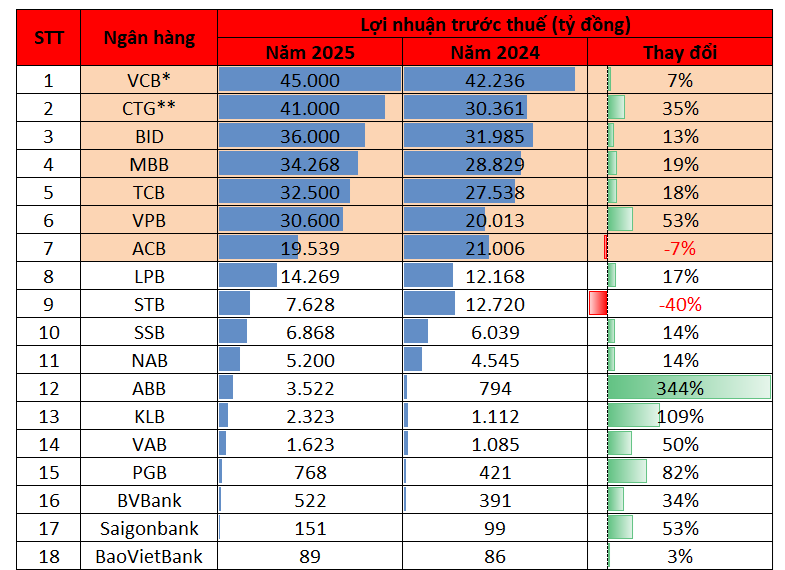

VCB: Estimated figures – CTG: Separate profits

BVBank’s Q4/2025 profit drops nearly 60% YoY

Ban Viet Commercial Bank (BVBank – Code: BVB) has announced its financial report, with pre-tax profit in Q4/2025 reaching VND 85 billion, a 59% decrease compared to the same period last year. For the whole year, BVBank’s profit reached VND 522 billion, up 34% compared to 2024, thanks to impressive results in the first 9 months.

As of December 31, 2025, BVBank’s total assets reached VND 133,048 billion, up 28.5% compared to the end of 2024. Customer deposits increased by 6%, reaching VND 71,414 billion. Meanwhile, the bank’s credit balance was VND 77,688 billion, up 14% compared to the beginning of the year.

As of the end of 2025, BVBank’s non-performing loans (from group 3 to group 5) were VND 2,341 billion, up 11.4% compared to the end of last year. However, in the context of credit growth of 14%, the bank’s NPL ratio decreased to 3%.

Saigonbank continues to report losses in Q4/2025

Sai Gon Commercial and Industrial Bank (Saigonbank – Code: SGB) has also announced its consolidated financial report for Q4/2025 with a pre-tax loss of over VND 107 billion, while the same period last year saw a loss of nearly VND 114 billion. However, 2025’s full-year profit still reached VND 151 billion, 1.5 times higher than in 2024.

As of the end of 2025, Saigonbank’s total assets reached VND 35,377 billion, up 6.4% compared to the end of 2024. Of which, Saigonbank’s consolidated lending reached VND 21,973 billion, up 0.6% compared to the end of 2024.

Saigonbank’s total non-performing loans (group 3-5) as of December 31, 2025, reached VND 649.4 billion, up 11.8% compared to the beginning of the year. Accordingly, the on-balance NPL ratio increased sharply from 2.66% at the beginning of the year to 2.95% at the end of the year.

On the funding side, customer deposits reached VND 26,327 billion, up 7.8%.

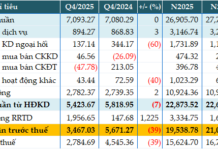

ACB’s Q4/2025 profit drops nearly 40%

Asia Commercial Bank (ACB – Code: ACB) has announced its financial report with pre-tax profit in Q4/2025 reaching VND 3,467 billion, down 38.9% compared to the same period last year. For the whole year 2025, ACB’s profit reached VND 19,539 billion, down 7% compared to 2024 and only achieved 85% of the plan.

As of December 31, 2025, ACB’s total assets reached VND 1,025,850 billion, up 18.7% compared to the end of 2024. With this result, ACB is the 8th bank with total assets exceeding VND 1 million billion, along with BIDV, VietinBank, Agribank, Vietcombank, MB, VPBank, and Techcombank.

In 2025, ACB’s credit balance increased by 18.3%, reaching VND 686,777 billion. Customer deposits increased by 8.9%, reaching VND 585,180 billion.

