I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts showed mixed movements during the trading session on January 23, 2026. Specifically, 41I1G2000 (I1G2000) decreased by 0.53% to 2,076 points; 41I1G3000 (I1G3000) dropped by 0.09% to 2,076 points; the 41I1G6000 (I1G6000) contract rose by 0.31% to 2,077.4 points; and the 41I1G9000 (I1G9000) contract increased by 0.4% to 2,080.3 points. The underlying index, VN30-Index, closed at 2,077.76 points.

Additionally, VN100 futures contracts experienced alternating increases and decreases during the same session. Notably, 41I2G2000 (I2G2000) fell by 0.33% to 1,950.5 points; 41I2G3000 (I2G3000) declined by 0.72% to 1,944 points; the 41I2G6000 (I2G6000) contract gained 0.34% to reach 1,953.8 points; and the 41I2G9000 (I2G9000) contract rose by 0.68% to 1,960 points. The underlying VN100-Index closed at 1,956.64 points.

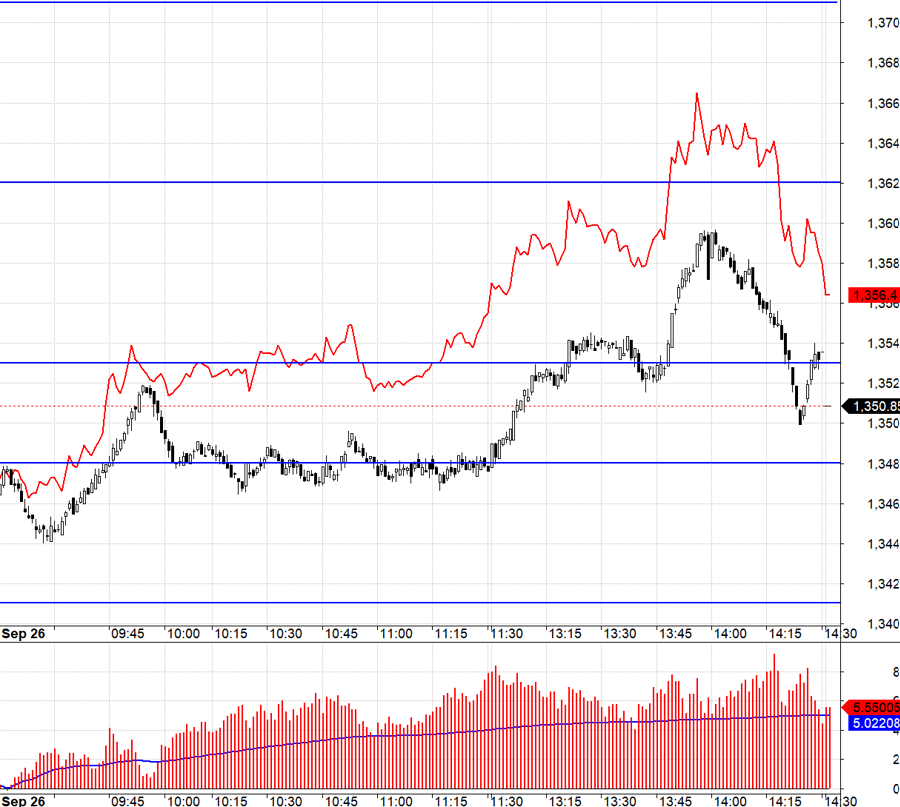

During the week of January 19-23, 2026, the 41I1G2000 contract experienced a highly volatile trading week. After an initial decline at the week’s opening, it quickly rebounded. However, selling pressure dominated in subsequent sessions, causing the contract to reverse and plummet. In the final sessions, a tug-of-war around the reference point persisted, with short sellers ultimately gaining control. The contract closed in the red at 2,076 points, a 5.2-point decrease from the previous week.

Intraday Chart of 41I1G2000 for January 19-23, 2026

Source: https://stockchart.vietstock.vn

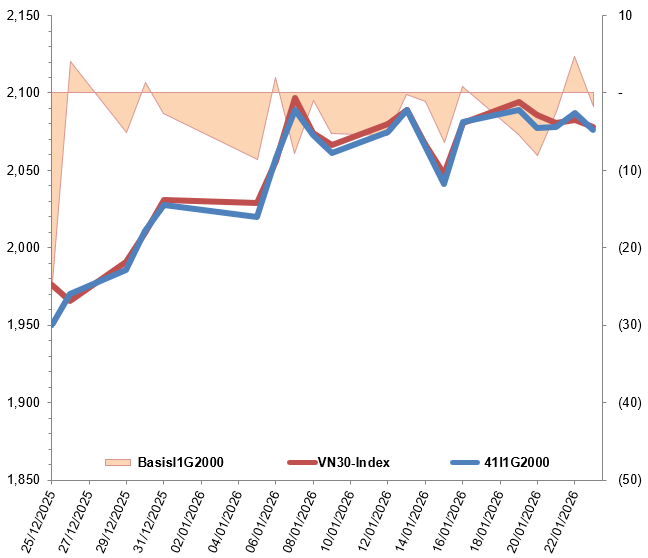

At the close, the basis of the I1G2000 contract reversed from the previous session, reaching -1.76 points. This indicates a return to bearish sentiment among investors.

