As of the latest update today, gold prices at major brands have surged by 6.9 million VND in buying and 7.2 million VND in selling. Currently, Bao Tin Minh Chau, SJC, DOJI, and PNJ are all listing prices between 181.7 – 184.2 million VND per tael.

Gold rings at Bao Tin Minh Chau, Bao Tin Manh Hai, DOJI, and PNJ are trading at 180 – 183 million VND per tael, a significant increase of 7 million VND per tael compared to the previous session.

———————–

Recorded in the early afternoon, gold bar and ring prices continue their strong upward trend.

For gold bars, Bao Tin Minh Chau, SJC, DOJI, and PNJ are all listing prices between 181.1 – 182.6 million VND per tael. Today, SJC gold prices at these retailers have risen by approximately 5.8 – 6.1 million VND in buying and 5.3 – 5.6 million VND per tael in selling. Bao Tin Manh Hai is trading gold bars at 179.7 – 182.2 million VND per tael, an increase of 4.4 – 4.9 million VND per tael in both buying and selling.

For gold rings, SJC is listing prices at 179.1 – 182.1 million VND per tael. Bao Tin Minh Chau is trading at 179.6 – 182.6 million VND per tael. Kim Gia Bao pressed gold rings at Bao Tin Manh Hai are being bought at 197.7 million VND per tael and sold at 182.2 million VND per tael. Today, prices for smooth gold rings at major brands have increased by 4.9 – 5.7 million VND per tael.

———————–

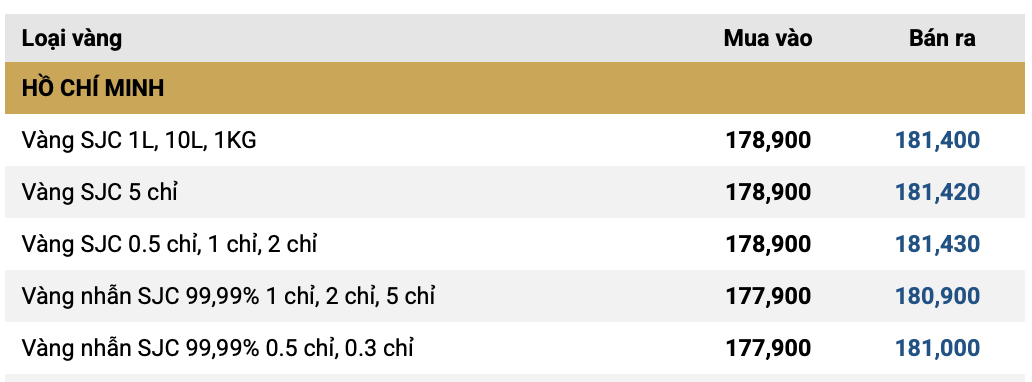

Recorded at 9:00 AM, SJC gold bar prices at major brands have surged by 4.4 million VND per tael compared to the previous session. Currently, SJC is trading gold bars at 178.9 – 181.4 million VND per tael, an increase of 3.6 million VND per tael in buying and 4.1 million VND per tael in selling. Bao Tin Manh Hai has adjusted prices up by 3.3 million VND in both buying and selling, listing at 178.6 – 180.6 million VND per tael. Bao Tin Minh Chau is selling at 180.6 million VND per tael and buying at 177.6 million VND per tael. Phu Quy has increased selling prices by 4.4 million VND per tael, currently trading at 178.3 – 181.4 million VND per tael.

For gold rings, SJC has increased prices by 3.8 million VND per tael in buying and 4.4 million VND per tael in selling, reaching 177.9 – 180.9 million VND per tael. Bao Tin Minh Chau and Bao Tin Manh Hai have both adjusted prices to 177.6 – 180.6 million VND per tael, an increase of 3.6 million VND per tael compared to the latest update. Phu Quy is currently trading smooth rings at 178 – 181 million VND per tael, a 4.5 million VND per tael increase this morning.

———————–

Updated early morning on January 28th, SJC, DOJI, and PNJ are all listing SJC gold bar prices at 175.3 – 177.3 million VND per tael, a 300,000 VND per tael increase compared to the previous session. Similarly, at Bao Tin Minh Chau and Bao Tin Manh Hai, SJC gold bars are being bought at 175.3 million VND per tael and sold at 177.3 million VND per tael, an 800,000 VND per tael increase compared to the previous session.

For gold rings, at Bao Tin Minh Chau and Bao Tin Manh Hai, smooth gold rings are being bought at 174.3 million VND per tael and sold at 177.3 million VND per tael. Compared to the previous session, gold ring prices have increased by 800,000 VND per tael in both buying and selling. Meanwhile, SJC smooth gold rings are listed at 174.1 million VND per tael for buying and 176.6 million VND per tael for selling. DOJI and PNJ have kept prices unchanged in both buying and selling, at 173 – 176 million VND per tael.

Global gold prices have surged over 3% in Tuesday’s trading session, setting a new record high, as prolonged economic and geopolitical uncertainties continue to drive investors towards precious metals as a safe haven.

At one point, spot gold prices reached a peak of $5,181.84 per ounce. Previously, in Monday’s session, gold prices had surpassed the significant $5,000 per ounce mark for the first time. At the time of reporting, prices were fluctuating around $5,175.90 per ounce.

Since the beginning of the year, gold prices have risen by more than 18%, continuing the record-breaking momentum of last year, driven by a combination of factors including increased economic and geopolitical uncertainties, expectations of interest rate cuts by the U.S. Federal Reserve (Fed), and central banks’ increased gold purchases amid a global trend of “de-dollarization.”

“Price rallies typically only end when the initial drivers that brought investors into the gold market no longer exist – and that hasn’t happened yet,” said Michael Widmer, commodities strategist at Bank of America.

Concerns continue to grow after U.S. President Donald Trump announced plans to impose additional tariffs on imports from South Korea, while the risk of a partial U.S. government shutdown looms ahead of the budget approval deadline on January 30th.

The market is now focused on the Fed’s two-day policy meeting, which began on Tuesday. The Fed is expected to keep interest rates unchanged, and investors are particularly attentive to Fed Chair Jerome Powell’s press conference on Wednesday, amid growing concerns about the central bank’s independence.

Both Deutsche Bank and Société Générale have forecasted that gold prices could reach $6,000 per ounce by the end of this year.

Linh San

World’s Largest Gold ETF Unloads Massive Holdings

Amidst the recent surge in global gold price volatility, a notable sell-off by major investors, often referred to as “whales,” has taken center stage. This strategic move comes at a pivotal moment, as the precious metal’s value experiences significant fluctuations, capturing the attention of market observers worldwide.

The Public Holds a Staggering 500 Tons of Gold

This morning (January 14th), ring gold prices continued their sharp upward trend, while SJC gold bars remained unchanged. Estimates suggest Vietnamese households hold approximately 500 tons of gold, valued at a staggering 2 quadrillion VND at current rates.