I. MARKET DYNAMICS OF WARRANTS

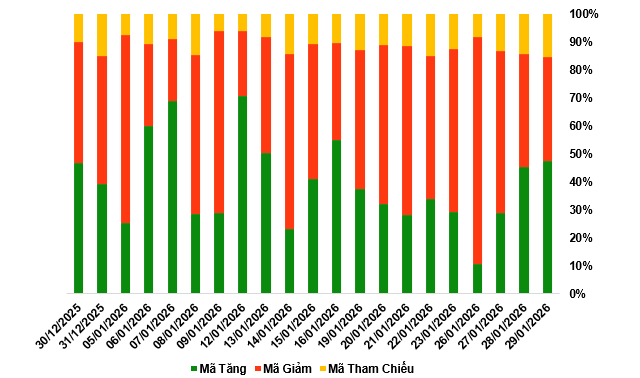

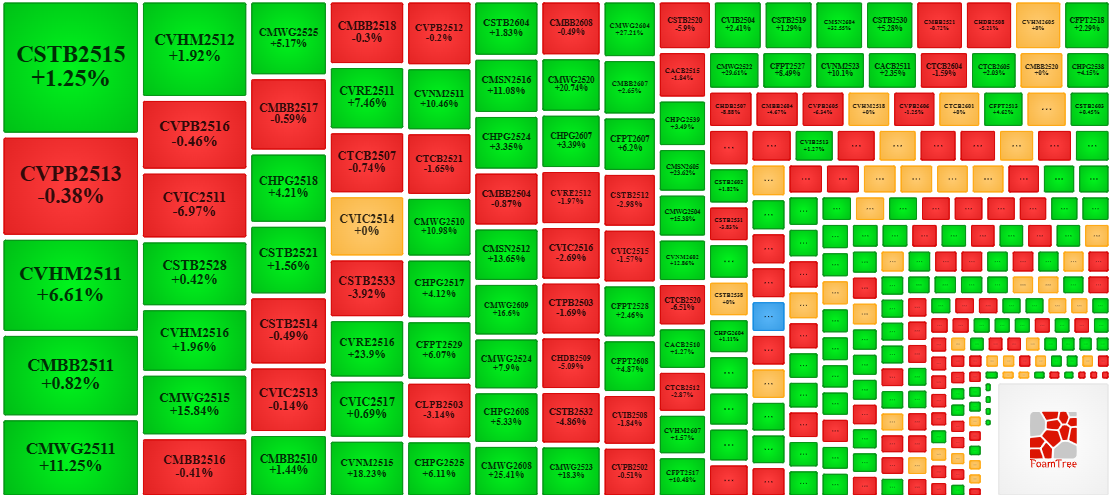

By the close of trading on January 29, 2026, the market recorded 153 gainers, 121 decliners, and 49 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

During the January 29, 2026 session, the market exhibited mixed movements, with buyers gaining a slight edge, leading to price increases for most warrant codes. Notably, the top gainers among warrant codes were CSTB2515, CVHM2511, CMBB2511, and CMWG2511.

Source: VietstockFinance

Source: VietstockFinance

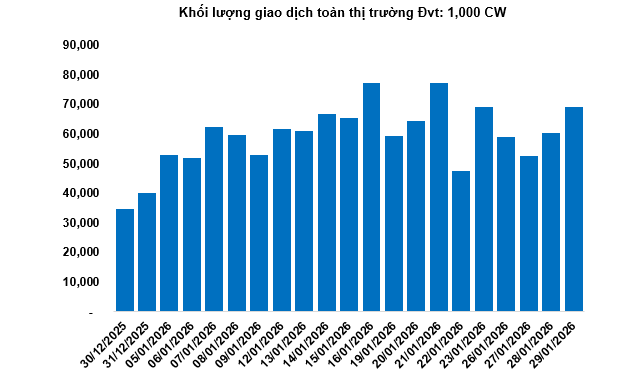

Total market volume on January 29 reached 69.1 million CW, up 14.52%; trading value hit 132.92 billion VND, a 10.29% increase compared to January 28. CMBB2604 led in volume with 4.61 million CW, while CMWG2515 topped in trading value at 8.8 billion VND.