ACB’s non-performing loans (from group 3 to group 5) as of the end of 2025 were VND 6,671 billion, down 23% compared to the end of last year, bringing the NPL ratio down to 0.97%.

Sacombank reports losses in Q4/2025, achieving only half of the year’s profit plan

Sai Gon Thuong Tin Commercial Bank (Sacombank) has announced its business results with consolidated pre-tax profit in 2025 reaching VND 7,628 billion, equivalent to 52% of the plan assigned by the General Meeting of Shareholders. This result was mainly affected by the bank’s proactive increase in provisioning for credit risk, with a total provisioning of over VND 11,300 billion for the whole year.

In the first 3 quarters, the bank reported a profit of nearly VND 11,000 billion. Thus, in Q4/2025, Sacombank recorded a negative profit of over VND 3,300 billion.

By the end of 2025, Sacombank’s total assets reached nearly VND 918,000 billion, up nearly 23% compared to the beginning of the year. Total mobilization reached over VND 837,000 billion, up 24%, and total credit reached over VND 626,000 billion, up 16%.

VietABank reports 1.5 times higher profit

Viet A Commercial Bank (VietABank – Code: VAB) has announced its Q4/2025 financial report with a profit of VND 1,623 billion, up 49.5% compared to the same period in 2024. Specifically, in Q4/2025, the profit reached VND 573 billion, up 96% compared to the same period last year.

As of December 31, 2025, VietABank’s total assets increased by 17.2%, reaching VND 140,486 billion; customer lending increased by 11% compared to the end of 2024. Customer deposits reached VND 99,080 billion, up 9.7% compared to the beginning of the year.

Regarding asset quality, VietABank’s non-performing loans at the end of Q4 were VND 1,162 billion, up 6.5%. The NPL ratio decreased from 1.37% at the beginning of the year to 1.31%.

SeABank’s 2025 profit reaches VND 6,868 billion

Southeast Asia Commercial Bank (SeABank – Code: SSB) has announced its 2025 business results with pre-tax profit reaching VND 6,868 billion, up 13.73% compared to 2024 and achieving 106% of the plan.

As of December 31, 2025, SeABank’s total assets reached VND 396,443 billion, up 21.72% compared to 2024 and achieving 111% of the annual plan. Charter capital increased to VND 28,450 billion, and equity reached VND 40,373 billion, up 15.34%.

SeABank’s credit balance increased by 16.69%, reaching VND 244,972 billion, while total deposit mobilization and securities reached VND 221,791 billion, up 11.58% compared to 2024.

PGBank reports 81% higher profit

Prosperity and Development Commercial Bank (PGBank) has announced its Q4/2025 business results with pre-tax profit reaching VND 271.6 billion, contributing to the cumulative pre-tax profit of 2025 reaching VND 768.3 billion, up 81% compared to 2024.

Cumulative operating income in 2025 reached approximately VND 2,538 billion, of which net interest income reached VND 1,971 billion, remaining the main revenue source.

In terms of operational scale, as of December 31, 2025, PGBank’s total assets reached VND 88,882 billion, up approximately 21.7% compared to the end of 2024. Of which, credit balance reached VND 47,165 billion, up approximately 13.6%. Customer deposits reached VND 48,460 billion, up approximately 11.9%.

The ratio of customer loans to customer deposits in the market 1 is 94.8%, and the ratio of short-term capital for medium and long-term loans is 21.28%. The NPL ratio in the market 1 is 2.36%.

BAOVIET Bank’s profit increases slightly

In 2025, BAOVIET Bank recorded a pre-tax profit increase of 3.64% compared to 2024, reaching nearly VND 89 billion.

By the end of the 2025 fiscal year, the bank’s total assets increased by 22.22% compared to the end of 2024. Total credit increased by 10.19% compared to the previous year, of which customer lending increased by 22.46%.

Regarding capital mobilization, customer deposits increased by 27.83% compared to the previous year.

LPBank reports record profit of VND 14,269 billion

Loc Phat Commercial Bank (LPBank) has announced its 2025 business results with pre-tax profit reaching VND 14,269 billion, the highest in the bank’s history and up 17% compared to 2024. In Q4 alone, the bank recorded a pre-tax profit of VND 4,657 billion, up 35% compared to Q3 and nearly 40% compared to the same period last year.

LPBank closed the 2025 fiscal year with total assets reaching VND 605,585 billion, up 19% compared to the previous year. Capital mobilization reached over VND 401,680 billion.

