Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 832 million shares, equivalent to a value of more than 26.4 trillion VND; the HNX-Index reached over 69.2 million shares, equivalent to a value of more than 1.7 trillion VND.

The VN-Index opened the afternoon session with a surprising return of buyers, helping the index quickly rebound despite persistent selling pressure. The buyers maintained their dominance until the end of the session. The most positively influential stocks on the VN-Index were VIC, GAS, GVR, and BID, contributing over 10 points of growth. Conversely, HVN, VCB, MSN, and SAB faced selling pressure, reducing the VN-Index by more than 2 points.

| Top 10 stocks impacting the VN-Index on January 19, 2026 (in points) |

Similarly, the HNX-Index showed positive momentum, influenced by stocks such as KSV (+8.33%), IDC (+9.92%), BAB (+8.59%), and PVS (+2.6%)…

| Top 10 stocks impacting the HNX-Index on January 19, 2026 (in points) |

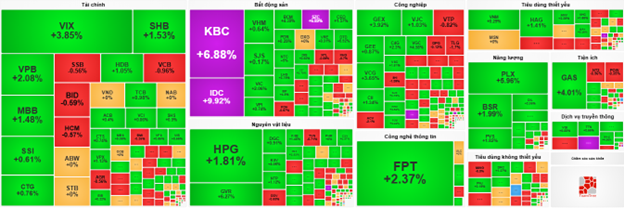

At the close, the market was predominantly green across most sectors. The communication services sector led with a 5.03% increase, primarily driven by VGI (+4.39%), CTR (+0.19%), FOX (+12.4%), and YEG (+0.82%). The energy and utilities sectors followed with gains of 3.54% and 2.22%, respectively. Notable performers included PLX (+6.92%), BSR (+3.23%), PVS (+2.6%), PVD (+1.38%), PVC (+2.14%), GAS (+6.01%), BWE (+0.11%), and PPC (+0.49%).

Conversely, the industrial sector saw a significant decline of 2.26%, mainly due to ACV (-3.72%), VEA (-6.73%), PC1 (-2.03%), and HVN (-4.07%).

Foreign investors resumed net buying, with over 502 billion VND on the HOSE, focusing on GAS (123.62 billion), PLX (117.86 billion), CTG (117.12 billion), and HPG (91.64 billion). On the HNX, they net sold over 7.7 billion VND, concentrated in MBS (23.87 billion), TNG (2.41 billion), SHS (2.2 billion), and PVI (1.46 billion).

| Foreign net buying and selling trends |

Morning Session: Cooling Momentum

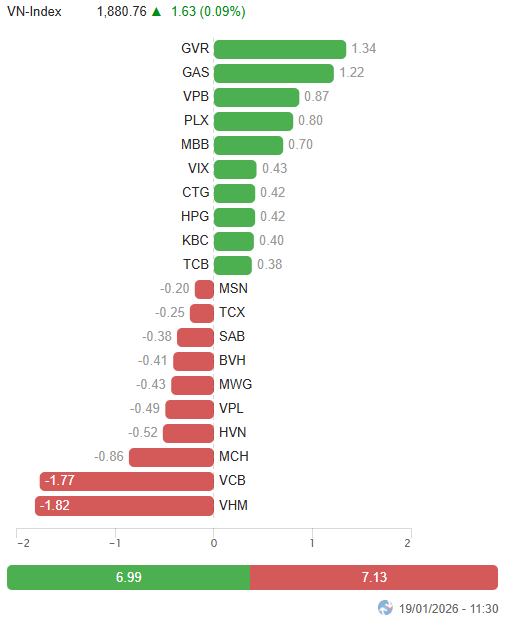

Sudden selling pressure caused the VN-Index to retreat close to the reference level by the end of the morning session. At the midday break, the VN-Index was up only 1.63 points (+0.09%), at 1,880.76 points; the HNX-Index rose 1.24%, reaching 255.4 points. Market breadth was balanced, with 354 gainers and 300 decliners.

Among the top 10 stocks influencing the VN-Index, GVR and GAS were the most positive contributors, adding 1.34 and 1.22 points, respectively. VPB, PLX, and MBB collectively added 2.37 points. Conversely, VHM and VCB were the most negative, each reducing the index by approximately 1.8 points.

Source: VietstockFinance

|

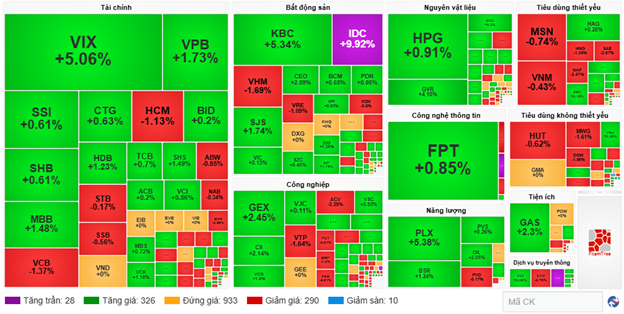

Divergence dominated, with most sectors trading within narrow ranges. The energy sector led with a 2.02% increase, thanks to strong performers like BSR (+1.24%), PLX (+5.38%), OIL (+2.05%), and PVC (+1.43%).

