is whether copper, aluminum, and nickel’s rally reflects 2026 supply-demand prospects or merely spillover from the precious metals frenzy. Most analysts predict balanced copper and aluminum markets next year, with nickel remaining oversupplied. This suggests the current industrial metal surge is likely driven by speculative sentiment and safe-haven demand rather than long-term fundamentals.

Source: Reuters

From Premium to Budget: Are iPhone and Samsung Downgrading Their Components?

Apple and Samsung’s flagship models are increasingly incorporating more affordable materials, potentially as a strategy to balance profitability.

Global Top Funds Rush to Buy Silver: Bank of America Predicts Stunning Price Surge

Silver may present a more enticing opportunity for investors willing to embrace higher risk in pursuit of greater returns, according to BofA experts. Historical trends suggest silver prices could potentially peak between $135 and $309.