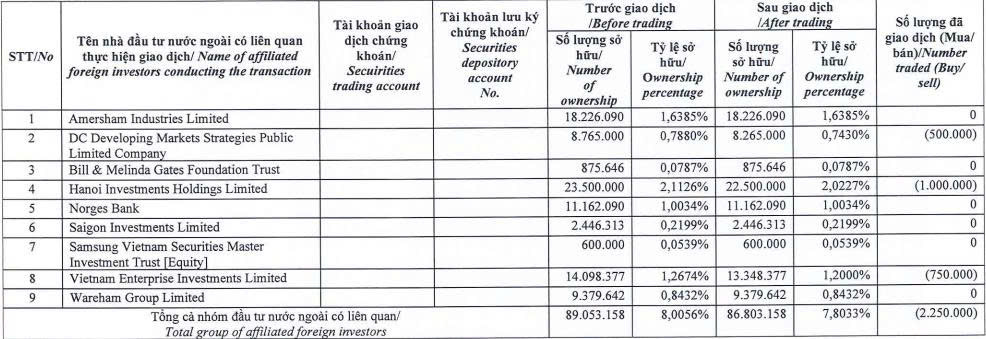

Recently, Dragon Capital, a foreign investment group, released a report detailing changes in ownership among its affiliated foreign investors who hold significant stakes (5% or more) in Dat Xanh Group Joint Stock Company (Stock Code: DXG, listed on HoSE).

On January 22, 2026, Dragon Capital announced that three of its member funds sold a combined total of 2.25 million DXG shares. Specifically, DC Developing Markets Strategies Public Limited Company sold 500,000 shares, Hanoi Investments Holdings Limited sold 1 million shares, and Vietnam Enterprise Investments Limited sold 750,000 shares.

Following these transactions, Dragon Capital’s holdings in DXG decreased from nearly 89.1 million shares to over 86.8 million shares, reducing its ownership stake from 8.0056% to 7.8033% of Dat Xanh Group’s total capital.

Source: DXG

In a separate development, Dat Xanh Group previously submitted a report to HNX outlining the utilization of proceeds from its recent private placement of shares.

Upon the completion of the offering on December 9, 2025, Dat Xanh Group successfully issued 93.5 million shares at an average price of VND 18,600 per share, raising a total of VND 1,739.1 billion.

The entire proceeds will be allocated to increase the capital of its subsidiary, Ha An Real Estate Investment and Business Joint Stock Company, in which Dat Xanh holds a 99.99% stake.

According to the issuance plan, Ha An Real Estate will use these funds to invest in its subsidiary, Phuoc Son Investment Joint Stock Company.

Prestigious Enterprises Rush to Sell Equity Stakes

VietinBank has officially registered to offload its entire stake of 19.6 million shares in Saigon Port, while Dragon Capital’s affiliated funds are set to sell 1.45 million shares in Dat Xanh Group.

VPS Securities Seeks Shareholder Approval for Capital Increase Plan

Following an underwhelming private stock offering, VPS Securities is now seeking shareholder approval for a new plan to issue shares and increase its equity capital from existing shareholders’ funds.