Illustrative image

F88 Investment Joint Stock Company (Stock Code: F88, UPCoM) has recently submitted a report to the State Securities Commission (SSC) and the Hanoi Stock Exchange (HNX) regarding the results of its share issuance to increase equity capital from shareholders’ equity.

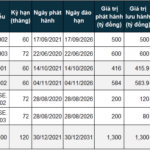

By the end of the offering period (January 21, 2026), F88 successfully distributed nearly 101.7 million shares to 1,021 shareholders at a ratio of 1:12 (as of the final registration date, each shareholder holding 1 share received 1 right, and each right entitled them to 12 additional shares).

The total number of shares post-issuance stands at 110,125,951. The expected share delivery date is scheduled for February-March 2026.

The capital raised from this issuance originates from the capital surplus based on the audited financial statements for 2024.

In a separate development, on January 26, 2026, F88 provided an explanation for the consecutive five-session ceiling price increase of its shares (from January 20, 2026, to January 26, 2026).

The company stated that it has consistently disclosed periodic and extraordinary information (if any) through official channels in compliance with legal regulations. Currently, there are no unusual or significant events related to production, business operations, finances, or governance.

Regarding share price fluctuations, the company attributes the movement to objective market supply and demand dynamics. All buying and selling decisions are made independently by investors.

F88 advises investors to rely solely on information officially disclosed by the company through designated channels, as required by law, and to avoid using unofficial sources.

The recent surge in F88’s share price has propelled the company into the billion-dollar market capitalization club on the Vietnamese stock market.

However, after five consecutive sessions of reaching the ceiling price, F88’s shares cooled off, closing the session on January 29, 2026, at VND 209,900 per share, a nearly 15% decrease from the previous session.

Masan Consumer Boosts Capital to Nearly VND 13,000 Billion Following Stock Split

Following the issuance of 10.88 million treasury shares and nearly 226.9 million bonus shares, Masan Consumer has successfully increased its charter capital to approximately VND 13,000 billion.

Vietnam’s Tech and Telecom Giant Surges, Hitting Record-High Valuation of Over $13 Billion

The stock has just marked its third ceiling-hitting surge in the last four sessions, emerging as one of the hottest focal points in the market during the early days of the new year.