Ho Chi Minh City Infrastructure Investment Joint Stock Company (Stock Code: CII) has recently submitted an official disclosure to the Hanoi Stock Exchange (HNX) regarding the outcomes of its bond issuance.

Between December 30, 2025, and January 23, 2026, CII successfully issued 5,000 domestic bonds under the code CII12504.

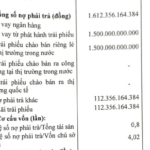

Each bond has a face value of VND 100 million, totaling VND 500 billion for the entire issuance. The bonds have a 60-month maturity and are expected to mature on December 30, 2030.

Additionally, on December 30, 2025, CII issued another batch of bonds, CII12503, with a total value of VND 280 billion, also maturing in 60 months on December 30, 2030.

Illustrative Image

Prior to this, CII’s Board of Directors approved a plan to issue two bond series to secure funding for the expansion of the Ho Chi Minh City – Trung Luong – My Thuan Expressway and to restructure short-term debts into long-term obligations.

The first series includes 2,800 bonds, aiming to raise VND 280 billion for debt restructuring. These are non-convertible, asset-backed bonds with a 60-month term.

The second series comprises up to 5,000 bonds, totaling VND 500 billion, also with a 60-month term. These bonds are non-convertible and guaranteed by a credit institution.

On February 4, 2026, CII will finalize the list of bondholders for the CII425021 series to seek their opinions, with a 1:1 voting rights ratio (one bond equals one vote).

The consultation is scheduled for February 2026, and details will be communicated to bondholders via the voting form.

The CII425021 series consists of 20 million convertible bonds, with no collateral or warrants. Issued on August 18, 2025, these bonds have a face value of VND 100,000 each, totaling VND 2,000 billion, and a 10-year term.

Source: CII

Vinam Land Reports Net Loss of Over 100 Billion VND in First Half of 2025

In the first half of 2025, Vinam Land reported a net loss exceeding 100 billion VND, a slight decrease from the nearly 101 billion VND net loss recorded in the same period the previous year.

Vietnamese Billionaires Rush to Raise Nearly $1.5 Billion Through Bonds, Enticed by Up to 12% Interest Rates

The corporate bond market concluded 2025 with a staggering scale of nearly 590 trillion VND. Notably, in just the past month, the market witnessed a remarkable “final sprint” from billionaire ecosystems such as Vingroup, Sovico, Thaco, and Techcombank, collectively raising an estimated total of over 35 trillion VND.

VinaLiving’s First Bond Issuance: What Makes It Stand Out?

In early January 2026, VinaLiving Holdings JSC (VinaLiving) successfully raised capital through the issuance of two bond tranches, both offering interest rates exceeding 10% per annum. The company is currently 99.98% foreign-owned.