Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.1 billion shares, equivalent to a value of more than 34.5 trillion VND; the HNX-Index reached over 106 million shares, equivalent to a value of more than 2.6 trillion VND.

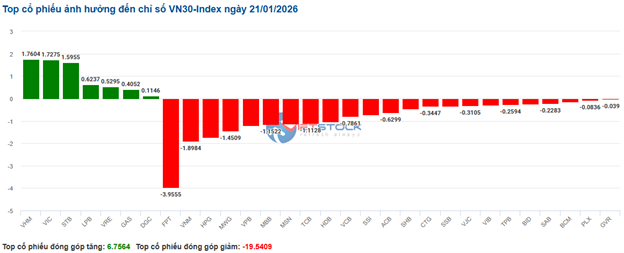

The VN-Index opened the afternoon session with continued selling pressure, but the return of buyers helped narrow the decline by the end of the session. In terms of impact, VNM, VCB, VPB, and GEE were the most negatively influential stocks on the VN-Index, contributing to a 4.8-point decrease. Conversely, GAS, STB, BSR, and CTG maintained their gains, helping the index retain 7.3 points.

| Top 10 stocks impacting the VN-Index on January 21, 2026 (in points) |

Similarly, the HNX-Index showed a rather pessimistic trend, with negative impacts from stocks like KSV (-5.86%), SHS (-3.54%), BAB (-4.38%), and MBS (-2.95%).

| Top 10 stocks impacting the HNX-Index on January 21, 2026 (in points) |

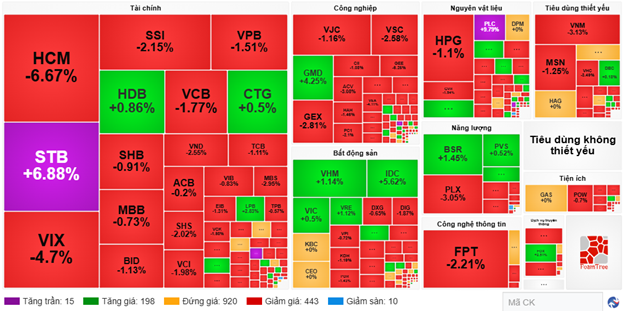

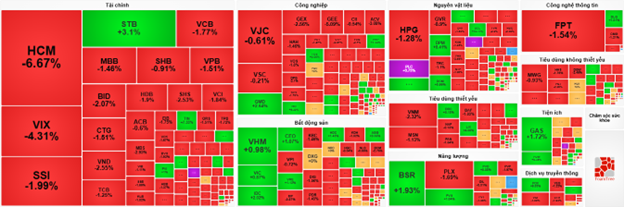

At the close, the market declined with red dominating most sectors. The industrial sector saw the sharpest decline at 2.15%, primarily due to stocks like GEX (-4.27%), VSC (-3.43%), CII (-3.24%), and GEE (-6.81%). This was followed by the essential consumer goods and materials sectors, which fell by 1.59% and 1.08%, respectively. Notable selling pressures were observed in stocks such as VNM (-4.22%), MSN (-0.13%), HAG (-0.56%), VHC (-1.59%), HPG (-1.65%), GVR (-1.28%), NTP (-3.77%), and PHR (-5.15%).

Conversely, the energy sector recorded a strong increase of 3.82%, primarily driven by BSR (+6.99%), PLX (+0.17%), PVS (+7.81%), and PVD (+4.39%).

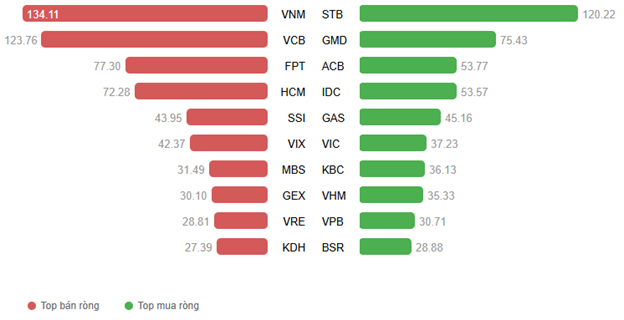

In terms of foreign trading, foreign investors continued to net sell over 312 billion VND on the HOSE, focusing on stocks like VNM (193.19 billion), VCB (151.81 billion), VIC (101.62 billion), and HCM (84.87 billion). On the HNX, foreign investors net bought over 88 billion VND, concentrating on IDC (87.98 billion), PVS (82.77 billion), VGS (2.45 billion), and VC3 (1.29 billion).

| Foreign net buying and selling trends |

Morning Session: Continuous Tug-of-War

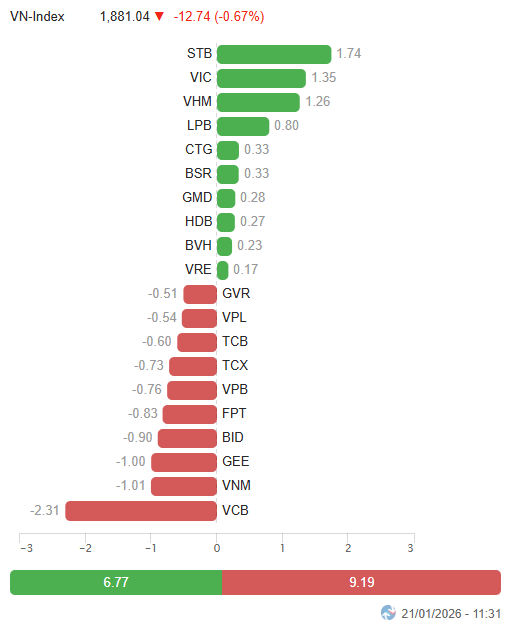

The market continued to experience strong tug-of-war dynamics in the final morning session. By the midday break, the VN-Index fell nearly 13 points (-0.67%), closing at 1,881.04 points; the HNX-Index dropped to 252.66 points, down 0.18%. Market breadth favored sellers, with 453 decliners, 213 advancers, and 920 unchanged stocks.

