Major Shareholder C69 Divests at Peak

Mr. Nguyễn Bá Dũng has reported ceasing to be a major shareholder in Construction Joint Stock Company 1369 (HNX: C69) after selling 3 million shares on January 19th, reducing his ownership from 8.33% to 3.48%, equivalent to 2.15 million shares. In the disclosure, Mr. Dũng did not reveal personal information or internal ties to the company.

On the same day, January 19th, but in the opposite direction, Ms. Lê Thị Thùy Linh reported purchasing 2 million C69 shares, increasing her ownership from 2.56% to 5.8%, equivalent to 3.58 million shares, becoming a major shareholder of the company.

Ms. Linh is the younger sister of Mr. Lê Tuấn Nghĩa, CEO and Board Member of C69. Currently, Mr. Nghĩa directly holds 5.17 million shares, equivalent to 8.37% of the charter capital. Following the transaction, the group of shareholders related to Mr. Nghĩa’s family increased their total ownership to 14.17%.

According to VietstockFinance data, after Mr. Nguyễn Bá Dũng withdrew from the major shareholder group, the two siblings, Mr. Nghĩa, are the remaining major shareholders of C69.

C69 CEO, Mr. Lê Tuấn Nghĩa – Photo: C69

|

The trading activity on January 19th showed signs that the seller transferred shares via a “negotiated” method to the buyer. Specifically, during this session, the market recorded exactly 3 million C69 shares traded through negotiations, matching the quantity sold by Mr. Dũng. The total transaction value reached 43.2 billion VND, averaging approximately 14,400 VND per share, about 15% lower than the closing price of 17,000 VND per share on the same day.

Over 5 Million Shares Traded in Three Consecutive Sessions

The activity didn’t stop on January 19th; in the following two sessions, C69 continued to record large-scale negotiated transactions, though detailed disclosures about the parties involved have not yet been published.

In total, across the three sessions from January 19th to 21st, nearly 5.2 million C69 shares, equivalent to 8.4% of the charter capital, were traded through negotiations, with a total value of approximately 77 billion VND. The average price was around 14,843 VND per share, significantly lower than the trading range of around 17,000 VND per share during the same period.

This series of transactions occurred precisely when C69 was at its multi-year high. The stock’s strong breakout was triggered in mid-July 2025, following a prolonged period of trading around 6,000 VND per share.

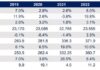

| Price Movement of C69 Stock Over the Past Year |

From that low point, the stock rose almost continuously, reaching 17,500 VND per share on January 30, 2025, a surge of over 190%, marking its highest level in five years. Average liquidity over the year exceeded 482,000 shares per session.

Currently, C69 has not released its Q4/2025 financial report. In the first nine months of 2025, the company reported a net profit of over 37.3 billion VND, nearly four times higher than the same period last year. Net revenue reached 601.5 billion VND, down 12%. The financial segment emerged as a highlight, generating over 29 billion VND in revenue, more than double the previous year, significantly supporting overall profitability.

– 14:06 30/01/2026

Hòa Bình Construction Appoints New Deputy General Director

Mr. Nguyễn Hùng Cường has been appointed as Deputy General Director of Hòa Bình Construction, effective February 1, 2026.

Vinhomes Records Staggering VND 42.111 Trillion Profit in 2025

In 2025, Vinhomes achieved a consolidated net revenue of VND 154,102 billion. The total consolidated net revenue, including core operations and joint business ventures, reached VND 183,923 billion, with a consolidated after-tax profit of VND 42,111 billion, setting new records. These figures surpassed the year’s initial targets, marking a 30% and 20% increase compared to 2024, respectively.

Tracking the Shark Money Flow: January 23rd – Big Money Hesitates

In a session marked by a declining VN-Index, both foreign and proprietary trading desks of securities companies engaged in modest net trading activities.