The cost-to-income ratio (CIR) was optimized to 28.3%, down 1% compared to 2024 and among the lowest in the industry; the NPL ratio was 1.68%.

Techcombank reports Q4/2025 profit twice as high as in 2024

Vietnam Technological and Commercial Bank (Techcombank – Code: TCB) has announced its 2025 business results with pre-tax profit (LNTT) reaching VND 32,500 billion, up 18.2% compared to the previous year and exceeding the target of VND 31,500 – 31,700 billion. Notably, Q4/2025 set a record for the third consecutive quarter with LNTT reaching VND 9,200 billion, nearly doubling (+94.9%) compared to the same period last year.

As of December 31, 2025, Techcombank’s total assets exceeded VND 1,190,000 billion, up 22% compared to the beginning of the year. Specifically, the bank’s credit increased by nearly 18.4% compared to the beginning of the year, reaching VND 824,000 billion.

Techcombank closed 2025 with total deposits reaching VND 665,600 billion, up 17.9% compared to the beginning of the year, with CASA accounting for 40.4% of total mobilization. The customer-centric strategy helped Techcombank reach 18 million customers, adding 2.7 million in 2025.

VPBank’s profit exceeds VND 30,000 billion for the first time

Vietnam Prosperity Commercial Bank (VPBank) has announced its 2025 business results with record consolidated pre-tax profit, reaching over VND 30,600 billion, up 53% compared to the same period last year, and achieving 121% of the plan. In Q4 alone, VPBank’s profit exceeded VND 10,200 billion, the highest in the last 4 years. Profitability indicators improved significantly, with consolidated ROE and ROA reaching nearly 16% and 2.2%, respectively. The parent bank achieved a profit of over VND 26,300 billion in 2025, up 44.4% compared to 2024.

Consolidated total assets reached VND 1,260,000 billion, up 36.4% compared to the beginning of the year and achieving 111% of the plan set at the General Meeting of Shareholders. Consolidated credit balance as of the end of 2025 reached over VND 961,000 billion, showing strong growth in both the parent bank and subsidiaries. Of which, individual credit was VND 850,000 billion, up 35% – marking the highest growth rate in many years.

By the end of 2025, the consolidated NPL ratio under Circular 31 decreased below 3%; individual NPL was around 2%.

Vietcombank’s estimated profit exceeds VND 45,000 billion

According to information from the Conference summarizing the Party and business activities in 2025, Vietcombank’s leadership stated that the bank’s pre-tax profit in 2025 increased by more than 7% compared to 2024 and as approved by the State Bank. With consolidated pre-tax profit in 2024 reaching over VND 42,200 billion, it is estimated that Vietcombank’s 2025 profit will exceed VND 45,000 billion – the highest in history.

As of December 31, 2025, Vietcombank’s total assets reached VND 2,480,000 billion, up nearly 20% compared to the end of 2024. Credit balance to the economy reached approximately VND 1,660,000 billion, up more than 15%. On the mobilization side, market I capital reached VND 1,680,000 billion, up more than 10% compared to the end of last year, ensuring safe capital balance. The NPL ratio was controlled below 1%.

BIDV’s consolidated pre-tax profit exceeds VND 36,000 billion

At the Conference deploying tasks and business plans for 2026, BIDV’s leadership reported that as of December 31, 2025, all business indicators of BIDV met and exceeded the plans set by the State Bank and the General Meeting of Shareholders. Specifically, consolidated pre-tax profit reached over VND 36,000 billion.

By the end of 2025, BIDV’s total assets reached over VND 3,250,000 billion, up 20% compared to 2024; continuing to be the bank with the largest total assets in Vietnam. Capital mobilization reached over VND 2,400,000 billion, up 13.7%. Credit balance reached over VND 2,300,000 billion, up 15.2%. Credit quality was controlled within limits; the NPL ratio under Circular 31 was controlled at 1.2%. The capital adequacy ratio (CAR) reached 9%.

VietinBank reports record profit

At the Conference summarizing the Party and business activities in 2025, VietinBank’s leadership stated that the bank had completed the targets and plans set by the General Meeting of Shareholders in 2025.

By the end of 2025, VietinBank achieved a separate pre-tax profit of over VND 41,000 billion, up 37% compared to 2024. Total assets exceeded USD 100 billion, up approximately 18% compared to 2024.