Fluctuations of I1G2000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

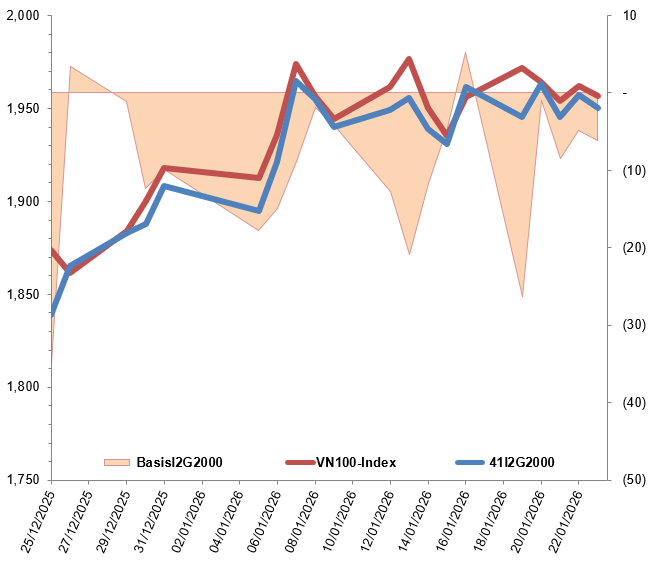

Meanwhile, the basis of the I2G2000 contract expanded from the previous session, reaching -6.14 points. This reflects an even more bearish sentiment among investors.

Fluctuations of I2G2000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

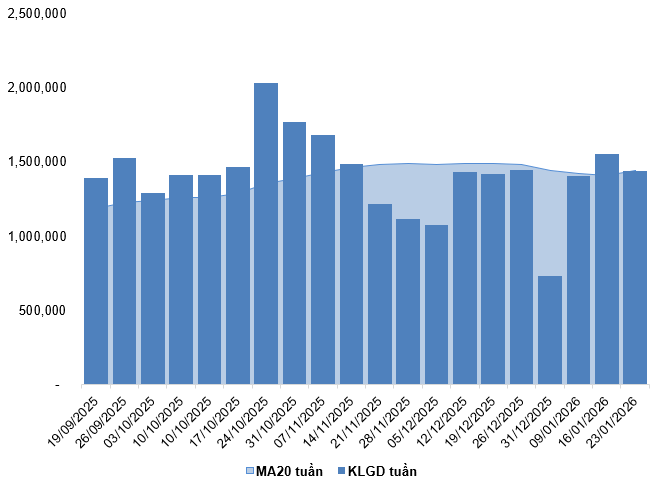

Trading volume and value in the derivatives market decreased by 14.66% and 14.68%, respectively, compared to the session on January 22, 2026. For the entire week, trading volume and value declined by 7.34% and 6.64%, respectively, compared to the previous week.

Foreign investors continued to sell, with a net selling volume of 776 contracts on January 23, 2026. For the week, foreign investors net bought a total of 174 contracts.

Weekly Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

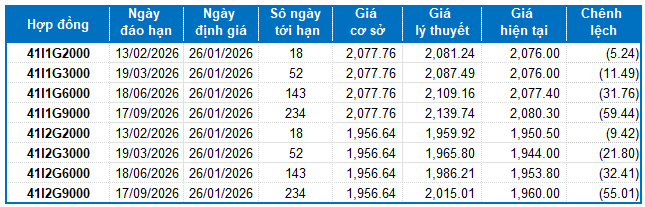

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of January 26, 2026, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Contract Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit interest rate of major banks, with term adjustments suitable for each futures contract.

I.3. Technical Analysis of VN30-Index

During the trading session on January 23, 2026, the VN30-Index declined, accompanied by a small-bodied candlestick pattern. The erratic trading volume in recent sessions indicates unstable investor sentiment.

Currently, the index is retesting the previous high from October 2025 (equivalent to the 2,022-2,070 range), which was previously broken. This occurs as the MACD indicator continues to decline after giving a sell signal, suggesting a bearish short-term outlook.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

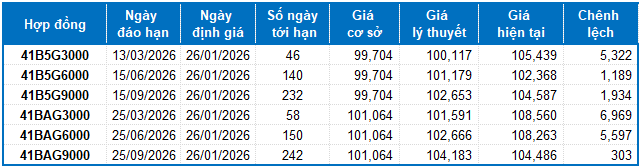

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of January 26, 2026, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Contract Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit interest rate of major banks, with term adjustments suitable for each futures contract.

According to the above valuation, no contract is currently attractively priced. Investors may observe and wait for better entry points in the coming period when these futures contracts offer more favorable prices.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:58 24/01/2026

Derivatives Market Outlook on January 23, 2026: Is the Short-Term Forecast Deteriorating?

On January 22, 2026, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index remained in a state of indecision, characterized by a small-bodied candlestick pattern, while trading volumes in recent sessions have fluctuated unpredictably, reflecting investors’ uncertain sentiment.

Derivatives Market Week 19-23/01/2026: Overall Market Liquidity Continues to Improve

On January 16, 2026, most VN30 and VN100 futures contracts closed higher. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern amid declining trading volume, indicating investor hesitation.