Among the top 10 stocks influencing the VN-Index, VCB had the most negative impact, subtracting 2.31 points from the index. VNM and GEE followed, each reducing the index by 1 point. Conversely, STB, VIC, and VHM were the most notable gainers, collectively contributing 4.35 points.

Source: VietstockFinance

|

Most sectors were engulfed in red. The information technology and communication services sectors temporarily ranked last, declining by 2.17% and 2.14%, respectively, due to negative impacts from stocks like FPT (-2.21%), CMG (-1.88%), ELC (-3.1%); VGI (+2.51%), CTR (-2.8%), SGT (-2.55%), and TTN (-3.28%).

Large-cap sectors like industrials and financials also weighed heavily on the index, with numerous stocks falling over 2%, including ACV, HVN, MVN, GEE, GEX, VEF, VTP, PC1, VSC; HCM, SSI, VIX, VND, SHS, and MBS.

Conversely, only the real estate sector maintained a slight gain of 0.42%. However, most of this was attributed to the Vin group trio: VIC (+0.5%), VHM (+1.14%), VRE (+1.12%), along with SJS (+2.11%) and IDC (+5.62%). The rest of the sector faced significant adjustments, including BCM (-1.25%), KDH (-1.19%), TAL (-2.35%), PDR (-1.43%), TCH (-1.93%), and DIG (-1.87%).

Source: VietstockFinance

|

Foreign investors net sold 595.34 billion VND across all three exchanges. Selling pressure concentrated on VNM and VCB, with values of 134.11 billion and 123.76 billion, respectively. Meanwhile, STB led the net buying list with 120.22 billion VND.

Source: VietstockFinance

|

10:30 AM: Selling Pressure Spreads, Real Estate and Energy Sectors Support Index

Pessimistic trading sentiment caused key indices to fluctuate below the reference level. As of 10:30 AM, the VN-Index fell 13.96 points, trading around 1,879.82 points. The HNX-Index decreased by 0.9 points, trading around 252.21 points.

Banking stocks like VPB, MBB, TCB, and HDB negatively impacted the VN30-Index, subtracting 1.2 points, 1.15 points, 1.11 points, and 1.03 points, respectively. Conversely, VHM, VIC, STB, and LPB were among the few pillar stocks helping the VN30 retain over 5.7 points.

Source: VietstockFinance

|

The real estate and energy sectors continued their contrasting trends, supporting the overall market index. Notable performers included VHM (+0.98%), VIC (+0.87%), IDC (+2.25%), BSR (+1.93%), PVS (+1.04%), PVD (+0.7%), and PVC (+0.72%).

Meanwhile, the financial sector faced significant headwinds, with most stocks recording losses. Specifically, HCM fell 6.47%, VIX dropped 3.91%, SSI declined 1.99%, and VCB decreased 1.63%. A few stocks showed slight recoveries, including STB (+2.93%), TIN (+7.33%), and PVI (+1%). Notably, F88 maintained its second consecutive session of hitting the ceiling price.

Compared to the opening, sellers still dominated, with 411 declining stocks and 184 advancing stocks.

Source: VietstockFinance

|

Opening: Red Dominates Financial Sector, VN-Index Loses Over 10 Points at Open

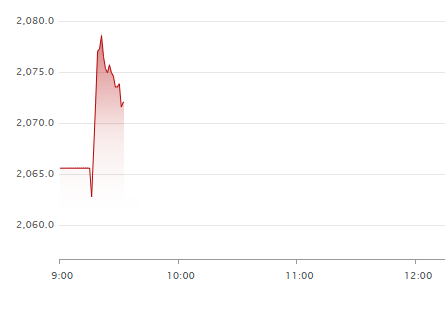

The market opened the morning session on a negative note, with red dominating most sectors. The VN30-Index was the most negatively impacted, as nearly all its constituent stocks declined.

|

VN30-Index early-day adjustment

Source: VietstockFinance

|

Numerous VN30 stocks fell sharply, including LPB, VRE, BID, VIB, TPB, GVR, BCM, SAB, DGC, and GAS. Only LPB and VRE showed slight gains.

The financial sector was notably under pressure, with widespread selling across stocks. Specifically, HCM fell 4.71%, VIX dropped 2.15%, TCB declined 0.56%, and SHB decreased 1.21%.

The materials sector followed suit, with leading stocks like HPG (-0.18%), GVR (-0.77%), MSR (-0.33%), and DRI (-2.44%) contributing to the decline.

Conversely, the real estate sector showed a positive divergence, with green spreading across most stocks, including CEO (+2.14%), DXG (+1.94%), HDC (+2.13%), and TIG (+1.16%).

– 15:25 21/01/2026

Vietstock Weekly 19-23/01/2026: Tug-of-War at New Peak Levels

The VN-Index is experiencing intense volatility near its new peak, marked by the emergence of a Doji candlestick pattern. The medium-term uptrend remains intact as the index closely follows the Upper Band of the Bollinger Bands, while the MACD sustains its upward momentum following a buy signal. However, short-term volatility risks may rise as the Stochastic Oscillator enters overbought territory, indicating the index needs more time to consolidate at this new price level.

Why Do 90% of Stock Market Investors Lose Money?

Numerous statistics from brokerage firms reveal that over 90% of trading accounts fail to generate significant profits, often resulting in losses.

Stock Market Expert: Positive Capital Flow Persists, Offering Ample Profit Opportunities for Investors

According to TVS experts, cash flow remains the decisive factor in helping investors determine the overall market’s positive or negative sentiment.