Except for a handful of state-owned enterprise (SOE) stocks maintaining relative stability—primarily in the oil, gas, and banking sectors, where companies boast clear asset foundations or unique narratives retaining investor interest—most SOEs have begun to lose upward momentum. According to Tyler Nguyễn Mạnh Dũng, Senior Director of Market Strategy Research at HSC Securities (HOSE: HCM), this slowdown is a healthy correction following a recent uneven market rally driven more by liquidity than fundamental macroeconomic prospects.

“Additionally, investigations into several large-scale SOEs have heightened investor caution, amplifying market sensitivity to short-term fluctuations,” the HSC expert added.

In Monday’s session, the VN Index breached its 20-day moving average support at 1,850 points after prolonged consolidation below 1,900, signaling growing selling pressure. HSC analysts highlight seasonal risks, as retail investors typically withdraw funds ahead of the Lunar New Year holiday. Liquidity may remain subdued below historical averages, especially with profit-taking pressures persisting. This suggests the current correction could extend beyond technical adjustments, potentially lasting into mid-to-late February post-holiday.

Conversely, optimism is gradually returning post the 14th National Party Congress’s early conclusion on January 23, 2026. The swift, disciplined proceedings alleviated prolonged policy uncertainty. Historically, post-Congress periods see improved sentiment and liquidity as leadership and policy direction stabilize. Economically, new project initiatives are emerging, with private sector activity expected to surge post-holiday, bolstered by favorable corporate updates.

Double-digit SOE growth targets: A mid-to-long-term anchor

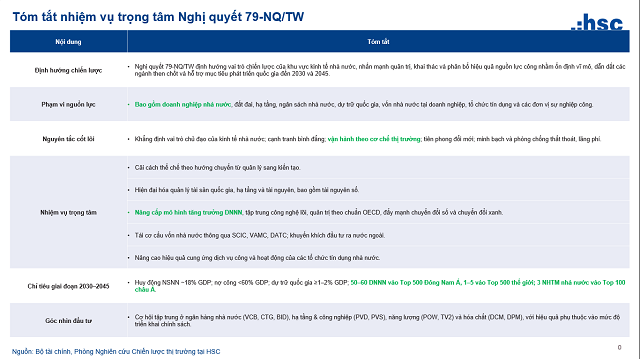

On the policy front, HSC remains cautiously optimistic. The Prime Minister recently mandated SOEs to target minimum 10% revenue or output growth in 2026—a quantifiable shift from qualitative resolutions like Resolution 79, which broadly emphasized innovation and SOE leadership without specific metrics. This 10% threshold introduces clearer accountability, enabling market reassessment of individual SOE prospects.

Mature SOEs like VNM could benefit if targets are paired with market expansion or efficiency strategies. Meanwhile, the goal of ranking three state-owned banks among Asia’s top 100 by 2030 is expected to drive growth for VCB, BID, and CTG via capital hikes, lending expansion, and competitiveness enhancements.

|

Infrastructure and FDI: Long-term narratives taking shape

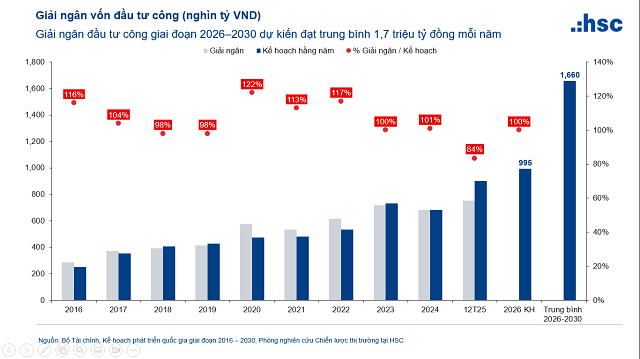

Policy focus on public investment and FDI is sharpening. The government prioritizes large-scale, high-tech FDI in semiconductors, AI, and digital tech, alongside strategic infrastructure projects like the Lào Cai–Hà Nội–Hải Phòng railway, Long Thành Airport Phase 2, and Cần Giờ transshipment port. With 2026 public investment disbursement targets nearing $43 billion and rising, HSC favors sector leaders like HPG and CTD, poised to benefit from this new investment cycle.

Despite FDI’s export dominance, HSC notes a historic lack of comprehensive policy frameworks. Upcoming measures are expected to retain and upgrade existing investors while fostering domestic linkages, potentially boosting industrial zone stocks like IDC and BCM in the medium term.

|

Corporate earnings: The linchpin for market revaluation

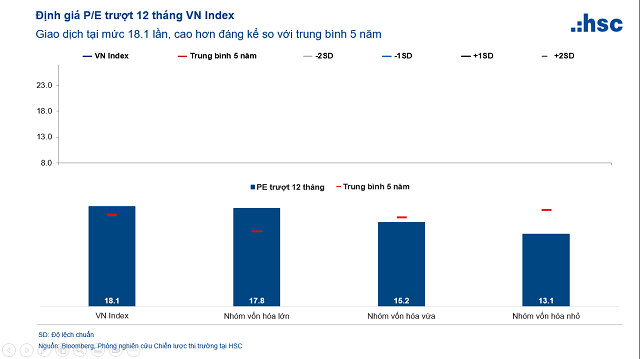

While mid-term prospects remain positive, HSC cautions that current valuations are no longer cheap. The VN-Index trades at 18.1x P/E, significantly above its 5-year average. Foreign inflows increasingly favor Taiwan and South Korea’s AI and semiconductor narratives. “Amid intensifying capital competition, Vietnam’s market must rely on tangible corporate earnings growth, particularly from blue-chips. The ongoing earnings season will be pivotal—only companies surpassing expectations will attract sustained inflows,” the HSC expert concluded.

|

Services

– 07:00 30/01/2026

Vietstock Daily 16/01/2026: Mounting Pressure

The VN-Index continues its adjustment phase, with trading volumes remaining above the 20-day average, indicating significant profit-taking pressure. Short-term risks appear to be rising as the Stochastic Oscillator weakens further following a sell signal, while the MACD shows signs of slowing its upward momentum. In this context, the previously breached October 2025 peak will serve as a critical short-term support level.

Market Outlook 2026: Insights from Leading Securities Firms

The year 2026 is widely regarded by leading securities firms as the pivotal moment when Vietnam’s stock market enters a new growth cycle. This optimism is underpinned by a stable macroeconomic foundation, robust institutional reforms, and the convergence of intrinsic growth drivers. By closely examining strategic insights from top securities firms’ reports, investors can gain valuable perspectives to inform their strategic analyses and enhance their investment decisions throughout 2026.

Ho Chi Minh City Launches and Inaugurates Multiple Key Projects and Works Today

Ho Chi Minh City has embarked on an ambitious initiative, inaugurating and completing a series of projects and infrastructure developments to commemorate the 14th National Party Congress. This concerted effort underscores the city’s commitment to progress and innovation, setting a remarkable precedent for future endeavors.