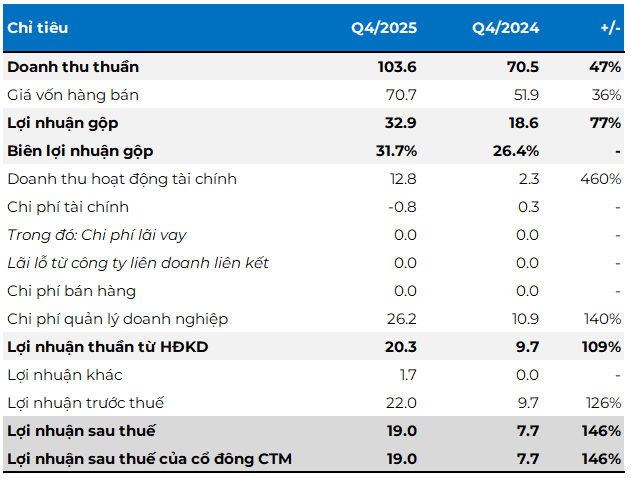

In Q4/2025, a leading construction stone supplier in Dong Nai—a region buzzing with major infrastructure projects—reported a remarkable surge in revenue. The company’s net sales reached nearly VND 104 billion, a 47% increase year-over-year. Net profit soared to VND 19 billion, nearly 2.5 times higher than the same period last year.

This growth was fueled by a significant rise in revenue, an improved profit margin (from 26.4% to 31.7%), and a substantial dividend from VLB. During this quarter, DHA received a VND 11.3 billion dividend from VLB, accounting for the majority of its VND 12.8 billion financial revenue.

However, the financial report also highlighted a 1.4x increase in administrative expenses, reaching VND 26 billion. This rise partially offset the profit growth for Hoa An.

Q4/2025 Financial Results of DHA

Unit: Billion VND

Source: VietstockFinance

|

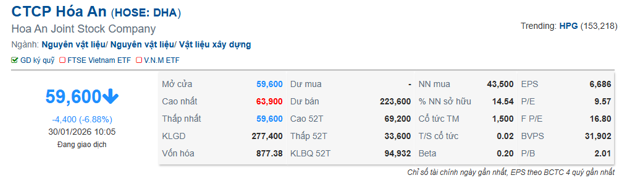

Despite the robust profit growth, investors reacted by heavily selling off DHA shares. By 10 AM on January 30, the stock price dropped nearly 7% to VND 59,600 per share, with trading volume nearing 280,000 shares. Notably, the sell orders exceeded 220,000 shares, far surpassing the average 52-week trading volume.

This reaction is understandable, as the VND 19 billion profit fell short of the previous quarter’s VND 34 billion. Given the rising stone prices, investors had anticipated even stronger results than in Q3.

Source: VietstockFinance

|

Surpassing Profit Targets

For the full year 2025, DHA achieved net sales of VND 404 billion and a net profit of nearly VND 109 billion, up 36% and 112% respectively compared to 2024. These results exceeded the company’s targets by 28% for revenue and more than doubled the planned after-tax profit of VND 58 billion.

This impressive performance comes amid an unprecedented boom in the construction stone industry. Vietnam’s aggressive push in public investment and infrastructure development has skyrocketed demand and prices for construction materials.

DHA enjoys a strategic advantage by operating in Dong Nai, a hub for major projects like Long Thanh Airport, multiple highways, and an upcoming metro line. Looking ahead, DHA shareholders have much to anticipate, as the public investment surge continues and the company expands with the acquisition of the Tay Krom quarry in Khanh Hoa province.

The sharp decline in DHA shares, despite strong financial results, reflects heightened market expectations amid the infrastructure boom. The question remains: Can DHA sustain its robust growth and meet investors’ escalating demands?

– 10:39 30/01/2026

Where Does Vietnam’s $9.5 Billion Airport Expansion Project Stand After Nearly a Month Under New Ownership?

The expansion project of Phu Quoc International Airport boasts a total investment of VND 22,000 billion.

Pioneering Urban Flood Control: Đèo Cả Partners with Japanese Conglomerate to Build TBM-Style Tunnels

Recently, Deo Ca Group held a meeting with Japan’s IHI Corporation, establishing a cooperative framework with two clear objectives: jointly bidding on PPP projects and forging a strategic partnership where IHI invests and contributes capital to Deo Ca.