These stocks are meticulously selected based on technical analysis signals, liquidity, and investor interest. The following analyses can serve as valuable references for both short-term and long-term investment strategies.

AGG – An Gia Investment and Development JSC

On January 28, 2026, AGG stock price surged despite a significant market correction. Trading volume increased but remained below the 20-day average, indicating investor caution. The old support level from July 2020 (12,700-14,700) is providing strong support, making this an attractive buying opportunity.

DRC – Danang Rubber JSC

On January 28, 2026, DRC continued its downward trend, forming a Spinning Top candlestick pattern. The price fell below the 50-day and 100-day SMAs, threatening a trend reversal. The MACD indicates strong selling pressure, and trading volume dropped below the 20-day average, reflecting increased investor caution.

FPT – FPT Corporation

On January 28, 2026, FPT stock price rallied, testing the September and November 2025 highs (103,000-106,500). The Stochastic Oscillator has issued a sell signal, and if the MACD follows suit, volatility may return. The price bounced off the Bollinger Bands’ Middle line, limiting downside risk.

MBB – Military Commercial Joint Stock Bank

On January 28, 2026, MBB experienced a volatile session, forming a Long-Legged Doji candlestick. The MACD continues its downward trajectory after a strong sell signal, increasing risk. Trading volume remains below the 20-day average, indicating investor caution despite the price decline.

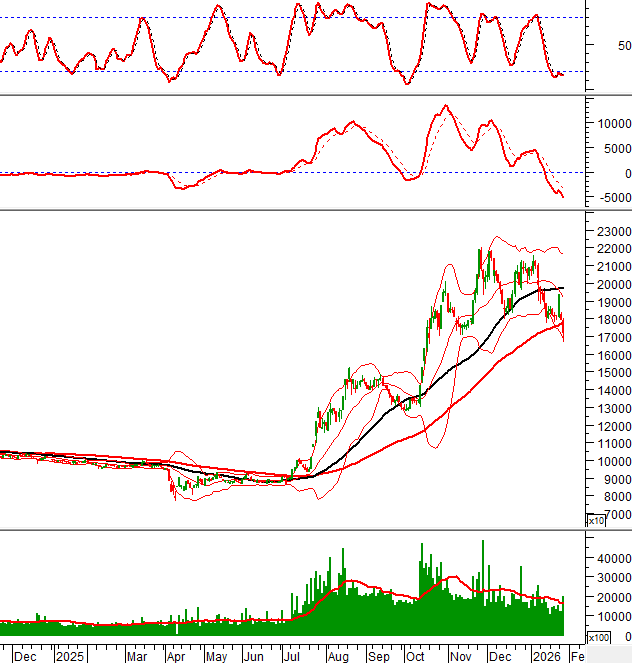

MWG – Mobile World Investment Corporation

On January 28, 2026, MWG stock price consolidated, with trading volume approaching the 20-day average. The price fell below the Bollinger Bands’ Middle line, suggesting a bearish short-term outlook. The November 2025 support level (75,500-81,500) may provide a cushion if selling pressure intensifies.

OCB – Orient Commercial Joint Stock Bank

On January 28, 2026, OCB extended its decline, marking the 7th drop in 9 sessions. The price is testing the December 2025 support level (11,600-12,000), which is expected to hold. Both the MACD and Stochastic Oscillator indicate selling pressure, increasing short-term risk.

STB – Saigon Thuong Tin Commercial Joint Stock Bank

On January 28, 2026, STB experienced a volatile session, forming an Inverted Hammer candlestick. However, the Stochastic Oscillator’s sell signal and downward divergence suggest short-term volatility. Trading volume remains below the 20-day average, indicating renewed investor caution.

TPB – Tien Phong Commercial Joint Stock Bank

On January 28, 2026, TPB resumed its decline, with low trading volume. The price fell below the 100-day and 50-day SMAs, and the MACD issued a sell signal. The break below the 23.6% Fibonacci Retracement level further increases downside risk.

VJC – Vietjet Aviation Joint Stock Company

On January 28, 2026, VJC continued its decline, touching the Bollinger Bands’ Lower Band. The price also fell below the 100-day SMA, threatening a trend reversal. Foreign investors’ net selling and larger average selling volume suggest continued volatility.

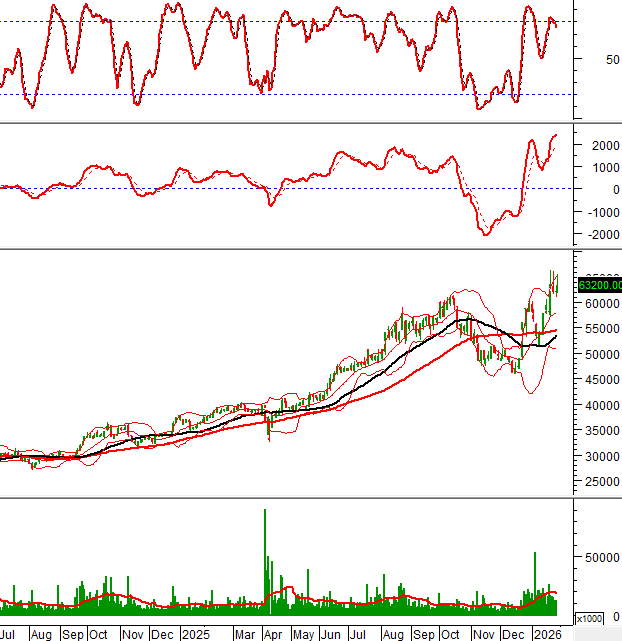

VNM – Vietnam Dairy Products Joint Stock Company

On January 28, 2026, VNM experienced a volatile session, forming a Doji candlestick. Trading volume remains above the 20-day average, but the MACD’s recent sell signal increases the likelihood of continued volatility. The December 2025 resistance level (64,000-66,000) has been breached and may now act as support.

Technical Analysis Department, Vietstock Advisory Division

– 08:58 29/01/2026

Why Do 90% of Stock Market Investors Lose Money?

Numerous statistics from brokerage firms reveal that over 90% of trading accounts fail to generate significant profits, often resulting in losses.

Tracking the Shark Money Flow: January 23rd – Big Money Hesitates

In a session marked by a declining VN-Index, both foreign and proprietary trading desks of securities companies engaged in modest net trading activities.