Proactively Bolstering Risk Buffers

The most notable highlight in Eximbank’s 2025 financial landscape is the substantial increase in risk provision by VND 1,526 billion, a 57.5% surge compared to the previous year. This proactive and prudent decision aims to strengthen the financial buffer, enhancing the bank’s resilience against unpredictable market fluctuations.

The inevitable rise in provision costs has led to a pre-tax profit of over VND 1,511 billion in 2025, falling short of the initial annual target. However, this “decline” is a calculated strategic move. Eximbank willingly sacrifices short-term gains for long-term safety, transparency, and improved asset quality in subsequent periods.

Positive Signals from Core Metrics

Despite profit being impacted by provision and investment costs, Eximbank’s core business activities maintained a steady pace. The Q4 consolidated financial report reveals a 11.4% increase in net interest income to VND 1,690.8 billion year-on-year. While service activities saw a slight decline, foreign exchange operations contributed VND 115.5 billion, and other income reached VND 151.8 billion.

In 2025, Eximbank’s net interest income totaled VND 5,979.6 billion, a modest 0.95% increase from the previous year. The bank’s total pre-tax profit for 2025 was VND 1,511.7 billion, achieving only 29.12% of the annual plan. Nevertheless, total assets, capital mobilization, and credit balances all recorded double-digit growth. Crucially, key safety indicators such as non-performing loan ratio, capital adequacy ratio (CAR), and liquidity ratio (LDR) were tightly controlled, remaining well within the safety thresholds set by the State Bank of Vietnam.

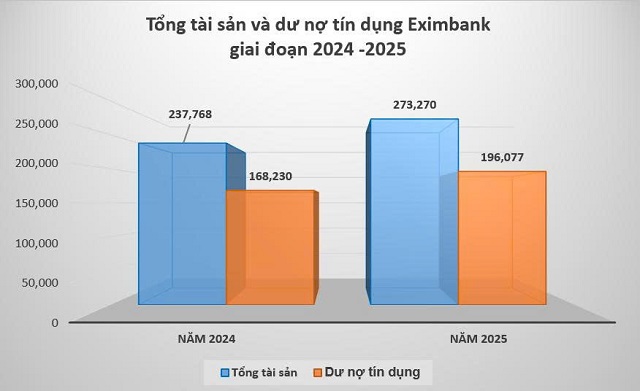

Eximbank’s Credit Growth and Total Assets in 2024 – 2025

|

As of December 31, 2025, Eximbank’s total assets reached VND 273,270 billion, a 13.97% increase from the beginning of the year. Mobilized capital stood at VND 242,669 billion, up 15.52%, and credit balances hit VND 196,077 billion, a 16.55% rise. The non-performing loan ratio was kept below 3%. The simultaneous growth in total assets, mobilization, and credit underscores Eximbank’s growing role in channeling capital into the economy, supporting businesses and individuals during the recovery and growth cycle.

Restructuring and Transformation: Investing in the Future

Currently, Eximbank is focusing on comprehensive restructuring and system transformation. The significant increase in operating expenses in 2025 is primarily due to investments in high-quality human resources, key technology and operational projects to enhance long-term competitiveness, and the strengthening of governance foundations in line with international standards.

Eximbank is investing in multiple key projects to support bank restructuring and transformation

|

These self-driven efforts have earned Eximbank a credit rating upgrade to BB- with a “stable” outlook from S&P Global Ratings in 2025. This objective recognition highlights the bank’s correct strategic direction in recent times.

As 2025 draws to a close, Eximbank has successfully fortified its internal strengths. The financial and operational foundations built during this period will propel the bank into 2026 with renewed confidence. With a focus on a safer balance sheet and a more modern governance system, Eximbank aims to achieve significant breakthroughs, unlocking its potential to create long-term, sustainable value for shareholders and customers.

– 15:45 30/01/2026

BAOVIET Bank 2025: Strengthening the Foundation for Growth

Amidst the turbulent financial landscape of 2025, BAOVIET Bank (Bank for Foreign Trade of Vietnam) has demonstrated remarkable resilience and growth. The bank’s performance is highlighted by its expanded asset portfolio, robust capital mobilization, and a strategic restructuring approach focused on safety and sustainability.

Why Credit Streamlining is Essential

This year, the State Bank has set a credit growth target lower than that of 2025, amidst an economic landscape where outstanding debt has reached a significantly high level relative to GDP. The regulatory approach indicates a tighter control over credit flows, prioritizing sectors such as manufacturing, retail, consumer goods, and areas that generate sustainable added value for the economy.

Digital Assets from 2026 and Beyond: Proactive Integration, Risk Management, and Development for National Interests

Starting in 2026, the central challenge will no longer be whether to develop the digital asset market, but rather how to do so in a way that maximizes innovative potential while ensuring absolute systemic security, safeguarding the legitimate rights of citizens, and maintaining national financial stability.