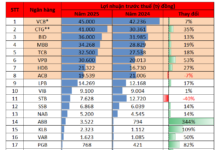

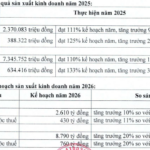

Ban Viet Joint Stock Commercial Bank (BVBank, stock code: BVB) announced its 2025 business results, reporting pre-tax profits of VND 522 billion (with Q4 reaching VND 85 billion), a 34% increase year-over-year. This achievement highlights the bank’s effective management, cost control, and optimized operations amidst a highly competitive market.

The primary driver was net revenue, which exceeded VND 2.9 trillion, up 17% from the previous year. Interest income remained the core business, accounting for 92%, demonstrating the stability and sustainability of the traditional banking model. Non-interest income also improved, driven by enhanced international payment services, foreign exchange trading (up 88%), and increased debt recovery efforts in the final months of the year.

Total assets grew significantly to VND 133 trillion

As of December 31, 2025, BVBank’s total assets surpassed VND 133 trillion, a 29% increase from the beginning of the year. This reflects the bank’s ability to expand operations and the success of its multi-channel strategy, particularly in digital banking.

Customer loans reached VND 78.2 trillion, up 15% year-over-year. BVBank’s lending activities aligned with the government and State Bank of Vietnam’s 2025 directives, focusing on supporting economic growth while maintaining credit quality. The bank targeted individual customers, small businesses, and SMEs, prioritizing sectors with high capital circulation potential, such as manufacturing, trade, supply chains, and retail. Credit expansion was conducted selectively to ensure growth alongside asset quality control, resulting in a notable reduction in non-performing loans.

In terms of capital mobilization, BVBank recorded nearly VND 123.3 trillion, a 29% increase from 2024. Customer deposits remained the primary source (over VND 98 trillion, up 31%), reflecting trust in the bank’s operations and liquidity management. Long-term deposits rebounded strongly, enabling BVBank to better manage capital allocation and support future credit growth and stability.

Accelerating digitalization to drive customer acquisition

Alongside its 126 nationwide branches, BVBank invested heavily in digital infrastructure, improving service quality, operational efficiency, and security. Digital platforms have become a key pillar, helping the bank expand its customer base and transaction volume.

In 2025, 89% of BVBank’s new customers were acquired through digital channels, a 32% increase from 2024. Users of the Digimi digital banking platform grew by 28%, indicating rising adoption of digital services among retail customers.

Digital transactions surged, with a 289% increase in 2025. Partner channel transactions exceeded 720 million, driven by expanded integrations with major payment platforms and intermediaries.

In payment solutions, Digistore attracted over 20,000 merchants in 2025, processing transactions worth more than VND 6 trillion. The platform supports merchants in order management, payments, e-invoicing, and more.

TPBank Reports Over 9.2 Trillion VND in Profit for 2025, ROE Surpasses 18%, with NPL Ratio at a Mere 0.96%

The bank reported a consolidated pre-tax profit of 9.203 trillion VND. Its digital banking segment continued to make a significant impact in the market, with 99% of transactions conducted through digital channels and double-digit growth in service revenue.

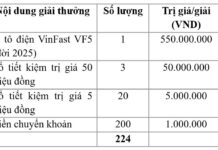

BVBank Unveils Exciting Tet Holiday Promotions

As we usher in the vibrant Year of the Fire Horse 2026, BVBank (Ban Viet Bank) is thrilled to launch its exclusive Tet promotion, “Ring in a Year of Prosperity.” This initiative reflects our commitment to standing by our customers, offering a range of tailored benefits to ensure a prosperous and auspicious start to the new year.

BVBank Appoints Senior Leadership: Deputy CEO and Chief Accountant

On January 12, 2026, Ban Viet Bank – BVBank officially appointed two senior executives: Deputy General Director and Chief Accountant to strengthen the bank’s leadership structure, thereby enhancing its capabilities in the financial market.