Caution dominated the market as the VN-Index plunged under pressure from the Vingroup sector. The index closed down 27.59 points at 1,802, with trading volume on HOSE surging past 33 trillion VND.

Foreign investors were net sellers, offloading approximately 1.834 trillion VND.

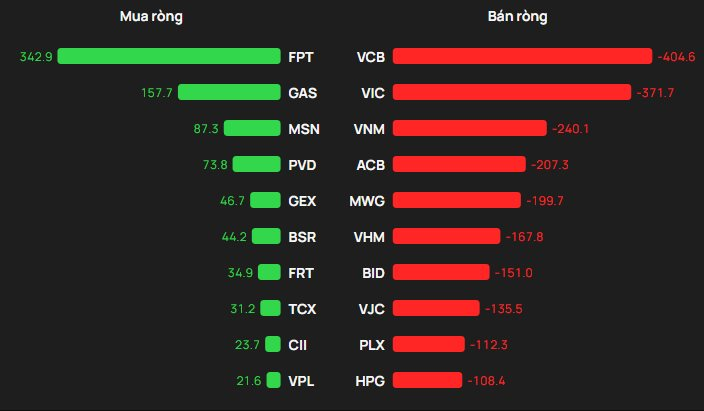

On HOSE, foreign investors net sold 1.777 trillion VND.

On the buying side, FPT led with foreign purchases exceeding 342 billion VND, followed by GAS at 158 billion VND. MSN and PVD also saw significant buying, with 88 billion VND and 74 billion VND, respectively.

Conversely, VCB saw the heaviest selling at 405 billion VND, with VIC and VNM also under pressure, shedding 371 billion VND and 240 billion VND, respectively.

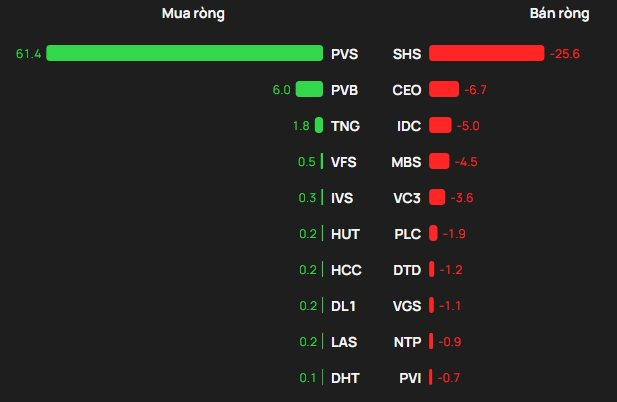

On HNX, foreign investors net bought 19 billion VND.

PVS led the buying with 61 billion VND, followed by PVB at 6 billion VND. TNG, VFS, and IVS also saw modest buying interest.

On the selling side, SHS faced the most pressure with nearly 26 billion VND sold, followed by CEO at 6 billion VND, and IDC, MBS, and VC3 with smaller sell-offs.

On UPCOM, foreign investors net sold 76 billion VND.

QNS saw buying interest with 9 billion VND, while MSR and MZG attracted a few hundred million VND each.

Conversely, ACV faced significant selling pressure with 82 billion VND sold, alongside F88, VGT, and others.

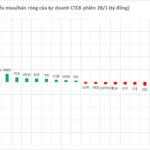

Retail Stocks Dumped as Brokerages Net Sell Amid VN-Index’s 12-Point Rally, Nearly VND 200 Billion Unloaded

Proprietary trading desks at Vietnamese securities companies collectively offloaded VND 63 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) during the session.