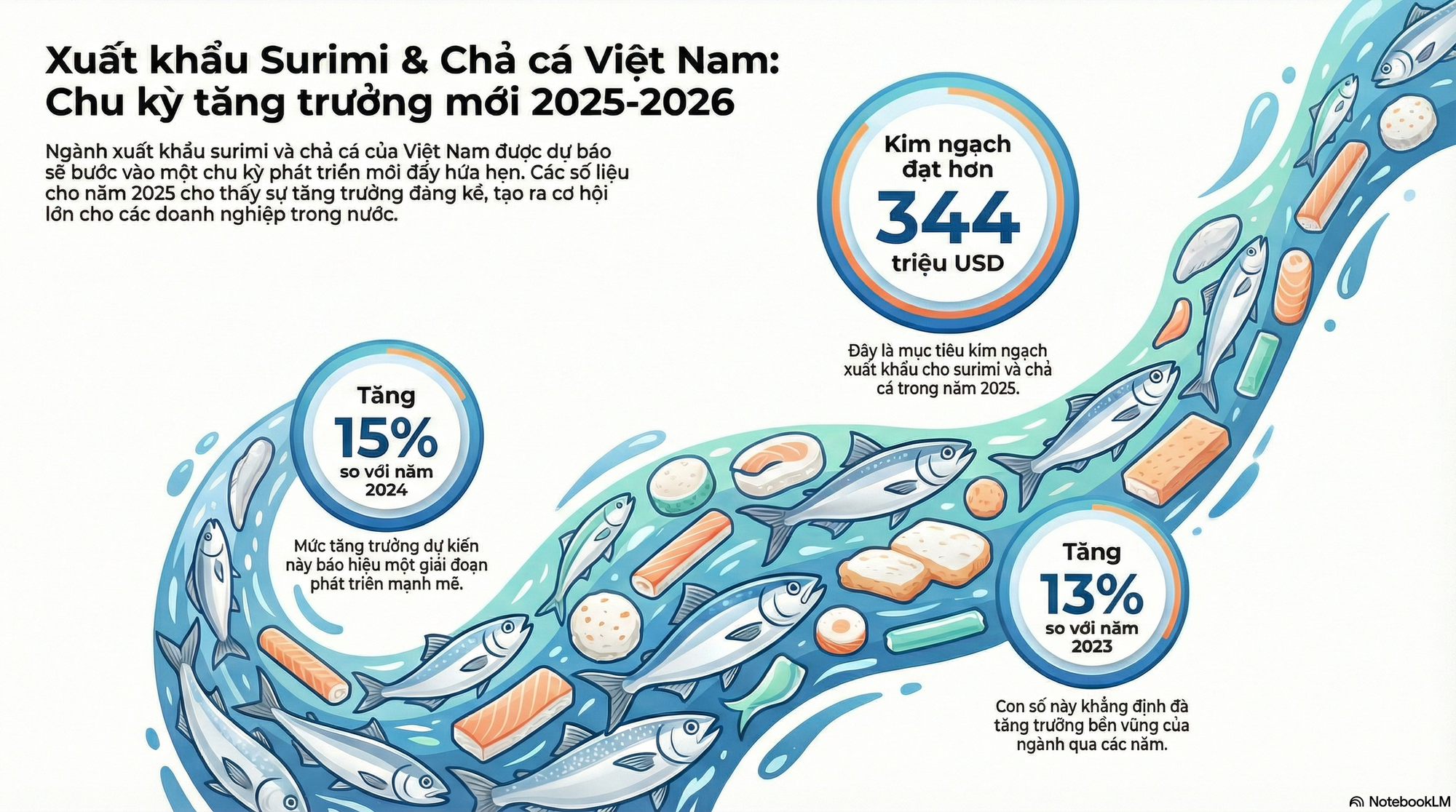

After two consecutive years of decline, Vietnam’s fish cake and surimi exports rebounded in 2025. The total export turnover for these products reached over $344 million, a 15% increase compared to 2024 and 13% higher than 2023, signaling a clear recovery in the industry.

This positive trend is closely tied to the global resurgence in the fish cake and surimi market following a period of consumer spending restraint. In 2025, demand for affordable, convenient food products rebounded, particularly in Asian countries and modern retail channels in the U.S. and European Union (EU).

Surimi continues to leverage its advantages as a cost-effective, versatile, and easy-to-process protein source. In the U.S., products like crab sticks maintain strong consumption across both traditional retail and e-commerce channels, thanks to their convenience and competitive pricing.

In the EU market, demand is recovering with a focus on cost-saving, favoring smaller, quick-consumption packaged products. Forecasts indicate the region remains a significant consumer of surimi raw materials, offering ample opportunities for exporters.

By aligning with market trends and maintaining orders, Vietnam’s fish cake and surimi exports saw steady growth throughout most of 2025. However, growth slowed in the final months of the year.

Among export destinations, South Korea, Thailand, China, the EU, and Japan are the top five markets, accounting for over 81% of total export turnover. Notably, the EU emerged as a standout market, with slow growth in the first half of the year followed by a strong acceleration in the latter part.

In 2025, exports to the EU exceeded $35 million, nearly doubling the previous year’s figure. In the final months, growth rates occasionally reached triple digits. Expanding market share in the EU is significant, as it demands high standards in quality, documentation, and traceability, helping businesses elevate their standards to access other demanding markets.

Alongside the EU, export turnover to other leading markets also increased compared to 2024. China saw stable growth, with export values surpassing $54 million, a 41% increase.

South Korea remained Vietnam’s largest importer of fish cakes and surimi, though export performance in 2025 was inconsistent, with monthly declines at times. For the year, turnover reached nearly $83 million, a modest 5% increase.

The global outlook for fish cakes and surimi remains positive, particularly for value-added and convenience products. However, importers increasingly prioritize suppliers ensuring consistent quality, timely delivery, and complete documentation. Additionally, cost pressures and factors like quotas and seasons may keep raw material prices, especially for white fish surimi, at elevated levels.

In this context, demand for deeply processed products like flavored fish cakes and crab sticks is expected to grow faster than raw materials, offering opportunities for Vietnam’s fish cake and surimi exports to sustain growth in 2026.