The global precious metals market is witnessing an unprecedented surge, with both gold and silver setting new record highs. This remarkable rally has captured investor attention amidst growing economic and geopolitical uncertainties. However, despite the market’s enthusiasm, Federal Reserve Chair Jerome Powell remains cautious about the achievements of these precious metals.

Many analysts suggest that the recent surge in gold and silver prices reflects increasing concerns about the Fed’s political independence and future monetary policy outlook. Nonetheless, during the first monetary policy meeting of the year, Powell dismissed the notion that the Fed is losing credibility.

“There may be arguments that we’re losing credibility, but that’s simply not the case,” Powell emphasized. He noted that current inflation expectations indicate the Fed retains the necessary level of trust. Powell also mentioned that the Fed is not overly concerned about the volatility of individual asset prices, though it continues to monitor market developments closely.

These remarks followed the Fed’s decision to maintain the federal funds rate within the 3.50–3.75% range, aligning with the majority of economists’ predictions. According to the CME FedWatch tool, the market anticipates no rate cuts until at least June.

Interestingly, despite Powell’s muted response to the historic rise in gold and silver prices, the precious metals market showed little negative reaction. Spot gold prices continued their upward trajectory post-meeting, trading at a record $5,538 per ounce. Meanwhile, silver surged to $117 per ounce.

In his economic outlook, Powell stated that both inflationary risks and labor market weakening concerns have subsided. “We believe the Fed is well-positioned to monitor further economic developments,” he said, leaving the door open for rate adjustments if economic conditions change. However, he acknowledged there is no consensus that the next move will necessarily be a rate hike.

According to analysts, the Fed’s neutral stance may create short-term headwinds for gold prices but is unlikely to reverse the current upward trend. Speaking to Kitco News, Nitesh Shah, Head of Commodity Research and Macroeconomics at WisdomTree, noted that the gold market is looking beyond the Fed’s current policy.

Shah explained that investors are focusing on the period after May, when Powell is likely to step down as Fed Chair. “His successor may be more dovish on rate cuts, which is what the gold market is anticipating,” he observed.

Beyond monetary policy, geopolitical risks remain a significant driver of safe-haven demand. Analysts attribute these uncertainties to gold’s 24.5% price surge in just one month, despite relatively stable oil prices and U.S. economic conditions.

Source: Kitco News

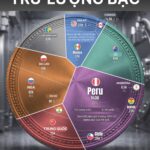

Silver Prices Surge: Who Holds the World’s Largest Silver Reserves?

Silver prices continue to soar to unprecedented heights, with one South American nation holding a staggering 140,000 tons of this precious metal.

Silver’s Physical Shortage Deepens, Prices Double, Forecast Hits $100/Ounce

The silver market has witnessed unprecedented volatility in recent months. By the end of November, silver prices surged to an all-time high, marking a remarkable 95% increase from the beginning of 2025. A severe physical silver shortage looms over the market, fueling predictions of sustained price growth.