According to the Q4/2025 financial report, Dabaco Vietnam Group JSC recorded net revenue of VND 3,729 billion, a 3.3% increase compared to the same period last year.

However, post-tax profit reached only VND 148.6 billion, a 38% decline year-over-year, due to a shrinking gross margin from 14.7% to 12%.

Specifically, gross profit decreased by 14.8%, equivalent to VND 78.3 billion, to VND 452 billion. Financial revenue increased slightly by 4.7% to VND 21.5 billion, while financial expenses decreased by 10.2% to VND 63.49 billion. Conversely, selling and administrative expenses rose by 4.6% to VND 232 billion. Other items showed insignificant fluctuations.

Dabaco attributed the profit decline in Q4 to lower hog prices compared to the same period, resulting in a VND 76.4 billion decrease in earnings for its hog farming subsidiaries. Conversely, the poultry segment recorded a profit of VND 53.4 billion, a significant improvement from a loss of VND 88.8 billion in the same period last year.

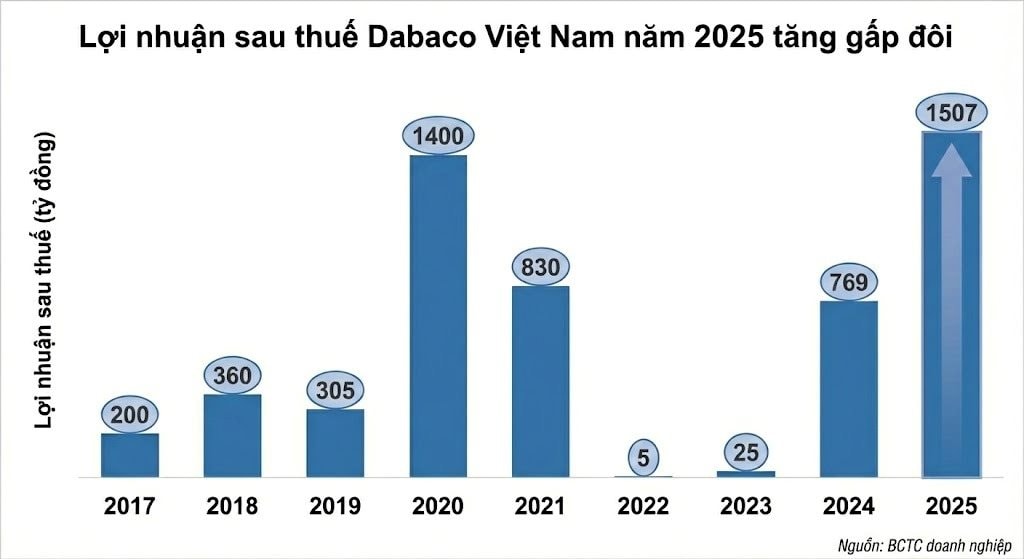

For the full year 2025, Dabaco Vietnam achieved revenue of VND 14,897 billion, a nearly 10% increase year-over-year; post-tax profit reached VND 1,507 billion, up 96% year-over-year, marking the highest level in the company’s history.

As of December 31, 2025, Dabaco Vietnam’s total assets reached VND 15,976 billion, a 13% increase from the beginning of the year. Inventory accounted for the largest share at VND 6,358 billion (40% of total assets), followed by cash and short-term financial investments at VND 2,271 billion (14%).

On the capital side, Dabaco’s total short-term and long-term debt at the end of 2025 was VND 5,876 billion, a 3.2% increase year-over-year, equivalent to 72.8% of equity.

On the stock market, DBC shares rose to VND 28,600 per share in the morning session on January 28th.

Pig Prices Cool Down, Dabaco’s Q4/2025 Profits Plunge by Nearly 38%

Dabaco Vietnam reported a slight revenue increase in Q4/2025 compared to the same period last year, yet net profit after tax saw a significant decline due to falling hog prices. Despite this, the company’s full-year 2025 results still surpassed its profit plan by nearly 50%.