I. MARKET TRENDS IN WARRANTS

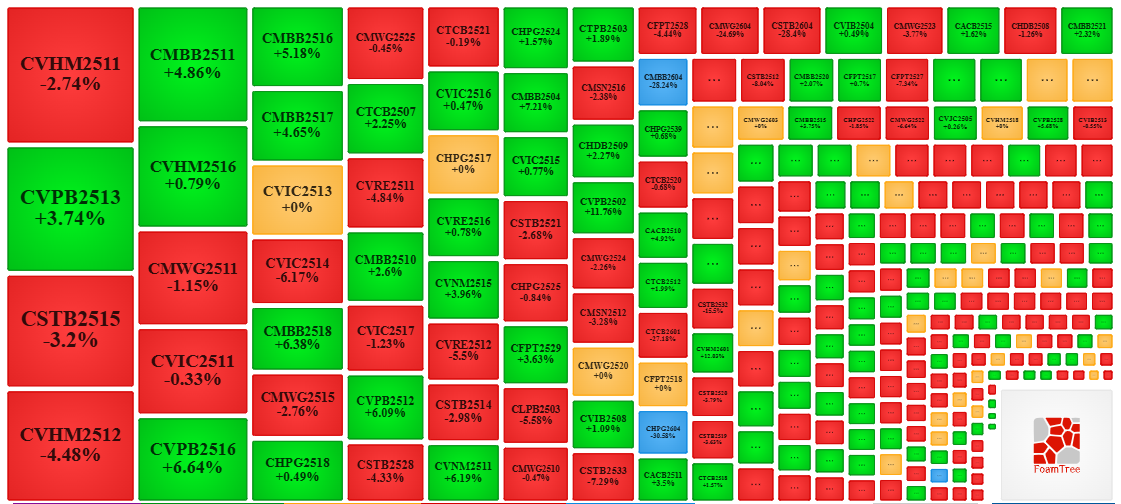

By the close of trading on January 19, 2026, the market saw 108 gainers, 142 decliners, and 37 unchanged securities.

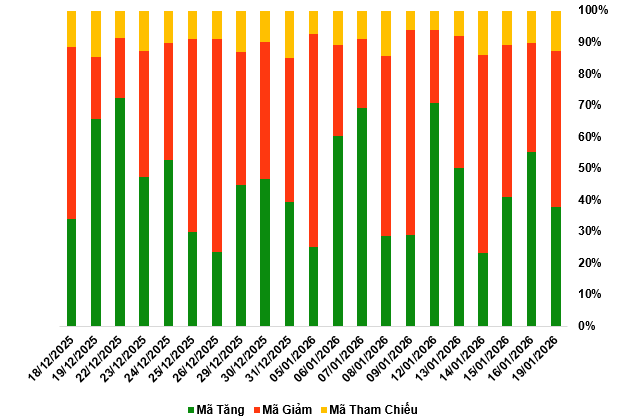

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

During the January 19, 2026 session, the market experienced mixed movements, with sellers gaining the upper hand, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CVHM2511, CSTB2515, CMWG2511, and CVIC2511.

Source: VietstockFinance

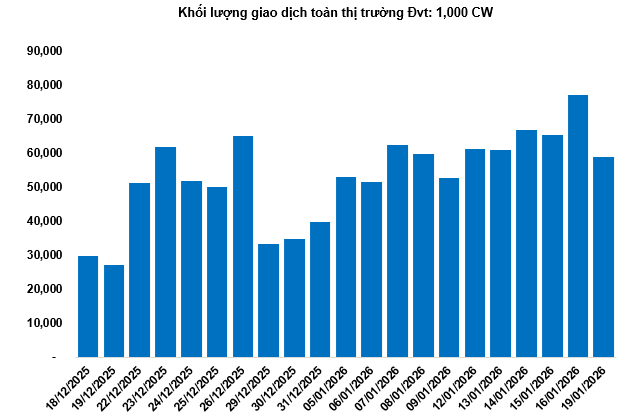

Total market trading volume on January 19 reached 59.18 million CW, down 23.31%; trading value hit 112.01 billion VND, down 19.81% compared to the January 16 session. Among these, CSTB2531 led the market in volume with 1.92 million CW, while CVNM2515 topped trading value at 5.42 billion VND.

