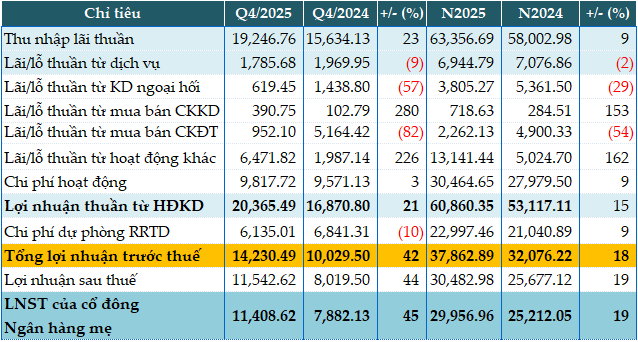

In 2025, BIDV’s net interest income reached nearly VND 63,357 billion, a 9% increase compared to the previous year.

Some non-interest income sources declined, such as service fees, which dropped by 2% to VND 6,945 billion, foreign exchange trading profits decreased by 29% to VND 3,805 billion, and investment securities trading profits fell by 54% to VND 2,262 billion.

Conversely, certain income streams experienced significant growth, including trading securities profits, which soared to nearly VND 719 billion (+153%), and other operating income, which surged to over VND 13,141 billion (+162%).

Furthermore, operating expenses rose by only 9% to VND 30,464 billion, resulting in a 15% increase in net operating profit to VND 60,860 billion.

During the year, the bank increased its credit risk provisioning costs by 9%, setting aside over VND 22,997 billion. Consequently, pre-tax profit reached nearly VND 37,863 billion, an 18% rise compared to the previous year.

|

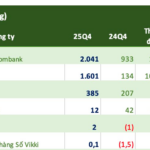

BID’s Q4 and 2025 business results. Unit: Billion VND

Source: VietstockFinance

|

Total assets as of year-end exceeded VND 3,330 trillion, a 21% increase from the beginning of the year. Customer loans reached over VND 2,370 trillion (+15%), and customer deposits amounted to VND 2,220 trillion (+14%).

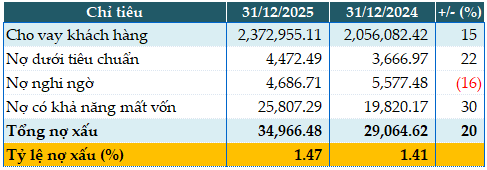

Total non-performing loans as of December 31, 2025, were recorded at VND 34,966 billion, a 20% increase from the start of the year. The non-performing loan ratio rose from 1.41% to 1.47%.

|

BID’s loan quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 11:20 AM, January 31, 2026

ACB’s Total Assets Surpass 1 Quadrillion VND, FDI Credit Soars 170%

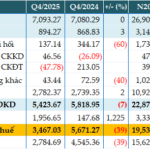

Asia Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 19,539 billion in Q4/2025, reflecting a modest 7% year-on-year decline due to heightened credit risk provisions. Notably, total assets surpassed VND 1,000 trillion by year-end, while non-performing loans significantly decreased compared to the beginning of the year.

GELEX Records Historic Pre-Tax Profit of VND 4.636 Trillion in 2025

GELEX Group Corporation (HoSE: GEX) achieved a pre-tax profit of VND 4,636 billion in 2025, marking the highest level in its history.

KienlongBank: Projected 2025 Profits Double, Nearly 50% of Loans at Risk of Default

KienlongBank (HOSE: KLB) has reported a remarkable pre-tax profit of nearly VND 2.323 trillion in 2025, doubling its previous year’s performance. This outstanding result surpasses the bank’s annual profit target by 68%. Notably, despite a 25% reduction, non-performing loans still amounted to over VND 625 billion by year-end, accounting for 47% of total bad debt.