Capital mobilization increased by 12% compared to the end of 2024. CASA growth was outstanding in a challenging market, with CASA ratio reaching over 25% by the end of 2025. The NPL ratio was controlled at 1%, in line with the plan. The NPL coverage ratio remained high.

MB reports profit of over VND 34,200 billion

At the 2025 Military-Political Conference and the Ceremony to receive the Third-Class Labor Order of the Military Commercial Bank (MB), Mr. Luu Trung Thai, Chairman of MB’s Board of Directors, stated that in 2025, the group’s pre-tax profit reached over VND 34,200 billion, up 18.7% compared to the previous year.

By the end of 2025, MB’s total assets reached VND 1,600,000 billion, up 35% compared to 2024. Credit balance exceeded VND 1,000,000 billion, up 35%. Efficiency and safety indicators remained stable. The NPL ratio was controlled below 1.3%, achieving the set plan.

Nam A Bank’s profit exceeds VND 5,200 billion

Nam A Commercial Bank (Nam A Bank) has announced its 2025 business results with pre-tax profit reaching VND 5,254 billion, up 15.6% compared to 2024.

As of December 31, 2025, the bank’s total assets reached VND 418,335 billion, 1.7 times higher than at the beginning of the year, officially entering the Top 15 banks with the largest total assets in the system. Total deposits from economic organizations, individuals, and bond issuance reached over VND 211,000 billion, up more than 18.4% compared to the end of 2024.

In terms of credit, the bank achieved over VND 198,000 billion, up 18.2% compared to the beginning of the year. Additionally, the total investment in Government bonds and securities issued by credit institutions reached over VND 40,000 billion, up 92.1%.

The bank’s NPL ratio decreased significantly to 2.15% (1.93% before CIC), while the NPL coverage ratio increased sharply to over 54%. The cost-to-income ratio (CIR) decreased from 44% in 2024 to 33.2%.

KienlongBank reports double the profit of the previous year

KienlongBank (KLB) recorded a pre-tax profit in Q4/2025 of VND 786 billion, up 124% compared to the same period last year. For the whole year, the bank recorded a profit of VND 2,323 billion, up 109%.

By the end of 2025, KienlongBank’s total assets exceeded VND 103,000 billion for the first time, up VND 5,284 billion compared to the end of the first 9 months. Capital mobilization reached VND 91,360 billion, while customer lending reached VND 71,587 billion, up VND 3,869 billion and VND 665 billion, respectively. The NPL ratio was controlled below 2%, while the NPL coverage ratio remained above 80%.

ABBank reports 4.7 times higher profit than in 2024

An Binh Commercial Bank (ABBank) has announced its 2025 business results with pre-tax profit reaching VND 3,522 billion, 4.7 times higher than the consolidated result in 2024 and achieving nearly 200% of the annual plan.

As of December 31, 2025, customer deposits reached VND 161,221 billion, achieving 140% of the annual plan, while credit balance reached over VND 127,000 billion, up 16% compared to 2024.

BVBank’s 11-month profit is 31% higher than the entire 2024

BVBank’s leadership stated that pre-tax profit as of November 2025 reached VND 515 billion, 31% higher than the result achieved in 2024 and completing 94% of the set plan. As of November 2025, BVBank’s total assets reached VND 127,281 billion, double that of 2020, with 126 transaction points, 1.4 times more than in 2020.

NCB’s pre-allocation profit is expected to reach nearly VND 900 billion

At the recent Extraordinary General Meeting of Shareholders, Ms. Bui Thi Thanh Huong, Chairwoman of National Citizen Bank (NCB), stated that with a credit growth of approximately 35%, the bank’s pre-allocation profit in 2025 is expected to reach nearly VND 900 billion.

However, according to the State Bank’s regulations and the approved Restructuring Plan, all of NCB’s arising profits will be used to offset financial losses from identified bad debts in the Restructuring Plan. Therefore, as announced, NCB’s post-allocation profit by the end of 2025 is expected to be VND 0.

NCB Accelerates in 2025: Early Capital Increase, Surpassing All Business Targets

By the end of 2025, National Commercial Bank (NCB) achieved record-breaking business results, surpassing all targets and accelerating the completion of key milestones outlined in its restructuring plan (PACCL). This remarkable performance underscores the bank’s strategic acumen and establishes a robust foundation for its upcoming growth phase.

Hòa Bình Construction Appoints New Deputy General Director

Mr. Nguyễn Hùng Cường has been appointed as Deputy General Director of Hòa Bình Construction, effective February 1, 2026.