Large-cap sectors like finance and real estate also contributed positively, with VPB (+1.73%), MBB (+1.48%), HDB (+1.23%), VPX (+1.62%); KBC (+5.34%), KSF (+1.23%), SJS (+1.74%), and IDC hitting the ceiling. However, several stocks faced significant adjustments, including VCB (-1.37%), TCX (-0.96%), BVH (-3.66%), PVI (-1.78%); VHM (-1.69%), VRE (-1.09%), NVL (-0.77%), TAL (-1.11%), and SNZ (-1.08%).

Conversely, the industrial sector lagged with a 1.53% decline, influenced by ACV (-3.39%), MVN (-8.71%), HVN (-2.71%), VEA (-4.81%), BMP (-3.26%), and PHP (-3.26%). However, the sector saw some bright spots, including LGC hitting the ceiling, GEX (+2.45%), VGC (+3.54%), VCG (+1.5%), TOS (+3.07%), HHX (+1.95%), and CII (+2.14%).

Source: VietstockFinance

|

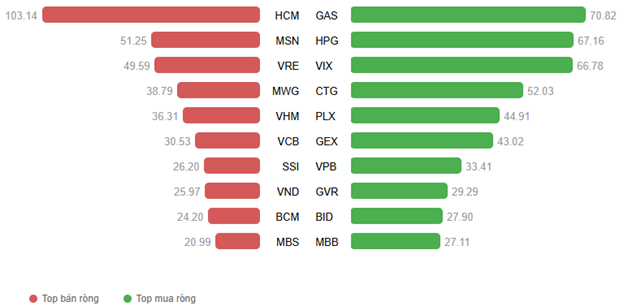

Foreign investors continued net selling, with a value of nearly 34 billion VND across all three exchanges. Selling pressure was concentrated on the HCM exchange, with a value of 103.13 billion VND. Leading the net buying were GAS, HPG, and VIX, with values ranging from 66 to 71 billion VND.

Source: VietstockFinance

|

10:30 AM: Industrial Real Estate Stocks Surge, VN-Index Breaks Out

Buyers maintained their advantage, driving the main indices higher. As of 10:35 AM, the VN-Index rose 17.58 points, trading around 1,896 points. The HNX-Index increased by 2.5 points, trading around 254 points.

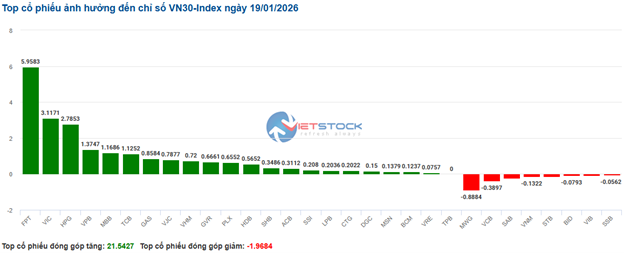

All stocks in the VN30 basket were mostly green, with notable contributors including FPT (+5.95 points), VIC (+3.11 points), HPG (+2.78 points), and VPB (+1.37 points). Conversely, a few stocks like MWG, VCB, SAB, and VNM faced selling pressure, reducing the index by over 1.6 points.

Source: VietstockFinance

|

The real estate sector attracted significant inflows, with several industrial real estate stocks hitting their ceilings, including KBC, IDC, and SZC. Other notable performers were BCM (+4%), VIC (+2.06%), NTC (+5%), and CEO (+1.57%)…

The energy sector also saw impressive gains, with BSR (+1.99%), PLX (+6.15%), and PVS (+1.82%).

Compared to the opening, buyers dominated, with 343 gainers and 256 decliners.

Source: VietstockFinance

|

Opening: Green Dominates Early Session

At the start of the session on January 19, as of 9:30 AM, the VN-Index fluctuated after a slight increase, trading around 1,885 points. The HNX-Index saw a slight increase, holding at 253 points.

Real estate was among the top-performing sectors, with leading stocks like VHM (+1.05%), VIC (+1.75%), IDC (+3.82%), and KBC (+1.83%)…

Essential consumer goods also showed stable growth from the opening, with significant contributions from HAG (+1.41%), HNG (+2.78%), and VHC (+1.33%).

In addition to these sectors, several large-cap stocks performed positively, including HPG, FPT, and GVR, supporting the index.

– 15:30 19/01/2026

Vietstock Daily 27/01/2026: Widespread Selling Pressure Intensifies

The VN-Index plunged dramatically, forming a long red candle accompanied by trading volume surpassing the 20-day average, reflecting investors’ subdued sentiment. The index is currently retesting the Middle Band of the Bollinger Bands, while both the Stochastic Oscillator and MACD indicators continue their sharp decline following earlier sell signals.

Market Pulse 20/01: Sellers Dominate, VN-Index Fails to Reclaim 1,900 Mark

Despite a robust surge of nearly 18 points during the afternoon session, the stock market failed to sustain its positive momentum. By the close, the VN-Index dipped nearly 3 points below the reference level, settling at 1,893.78. Meanwhile, the HNX-Index experienced a steeper decline of 0.7%, ending at 253.1 points.