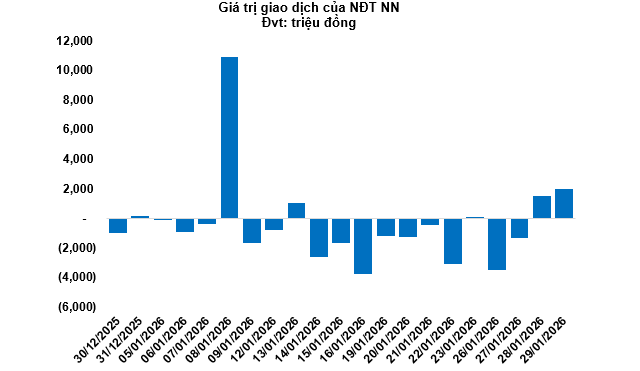

Foreign investors continued net buying on January 29, totaling 2 billion VND. CSTB2529 and CMWG2521 were the most net-bought warrants.

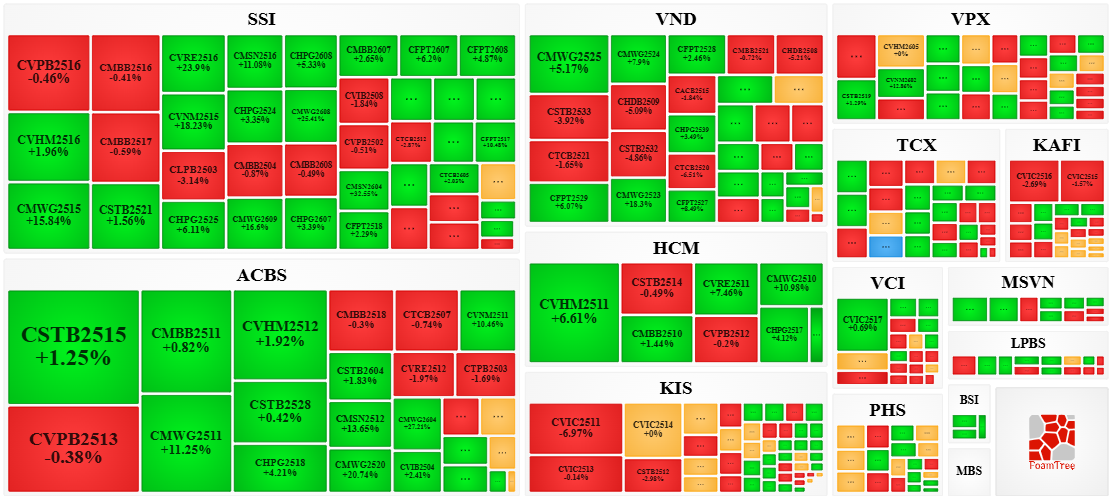

Securities firms SSI, VND, VPX, and ACBS are currently the leading issuers with the most warrant codes in the market.

Source: VietstockFinance

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

III. WARRANT VALUATION

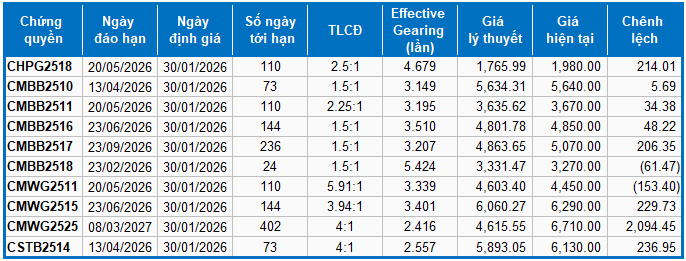

Based on the valuation method applicable as of January 30, 2026, the fair prices of the top 10 warrants by market capitalization and liquidity (both in value and volume) are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for the respective warrant maturities.

According to the above valuation, CMWG2511 and CMBB2518 are currently the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility in response to underlying stock movements. Currently, CMBB2518 and CHPG2518 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 January 29, 2026

Warrant Market on January 27, 2026: Fiery Red Alongside the Underlying Market

At the close of trading on January 26, 2026, the market saw 34 stocks rise, 263 fall, and 26 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of VND 3.53 billion.

Warrant Market Update for January 21, 2026: Continued Divergence

As the trading session closed on January 20, 2026, the market witnessed 99 stocks advancing, 177 declining, and 34 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 1.26 billion worth of shares.