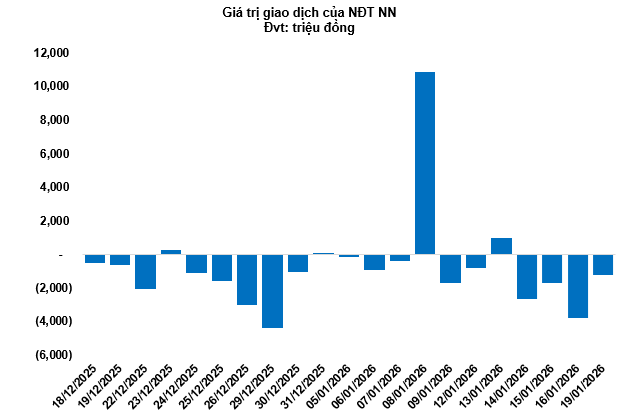

Foreign investors continued net selling in the January 19 session, totaling 1.21 billion VND. CMWG2521 and CHPG2527 were the two most net-sold codes.

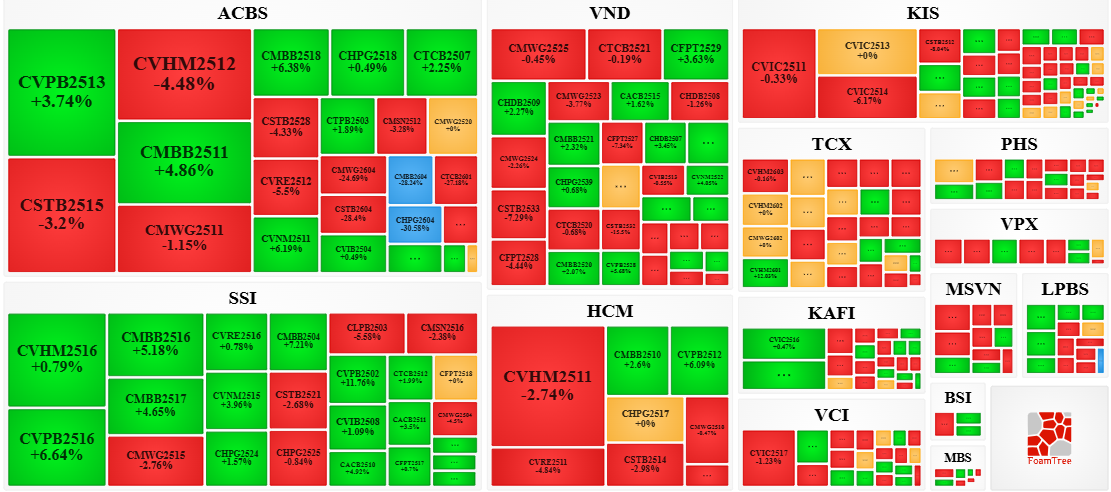

Securities companies ACBS, VND, KIS, and SSI are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

III. WARRANT VALUATION

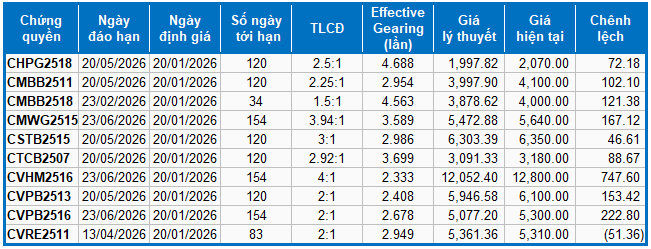

Based on the appropriate valuation method as of the starting date of January 20, 2026, the reasonable prices of the 10 largest-cap warrants with superior liquidity (both in value and order-matching volume) in the session are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) is replaced by the average deposit rate of major banks, with maturity adjustments appropriate for each warrant type.

According to the above valuation, CVRE2511 and CSTB2515 are currently the two most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to the underlying securities. Currently, CHPG2518 and CMBB2518 are the two warrant codes with the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 19/01/2026

Stock Market Expert: Positive Capital Flow Persists, Offering Ample Profit Opportunities for Investors

According to TVS experts, cash flow remains the decisive factor in helping investors determine the overall market’s positive or negative sentiment.